Do all parts

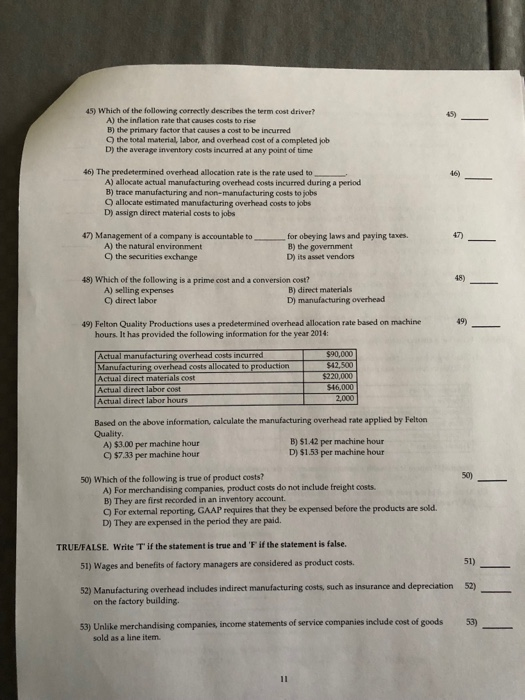

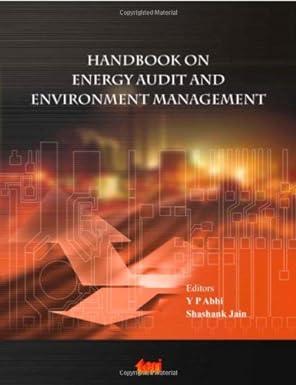

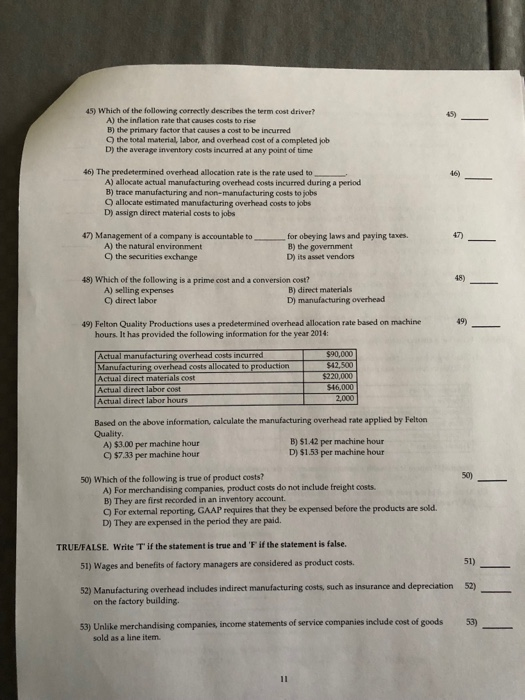

45) Which of the following correctly describes the term cost driver? 45) A) the inflation rate that causes costs to rise B) the primary factor that causes a cost to be in red Q) the total material, labor, and overhead cost of a completed job D) the average inventory costs incurred at any point of time 46) The predetermined overhead allocation rate is the rate used to 46) A) allocate actual manufacturing overhead costs incurred during a period B) trace manufacturing and non-manufacturing costs to jobs ) allocate estimated manufacturing overhead costs to jobs D) assign direct material costs to jobs 47) Management of a company is accountable tofor obeying laws and paying taxes. 47) A) the natural environment C) the securities exchange B) the government D) its asset vendors 48) Which of the following is a prime cost and a conversion cost? 48) A) selling expenses C) direct labor B) direct materials D) 19) 49) Felton Quality Productions uses a predetermined overhead allocation rate based on machine hours. It has provided the following information for the year 2014 $90,000 $42,500 Actual manufacturing overhead costs incurred overhead costs allocated to production materials cost Actual direct Actual direct labor cost Actual direct labor hours $46,000 2,000 Based on the above information, calculate the manufacturing overhead rate applied by Felton Quality A) $3.00 per machine hour C) $7.33 per machine hour B) $1.42 per machine hour D) $1.53 per machine hour 50) Which of the following is true of product costs? A) For merchandising companies, product costs do not include freight costs. B) They are first recorded in an inventory account ) For external reporting GAAP requires that they be expensed before the products are sold D) They are expensed in the period they are paid. TRUE/FALSE. Write T if the statement is true and 'F if the statement is false. 51) 51) Wages and benefits of factory managers are considered as product costs. 52) 52) Manufacturing overhead includes indirect manufacturing costs, such as insurance and depreciation on the factory building. 53) 53) Unlike merchandising companies, income statements of service companies include cost of goods sold as a line item