Question: Drop down 1: MinT; TmRE; GMAR; BRRT Drop down 2: will not; will also Drop down 3: will need; will not need Drop down 4:

Drop down 1: MinT; TmRE; GMAR; BRRT

Drop down 1: MinT; TmRE; GMAR; BRRT

Drop down 2: will not; will also

Drop down 3: will need; will not need

Drop down 4: impossible; very easy

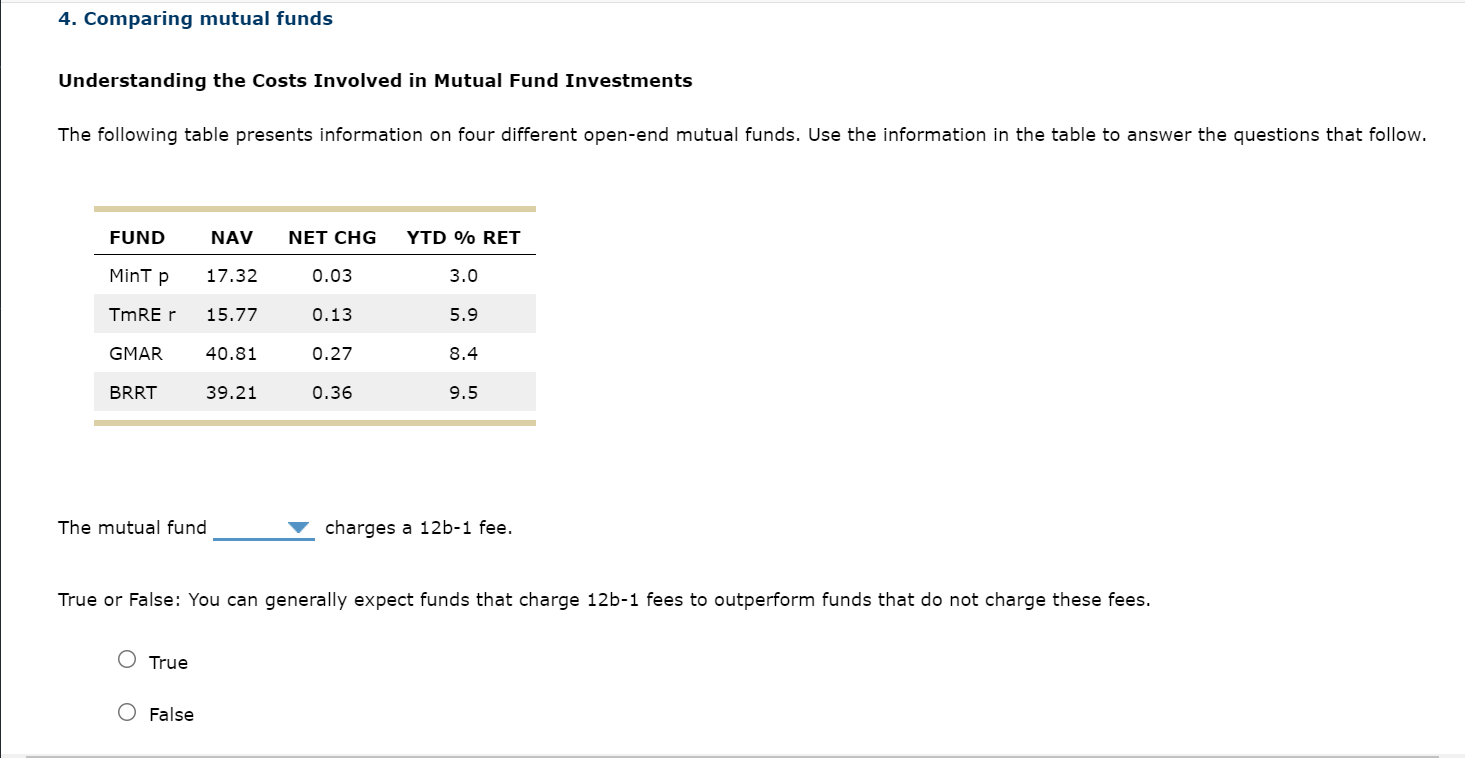

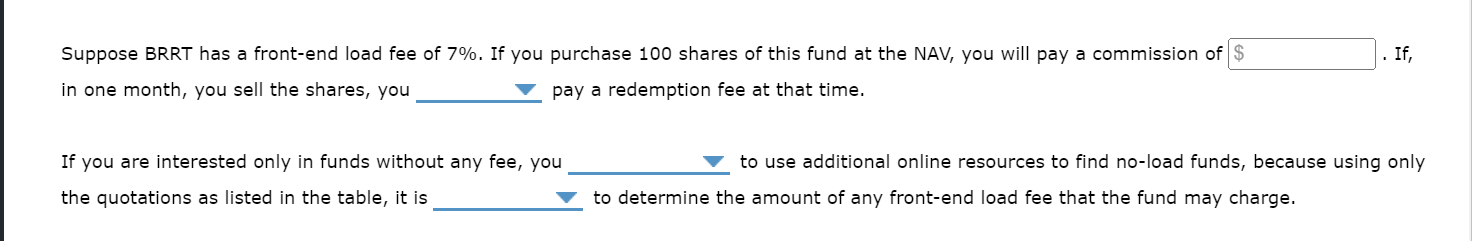

4. Comparing mutual funds Understanding the Costs Involved in Mutual Fund Investments The following table presents information on four different open-end mutual funds. Use the information in the table to answer the questions that follow. FUND NAV NET CHG YTD % RET Mint p 17.32 0.03 3.0 TmRE r 15.77 0.13 5.9 GMAR 40.81 0.27 8.4 BRRT 39.21 0.36 9.5 The mutual fund charges a 12b-1 fee. True or False: You can generally expect funds that charge 12b-1 fees to outperform funds that do not charge these fees. True False Suppose BRRT has a front-end load fee of 7%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you pay a redemption fee at that time. If you are interested only in funds without any fee, you the quotations as listed in the table, it is to determine the amount of any front-end load fee that the fund may charge. If, to use additional online resources to find no-load funds, because using only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts