Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do Williams Co. Cost of Goods Manufacturing Schedule An analysis of the accounts of Williams Company reveals the following manufacturing cost data for the month

Do Williams Co. Cost of Goods Manufacturing Schedule

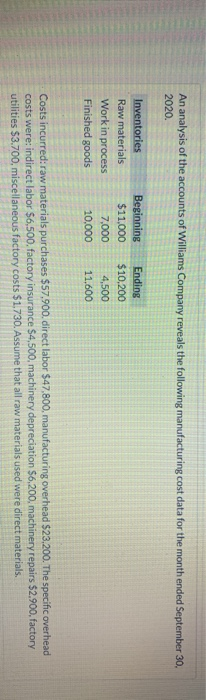

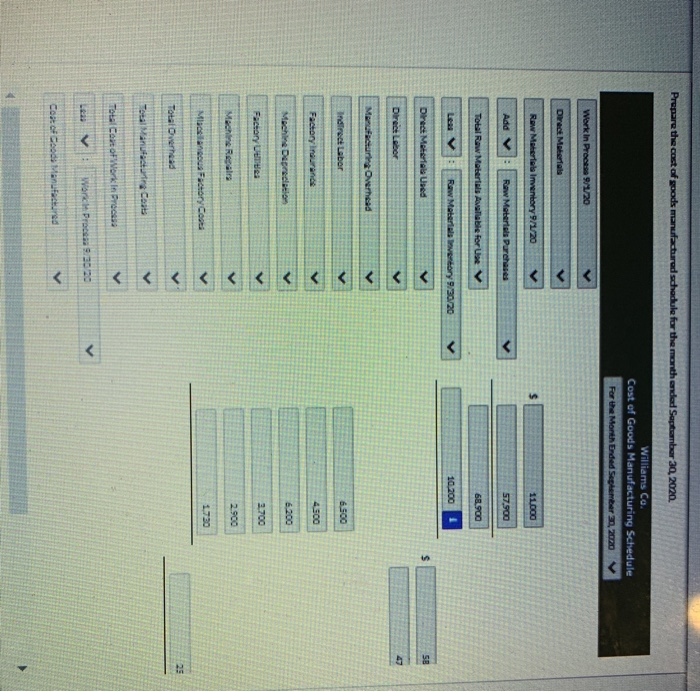

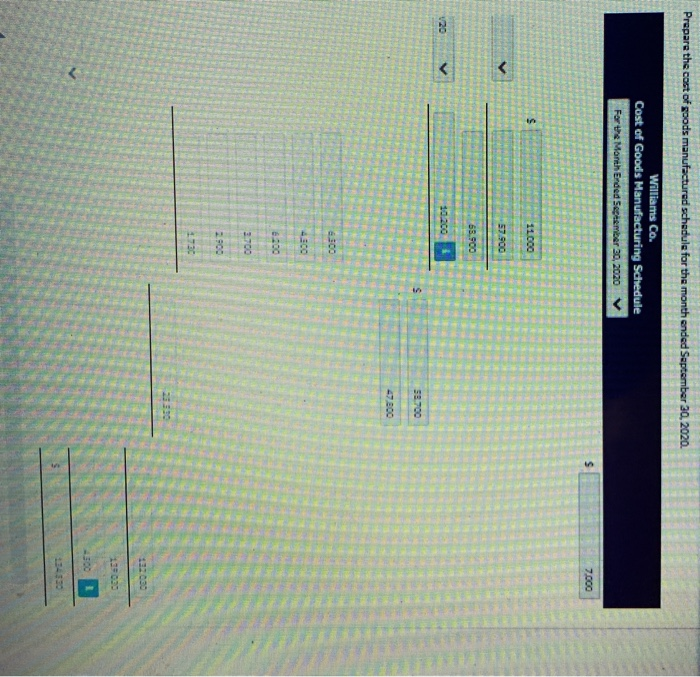

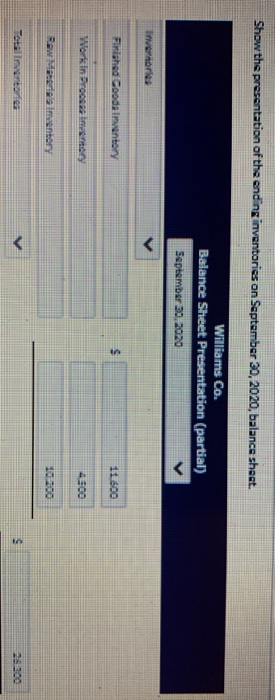

An analysis of the accounts of Williams Company reveals the following manufacturing cost data for the month ended September 30, 2020. Inventories Raw materials Work in process Finished goods Beginning $11,000 7,000 10.000 Ending $10,200 4,500 11,600 Costs incurred: raw materials purchases $57,900. direct labor $47,800, manufacturing overhead $23,200. The specific overhead costs were: indirect labor $6,500. factory insurance $4,500, machinery depreciation $6,200, machinery repairs $2.900, factory utilities $3.700, miscellaneous factory costs $1.730. Assume that all raw materials used were direct materials. Prepare the cost of goods manufactured schedule for the month anded September 30, 2020. Williams Co. Cost of Goods Manufacturing Schedule For the Month Ended September 21, 20/20 Work in Pro 9/1/20 Direct Materials Raw Materials inventory 9/1/20 11.000 Add Raw Materials Purchases 57.900 Total Raw Materials Avaliable for U V 68.900 Raw Materials lineary 9/30/20 10.200 Direct Materials Used $ Direct Labor V Manufacturing Overhead Indirect Labor 6.500 Factory indurance V 4500 Machine Depreciation V Factory Ute V 2.700 Machine Repair 2.900 1.730 Mladilnius Factory Coa 25 Total Overhead Total Manufacturing Coats Total Cost of Work In Process LE V Woc Prace 9300 Cost of Good Manufactured Prepare the cost of goods manufactured schedule for the month ended September 30, 2020 Williams Co. Cost of Goods Manufacturing Schedule For the Month Ended September 30, 2020 s 7.000 $ 11.000 V S > > > Williams Company is considering the purchase of an automated assembly line for its factory. The purchase would result in several changes in Williams' cost structure. Both direct labor and indirect labor would decrease by 40k. Factory insurance would increase to $4,200, machinery depreciation would double, machinery repairs would decrease to $500, utilities would decrease to $2,200 and miscellaneous factory costs would increase to $1,820. Materials usage would remain at current levels Analyze the new purchase by preparing a cost of goods manufactured schedule for September 30, 2020 using the new data. Williams Co. Cost of Goods Manufacturing Schedule LLUM $ EE $ Question 6 of 9 Cost of Goods Manufacturing Schedule $ $ 3 $ $ List of AccountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started