Answered step by step

Verified Expert Solution

Question

1 Approved Answer

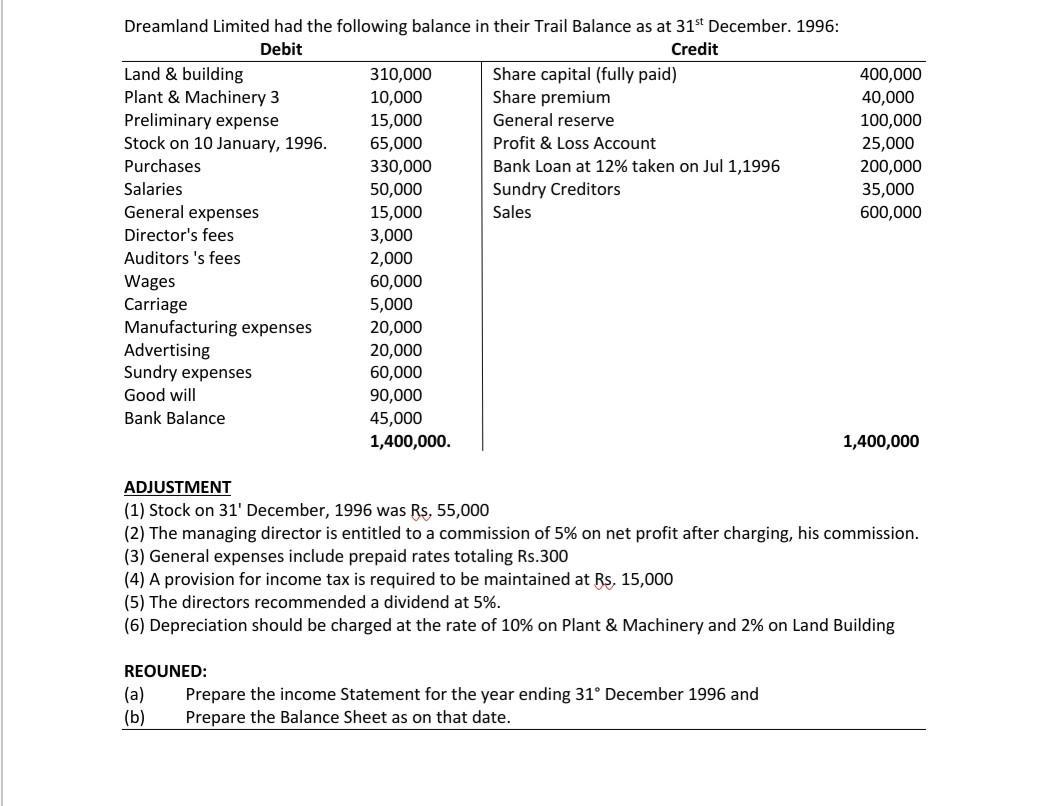

Dreamland Limited had the following balance in their Trail Balance as at 31st December. 1996: Debit Credit Land & building Plant & Machinery 3

Dreamland Limited had the following balance in their Trail Balance as at 31st December. 1996: Debit Credit Land & building Plant & Machinery 3 Preliminary expense Stock on 10 January, 1996. Purchases Share capital (fully paid) Share premium 310,000 400,000 10,000 40,000 General reserve 100,000 25,000 15,000 65,000 Profit & Loss Account 200,000 35,000 330,000 Bank Loan at 12% taken on Jul 1,1996 Sundry Creditors Sales Salaries 50,000 General expenses 15,000 600,000 Director's fees 3,000 Auditors 's fees 2,000 Wages Carriage 60,000 5,000 Manufacturing expenses Advertising Sundry expenses 20,000 20,000 60,000 Good will 90,000 Bank Balance 45,000 1,400,000. 1,400,000 ADJUSTMENT (1) Stock on 31' December, 1996 was Rs, 55,000 (2) The managing director is entitled to a commission of 5% on net profit after charging, his commission. (3) General expenses include prepaid rates totaling Rs.300 (4) A provision for income tax is required to be maintained at Rs, 15,000 (5) The directors recommended a dividend at 5%. (6) Depreciation should be charged at the rate of 10% on Plant & Machinery and 2% on Land Building REOUNED: (a) (b) Prepare the income Statement for the year ending 31 December 1996 and Prepare the Balance Sheet as on that date.

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Balanullet as 36t Dec 1996 Lialility Share Capital Bremium Regerus hare hemi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started