Answered step by step

Verified Expert Solution

Question

1 Approved Answer

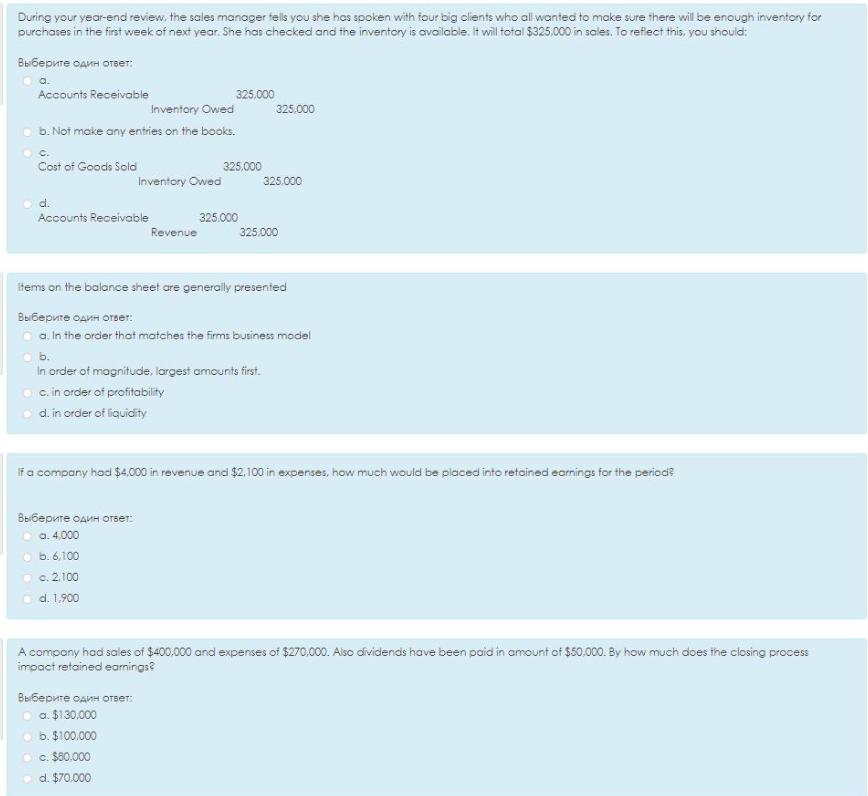

During your year-end review, the sales manager tells you she hos spoken with four big clients who all wanted to make sure there will

During your year-end review, the sales manager tells you she hos spoken with four big clients who all wanted to make sure there will be enough inventery for purchases in the first week of next year. She har checked and the inventory is available. It will total $325.000 in sales. To reflect this, you should: : a. Accounts Receivable 325,000 Inventory Owed 325.000 o b. Not make any entries on the books. C. Cost of Goods Sold 325.000 Inventory Owed 325.000 d. Accounts Receivable 325.000 Revenue 325.000 items on the balance sheet are generaly presented : o a. In the order that matches the firms business model Ob. In order of magnitude, largest amounts first. O c. in order of profitability o d. in order of liquidity If a company had $4.000 in revenue and $2.,100 in expenses, how much would be placed into retained earnings for the period? : O 0. 4.000 O b.6,100 O c. 2100 Od. 1,900 A company had sales of $400.000 and expenses of $270.000. Also dividends have been paid in amount of $50.000. By how much does the closing process impact retained eanings? : O a. $130,000 O b. $100.000 Oc. $80.000 d. $70.000

Step by Step Solution

★★★★★

3.64 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 c Cost of good sold 325000 Inventory owed 325000 2 d In order of liquidity Assets are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started