Discuss the weakness in the current staff performance system and budgeting system. Limit your discussion to Two (2) weakness each in the staff performance and budgeting system and recommendation to overcome the weakness. Limit you recommendation to Two (2) each.

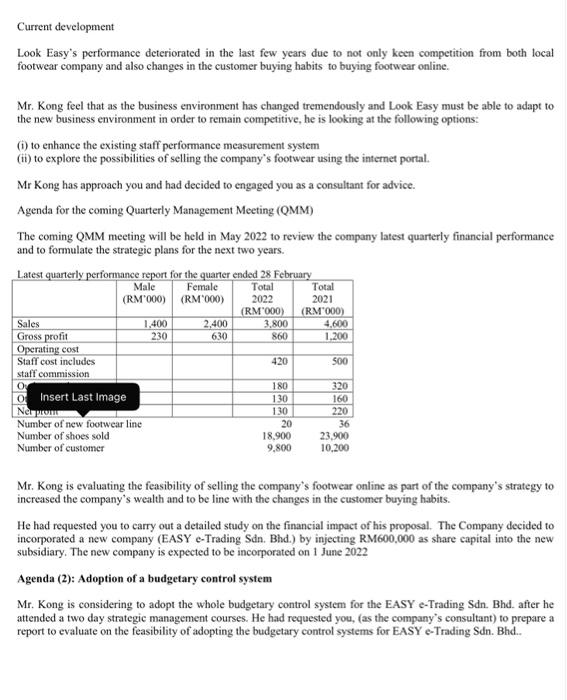

Company information Look Easy is a casual foot wear and retailer for young professionals of both gender, the company has 8 retail stores located in Klang Valley, Ipoh, Pinang, Melaka and Johor Baru. Look Easy closes its financial account on 31 March every year. Look Easy originally operated from a rented shop lot located in Gombak and was managed by Mr. Kong and his wife in the early years. The business grew steadily over the early years and was enjoying high profits and excellent cash flow. Company Objectives Look Easy strategic objectives are 'To maximise shareholder wealth by increasing the number of retail stores, ensuring our stores are attractive and offering the widest range of casual foot wear in our market." Budgeting system The budget setting process has remained unchanged since Look Easy was formed. All managers prepare draft budgets using spreadsheets and submit them to the board for approval. Managers use the previous year results as a starting point when drafting the budgets and increase the variable costs in line with any anticipated growth in volumes. Currently the company's accounting information systems are basic and focus solely on financial information. The Look Easy board has seen little need for non-financial performance indicators (NFPIs) so far, preferring instead to focus attention on cost control and working capital management. As a result, all senior managers are appraised against targets for operating profit Margin, inventory turnover and the current ratio. Budgetary control system is an important tool used in evaluating the performance of the company, which is done through variance analysis by assessing possible reasons that have caused actual results to be different from what was budgeted and taking necessary corrective actions to rectify the problems. Those possible reasons could be due to factors that are within or beyond the company's control (controllable or uncontrollable factors); management must focused its attention on those that can be controlled and minimise it from happening again in the future. Company information Look Easy is a casual foot wear and retailer for young professionals of both gender, the company has 8 retail stores located in Klang Valley, Ipoh, Pinang, Melaka and Johor Baru. Look Easy closes its financial account on 31 March every year. Look Easy originally operated from a rented shop lot located in Gombak and was managed by Mr. Kong and his wife in the early years. The business grew steadily over the early years and was enjoying high profits and excellent cash flow. Company Objectives Look Easy strategic objectives are 'To maximise shareholder wealth by increasing the number of retail stores, ensuring our stores are attractive and offering the widest range of casual foot wear in our market." Budgeting system The budget setting process has remained unchanged since Look Easy was formed. All managers prepare draft budgets using spreadsheets and submit them to the board for approval. Managers use the previous year results as a starting point when drafting the budgets and increase the variable costs in line with any anticipated growth in volumes. Currently the company's accounting information systems are basic and focus solely on financial information. The Look Easy board has seen little need for non-financial performance indicators (NFPIs) so far, preferring instead to focus attention on cost control and working capital management. As a result, all senior managers are appraised against targets for operating profit Margin, inventory turnover and the current ratio. Budgetary control system is an important tool used in evaluating the performance of the company, which is done through variance analysis by assessing possible reasons that have caused actual results to be different from what was budgeted and taking necessary corrective actions to rectify the problems. Those possible reasons could be due to factors that are within or beyond the company's control (controllable or uncontrollable factors); management must focused its attention on those that can be controlled and minimise it from happening again in the future. Current development Look Easy's performance deteriorated in the last few years due to not only keen competition from both local footwear company and also changes in the customer buying habits to buying footwear online. Mr. Kong feel that as the business environment has changed tremendously and Look Easy must be able to adapt to the new business environment in order to remain competitive, he is looking at the following options: 0) to enhance the existing staff performance measurement system (ii) to explore the possibilities of selling the company's footwear using the internet portal Mr Kong has approach you and had decided to engaged you as a consultant for advice. Agenda for the coming Quarterly Management Meeting (OMM) The coming QMM meeting will be held in May 2022 to review the company latest quarterly financial performance and to formulate the strategic plans for the next two years. Latest quarterly performance report for the quarter ended 28 February Male Female Total (RM'000) (RM 000) 2022 2021 (RM"000) (RM'000) 1,400 2.400 3.800 Gross profit Operating cost Staff cost includes staff commission O 320 Insert Last Image Neapons Number of new footwear line Number of shoes sold 18.900 23.900 Number of customer 9,800 10.200 Total Sales 4.600 230 630 860 1.200 420 500 180 130 130 20 160 220 36 Mr. Kong is evaluating the feasibility of selling the company's footwear online as part of the company's strategy to increased the company's wealth and to be line with the changes in the customer buying habits. He had requested you to carry out a detailed study on the financial impact of his proposal. The Company decided to incorporated a new company (EASY e-Trading Sdn. Bhd.) by injecting RM600,000 as share capital into the new subsidiary. The new company is expected to be incorporated on 1 June 2022 Agenda (2): Adoption of a budgetary control system Mr. Kong is considering to adopt the whole budgetary control system for the EASY e-Trading Sdn. Bhd. after he attended a two day strategic management courses. He had requested you, (as the company's consultant) to prepare a report to evaluate on the feasibility of adopting the budgetary control systems for EASY-Trading Sdn. Bhd.. Group assignment 1 (20 marks) 1. Discuss the weakness in the current staff performance system and budgeting system. Limit your discussion to Two (2) weakness each in the staff performance and budgeting system and recommendation to overcome the weakness. Limit you recommendation to Two (2) each. Individual assignment (20 marks) 2. Recommend two (2) financial performance and two (2) non-financial performance indicator (NFPI) to evaluate staff performance and the related performance measures that is suitable for EASY E-Trading Sdn. Bhd. Justified your recommendation