Answered step by step

Verified Expert Solution

Question

1 Approved Answer

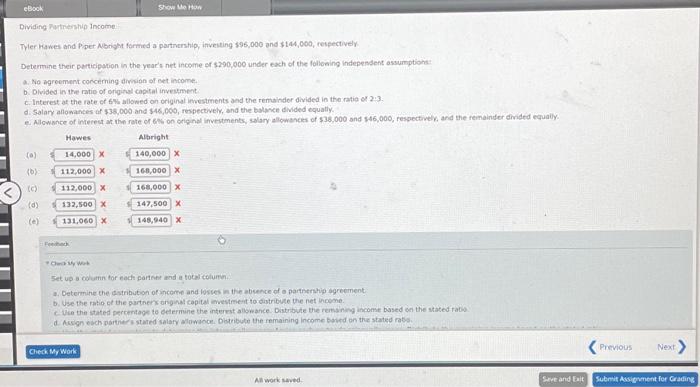

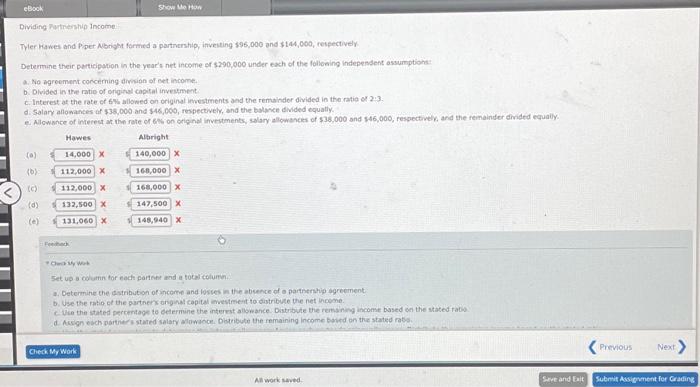

Dividing nutinershe Income. Tyler hawes and Poer Mbright formed a partrership, inveiting $95,000 and $144,000, respectovely Determune their pertipipaph in the year's net income ef

Dividing nutinershe Income. Tyler hawes and Poer Mbright formed a partrership, inveiting $95,000 and $144,000, respectovely Determune their pertipipaph in the year's net income ef $290,000 under each of the foliosing independent assumptions a. No agreement concerming divinion of eet income. b. Dlvibed in the ratio of original capital investment c. Interest af the rate of 6% allowed on original investments and the remaindor divided in the ratio of 2:3. d. Salary allowances of $38,009 and $46,060, respectively, and the bolance divided equatly. Ohenive wer Set up a column tor each partine and a tocal columen. a. Determine the sistribution of income and loskes in the absence of a partnership agreement. b. Use the ratio ot the partners onganal capital westrient to distribste the net income. d. Akign ebch parthits stared salafy allowacce. Dotribute the remaining income bakd on the stated rabs

Dividing nutinershe Income. Tyler hawes and Poer Mbright formed a partrership, inveiting $95,000 and $144,000, respectovely Determune their pertipipaph in the year's net income ef $290,000 under each of the foliosing independent assumptions a. No agreement concerming divinion of eet income. b. Dlvibed in the ratio of original capital investment c. Interest af the rate of 6% allowed on original investments and the remaindor divided in the ratio of 2:3. d. Salary allowances of $38,009 and $46,060, respectively, and the bolance divided equatly. Ohenive wer Set up a column tor each partine and a tocal columen. a. Determine the sistribution of income and loskes in the absence of a partnership agreement. b. Use the ratio ot the partners onganal capital westrient to distribste the net income. d. Akign ebch parthits stared salafy allowacce. Dotribute the remaining income bakd on the stated rabs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started