Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dr Anderson, a self-employed medical practitioner, incurred the following expenses during the year ended 30 June 2021: $ 1,200 4,600 800 1,200 rewiring of

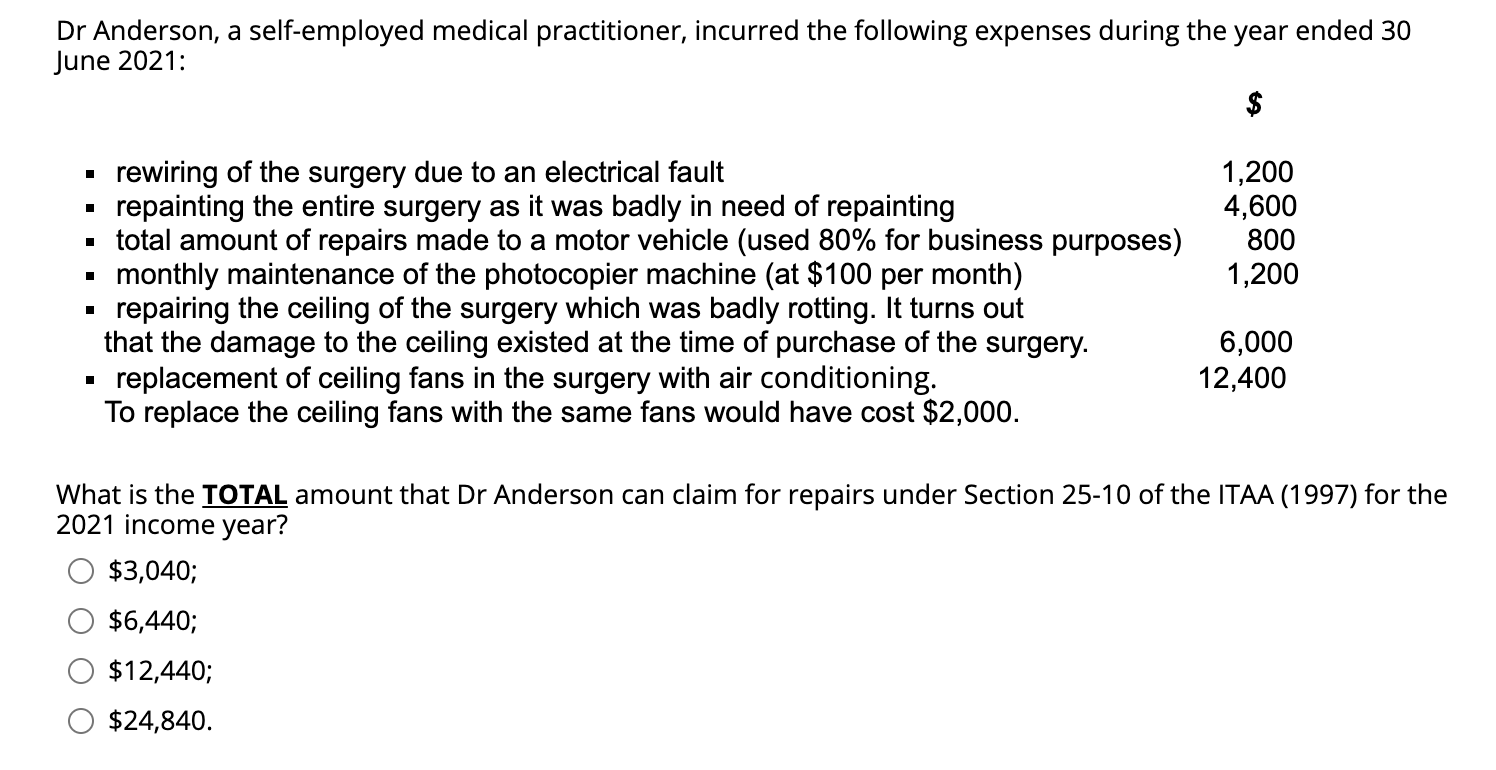

Dr Anderson, a self-employed medical practitioner, incurred the following expenses during the year ended 30 June 2021: $ 1,200 4,600 800 1,200 rewiring of the surgery due to an electrical fault repainting the entire surgery as it was badly in need of repainting total amount of repairs made to a motor vehicle (used 80% for business purposes) monthly maintenance of the photocopier machine (at $100 per month) repairing the ceiling of the surgery which was badly rotting. It turns out that the damage to the ceiling existed at the time of purchase of the surgery. replacement of ceiling fans in the surgery with air conditioning. To replace the ceiling fans with the same fans would have cost $2,000. 6,000 12,400 What is the TOTAL amount that Dr Anderson can claim for repairs under Section 25-10 of the ITAA (1997) for the 2021 income year? $3,040; $6,440; $12,440; $24,840.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Out of the expenses listedDrAnderson can claim the following for repairs under Section 2510 of the I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started