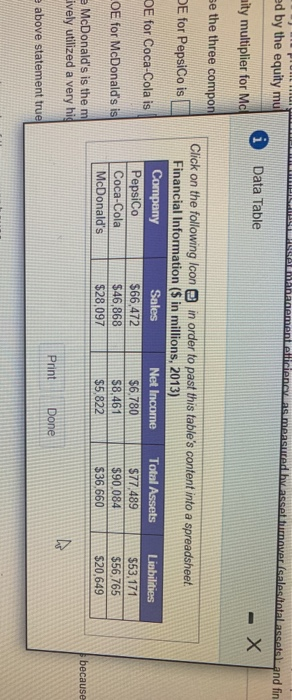

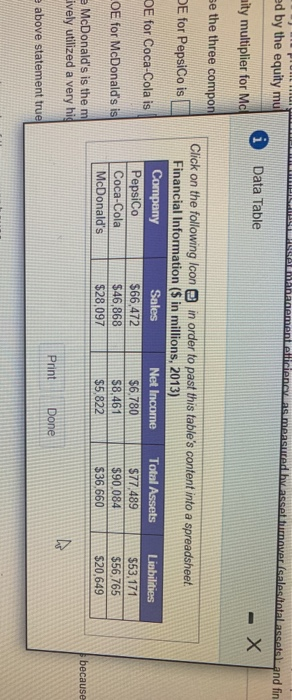

DuPont identity. For the firms in the popup window, I find the return on equity using the three components of the DuPont idently operating efficiency, as measured by the profit margin (net income/sales), asset management efficiency, as measured by asset turnover (sales/Total assets) and financial leverage, as measured by the equity multiplier (total assets/total equity) The profit margin for PepsiCo is % (Round to two decimal places) The profit margin for Coca-Cola is % (Round to two decimal places) The profit margin for McDonald's is * (Round to two decimal places) The asset turnover for PepsiCo is (Round to four decimal places) The asset turnover for Coca-Cola is (Round to four decimal placus.) The asset turnover for McDonald's is (Round to four decimal places) The equity multiplier for PepsiCo is (Round to four decimal places) vururunuy. For the norms in the popup window, find the return on equity using the three components of the DuPont identity, operating efficiency, as measured by the profit margin (net income/sales), asset management efficiency, as measured by asset turnover (sales/total assets), and financial leverage, as measured by the equity multiplier (total assets/total equity) The asset turnover for McDonald's in (Round to four decimal places) The equity multiplier for PepsiCois (Round to four decimal places.) The equity multiplier for Coca-Cola is (Round to four decimal places.) The equity multiplier for McDonald's isQ (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE The ROE for PepsiCo is % (Round to two decimal places) The ROE for Coca-Cola is [% (Round to two decimal places) The ROF for Mennalleels IRundt tun darimal laro The equity multiplier for McDonald's is (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE The ROE for PepsiCo is % (Round to two decimal places.) The ROE for Coca-Cola is [%. (Round to two decimal places) The ROE for McDonald's is % (Round to two decimal places) "While McDonald's is the most operationally efficient and Pepsi the most efficient in management, Pepsi is the best to its shareholders because it has effectively utilized a very high financial leverage strategy, using debt and not shareholder earnings to finance the profits of the firm." Is the above statement true or false? True (Select from the drop-down menu.) Enter your answer in each of the ans True False WILLIAM ement elliciency as measured by asset toner (salesitatal assets and fin ed by the equity mu Data Table mity multiplier for Mc se the three compon DE for PepsiCo is DE for Coca-Cola is Click on the following Icon in order to past this table's content into a spreadsheet Financial Information ($ in millions, 2013) Company Sales Net Income Total Assets Liabilities PepsiCo $66,472 $6.780 $77,489 $53,171 Coca-Cola $46,868 $8,461 $90.084 $56.765 McDonald's $28,097 $5.822 $36,660 $20,649 OE for McDonald's is e McDonald's is the m Lively utilized a very hig because Print Done e above statement true