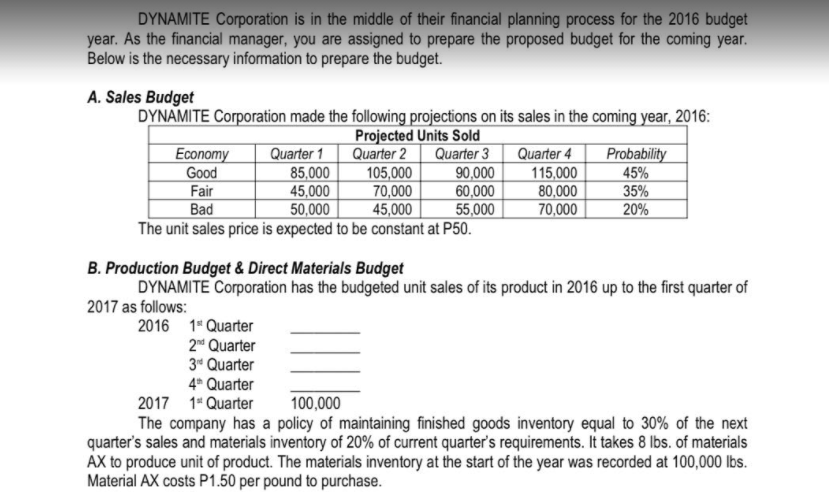

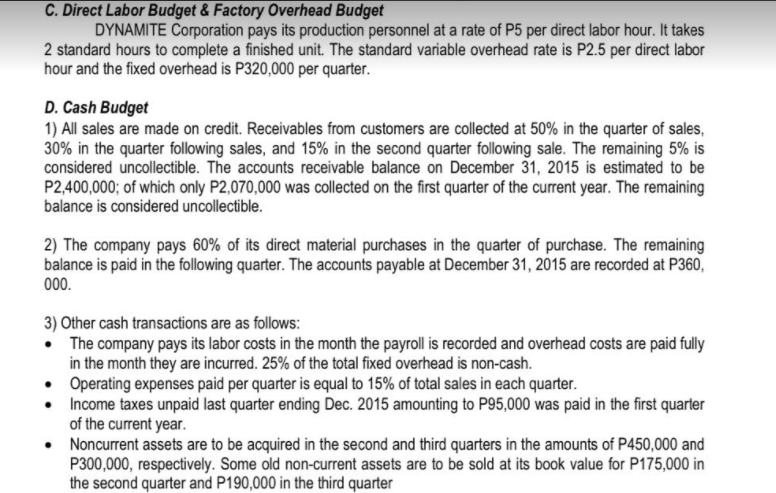

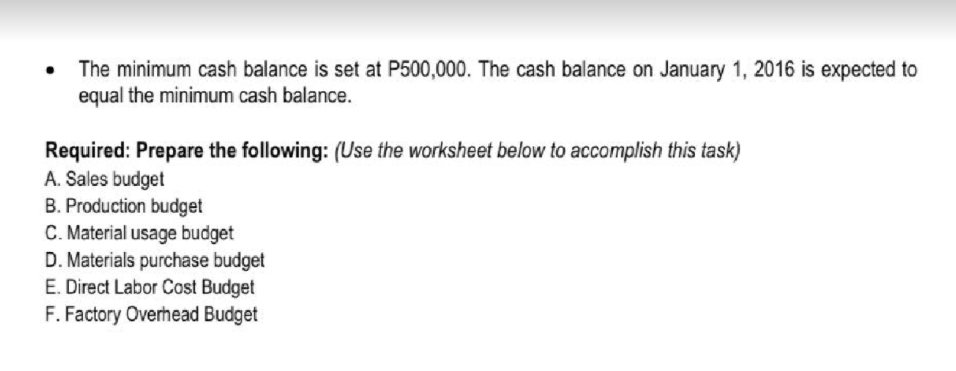

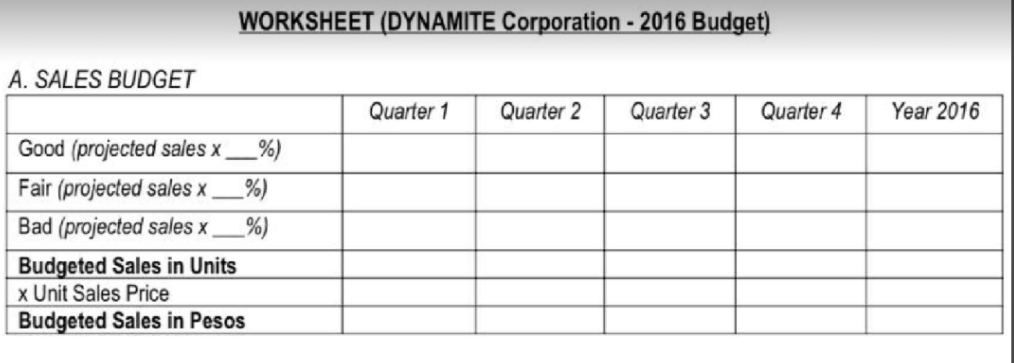

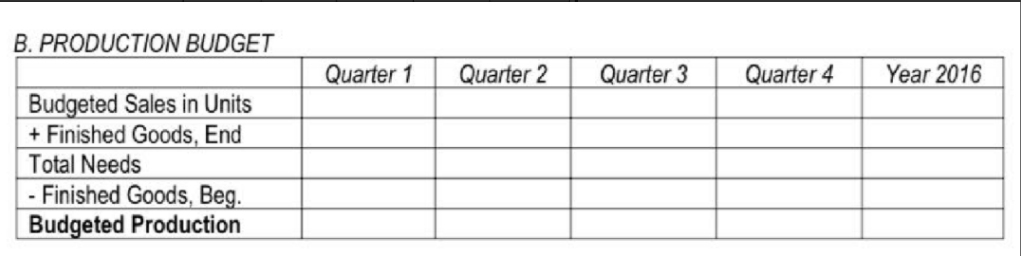

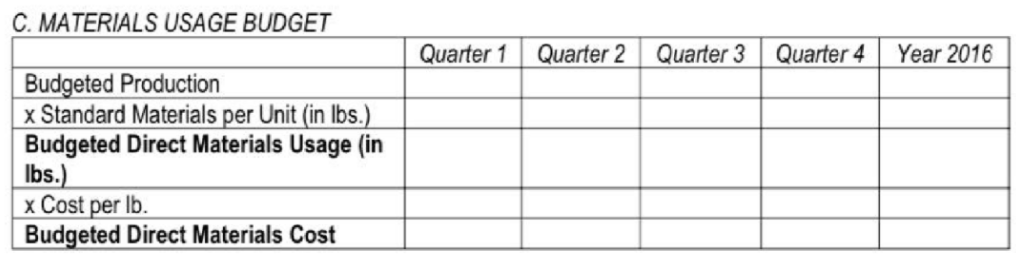

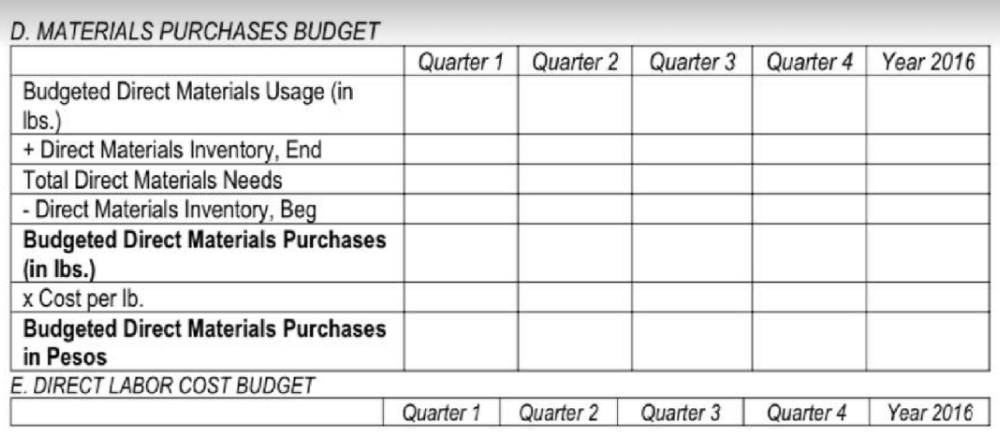

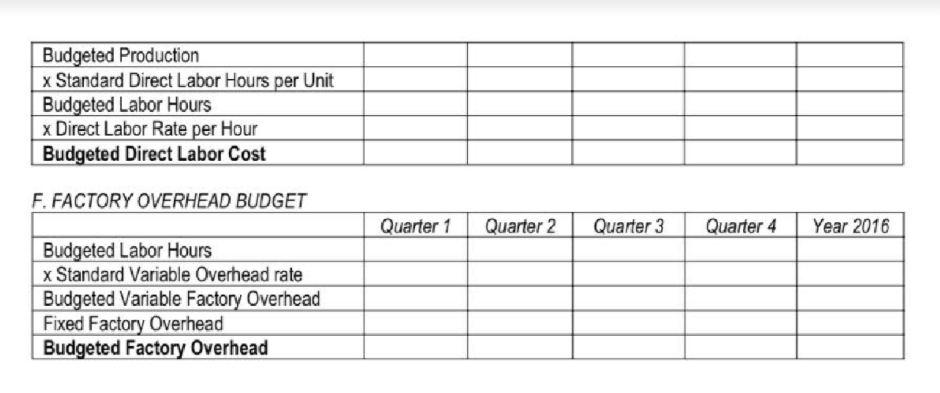

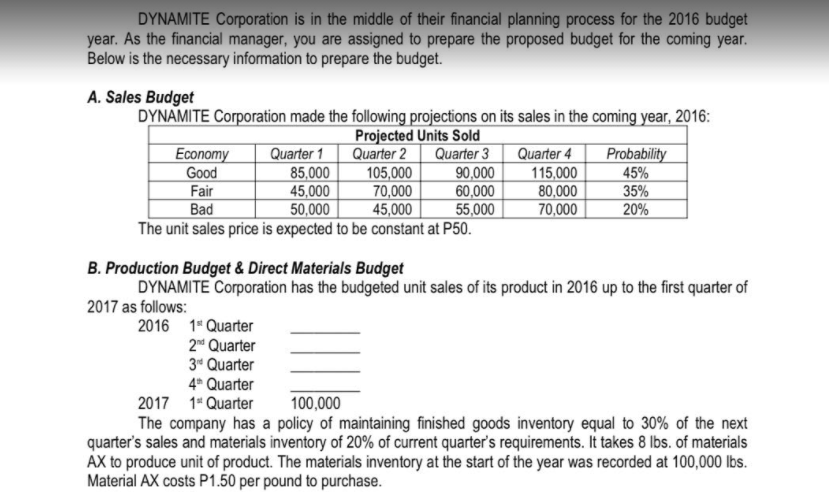

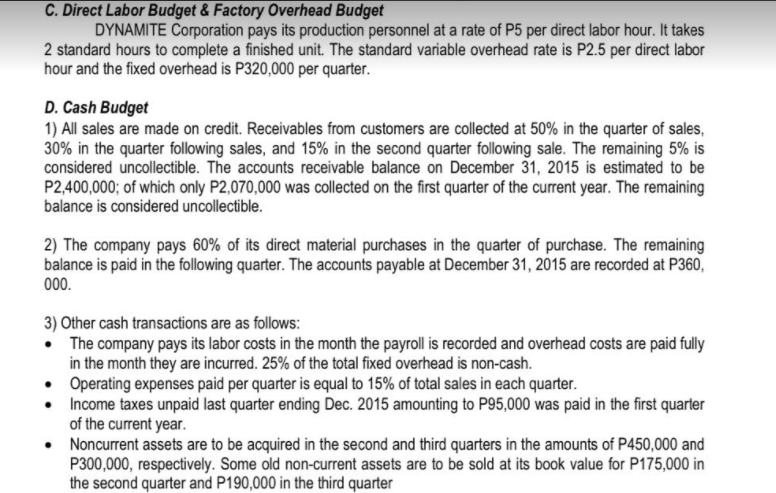

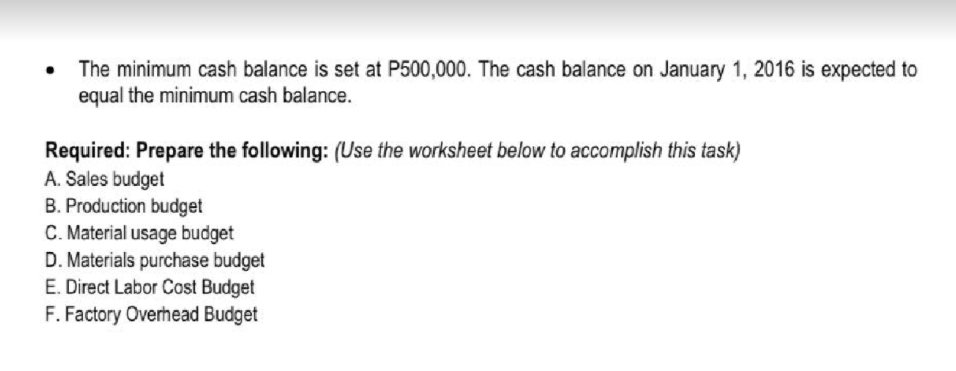

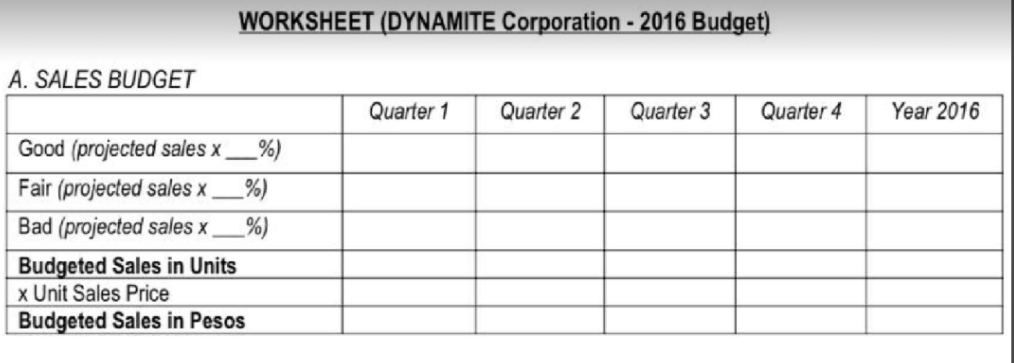

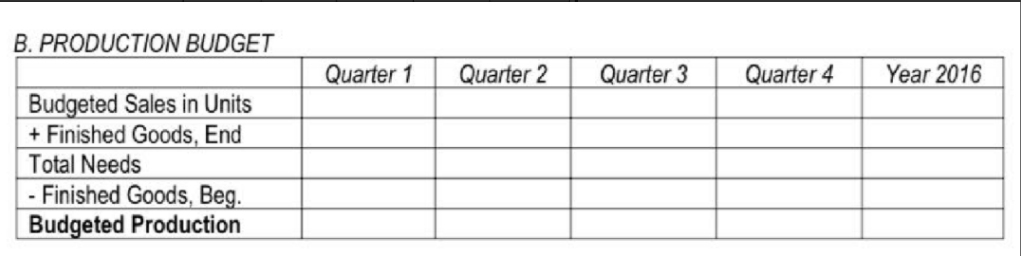

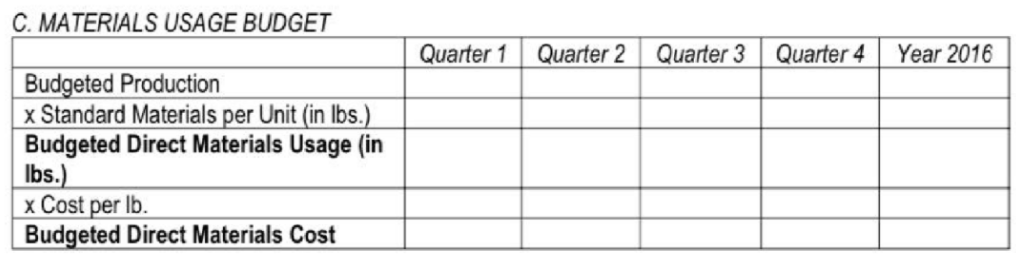

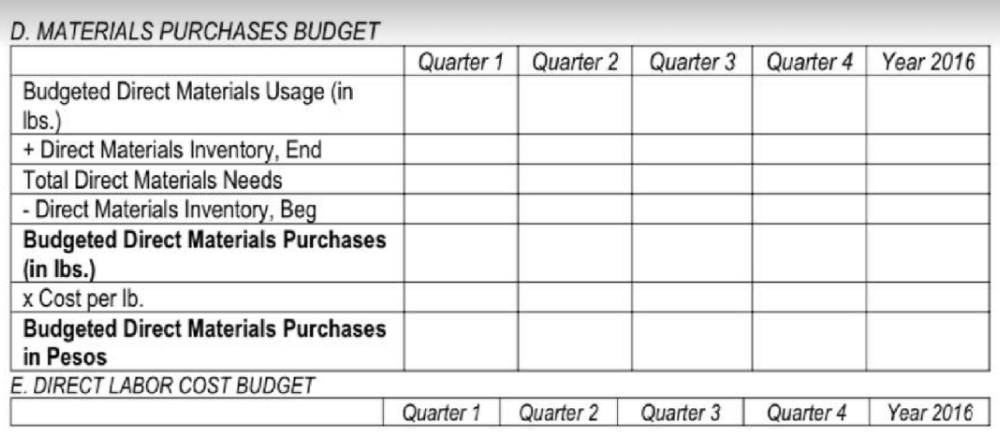

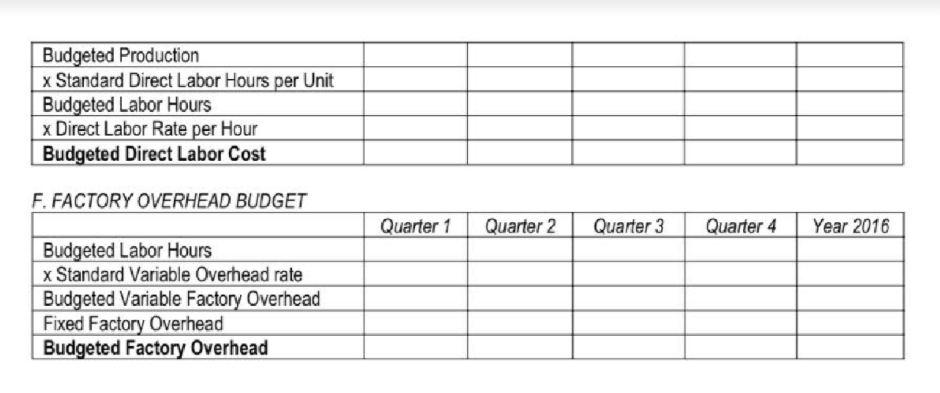

DYNAMITE Corporation is in the middle of their financial planning process for the 2016 budget year. As the financial manager, you are assigned to prepare the proposed budget for the coming year. Below is the necessary information to prepare the budget. A. Sales Budget DYNAMITE Corporation made the following projections on its sales in the coming year, 2016: Projected Units Sold Economy Quarter 1 Quarter 2 Quarter 3 Quarter 4 Probability Good 85,000 105,000 90,000 115,000 45% Fair 45,000 70,000 60,000 80,000 35% Bad 50,000 45,000 55,000 70,000 20% The unit sales price is expected to be constant at P50. B. Production Budget & Direct Materials Budget DYNAMITE Corporation has the budgeted unit sales of its product in 2016 up to the first quarter of 2017 as follows: 2016 1* Quarter 204 Quarter 34 Quarter 4* Quarter 2017 1" Quarter 100,000 The company has a policy of maintaining finished goods inventory equal to 30% of the next quarter's sales and materials inventory of 20% of current quarter's requirements. It takes 8 lbs. of materials AX to produce unit of product. The materials inventory at the start of the year was recorded at 100,000 lbs. Material AX costs P1.50 per pound to purchase. C. Direct Labor Budget & Factory Overhead Budget DYNAMITE Corporation pays its production personnel at a rate of P5 per direct labor hour. It takes 2 standard hours to complete a finished unit. The standard variable overhead rate is P2.5 per direct labor hour and the fixed overhead is P320,000 per quarter. D. Cash Budget 1) All sales are made on credit. Receivables from customers are collected at 50% in the quarter of sales, 30% in the quarter following sales, and 15% in the second quarter following sale. The remaining 5% is considered uncollectible. The accounts receivable balance on December 31, 2015 is estimated to be P2,400,000; of which only P2,070,000 was collected on the first quarter of the current year. The remaining balance is considered uncollectible. 2) The company pays 60% of its direct material purchases in the quarter of purchase. The remaining balance is paid in the following quarter. The accounts payable at December 31, 2015 are recorded at P360, 000. 3) Other cash transactions are as follows: The company pays its labor costs in the month the payroll is recorded and overhead costs are paid fully in the month they are incurred. 25% of the total fixed overhead is non-cash. Operating expenses paid per quarter is equal to 15% of total sales in each quarter. Income taxes unpaid last quarter ending Dec. 2015 amounting to P95,000 was paid in the first quarter of the current year. Noncurrent assets are to be acquired in the second and third quarters in the amounts of P450,000 and P300,000, respectively. Some old non-current assets are to be sold at its book value for P175,000 in the second quarter and P190,000 in the third quarter The minimum cash balance is set at P500,000. The cash balance on January 1, 2016 is expected to equal the minimum cash balance. Required: Prepare the following: (Use the worksheet below to accomplish this task) A. Sales budget B. Production budget C. Material usage budget D. Materials purchase budget E. Direct Labor Cost Budget F. Factory Overhead Budget WORKSHEET (DYNAMITE Corporation - 2016 Budget) A. SALES BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Good (projected sales x %) Fair (projected sales x Bad (projected sales x _%) Budgeted Sales in Units x Unit Sales Price Budgeted Sales in Pesos B. PRODUCTION BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Sales in Units + Finished Goods, End Total Needs - Finished Goods, Beg. Budgeted Production C. MATERIALS USAGE BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Production x Standard Materials per Unit (in lbs.) Budgeted Direct Materials Usage (in lbs.) x Cost per lb. Budgeted Direct Materials Cost D. MATERIALS PURCHASES BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Direct Materials Usage (in lbs. + Direct Materials Inventory, End Total Direct Materials Needs - Direct Materials Inventory, Beg Budgeted Direct Materials Purchases (in lbs.) x Cost per lb. Budgeted Direct Materials Purchases in Pesos E. DIRECT LABOR COST BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Production x Standard Direct Labor Hours per Unit Budgeted Labor Hours x Direct Labor Rate per Hour Budgeted Direct Labor Cost F. FACTORY OVERHEAD BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Labor Hours x Standard Variable Overhead rate Budgeted Variable Factory Overhead Fixed Factory Overhead Budgeted Factory Overhead DYNAMITE Corporation is in the middle of their financial planning process for the 2016 budget year. As the financial manager, you are assigned to prepare the proposed budget for the coming year. Below is the necessary information to prepare the budget. A. Sales Budget DYNAMITE Corporation made the following projections on its sales in the coming year, 2016: Projected Units Sold Economy Quarter 1 Quarter 2 Quarter 3 Quarter 4 Probability Good 85,000 105,000 90,000 115,000 45% Fair 45,000 70,000 60,000 80,000 35% Bad 50,000 45,000 55,000 70,000 20% The unit sales price is expected to be constant at P50. B. Production Budget & Direct Materials Budget DYNAMITE Corporation has the budgeted unit sales of its product in 2016 up to the first quarter of 2017 as follows: 2016 1* Quarter 204 Quarter 34 Quarter 4* Quarter 2017 1" Quarter 100,000 The company has a policy of maintaining finished goods inventory equal to 30% of the next quarter's sales and materials inventory of 20% of current quarter's requirements. It takes 8 lbs. of materials AX to produce unit of product. The materials inventory at the start of the year was recorded at 100,000 lbs. Material AX costs P1.50 per pound to purchase. C. Direct Labor Budget & Factory Overhead Budget DYNAMITE Corporation pays its production personnel at a rate of P5 per direct labor hour. It takes 2 standard hours to complete a finished unit. The standard variable overhead rate is P2.5 per direct labor hour and the fixed overhead is P320,000 per quarter. D. Cash Budget 1) All sales are made on credit. Receivables from customers are collected at 50% in the quarter of sales, 30% in the quarter following sales, and 15% in the second quarter following sale. The remaining 5% is considered uncollectible. The accounts receivable balance on December 31, 2015 is estimated to be P2,400,000; of which only P2,070,000 was collected on the first quarter of the current year. The remaining balance is considered uncollectible. 2) The company pays 60% of its direct material purchases in the quarter of purchase. The remaining balance is paid in the following quarter. The accounts payable at December 31, 2015 are recorded at P360, 000. 3) Other cash transactions are as follows: The company pays its labor costs in the month the payroll is recorded and overhead costs are paid fully in the month they are incurred. 25% of the total fixed overhead is non-cash. Operating expenses paid per quarter is equal to 15% of total sales in each quarter. Income taxes unpaid last quarter ending Dec. 2015 amounting to P95,000 was paid in the first quarter of the current year. Noncurrent assets are to be acquired in the second and third quarters in the amounts of P450,000 and P300,000, respectively. Some old non-current assets are to be sold at its book value for P175,000 in the second quarter and P190,000 in the third quarter The minimum cash balance is set at P500,000. The cash balance on January 1, 2016 is expected to equal the minimum cash balance. Required: Prepare the following: (Use the worksheet below to accomplish this task) A. Sales budget B. Production budget C. Material usage budget D. Materials purchase budget E. Direct Labor Cost Budget F. Factory Overhead Budget WORKSHEET (DYNAMITE Corporation - 2016 Budget) A. SALES BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Good (projected sales x %) Fair (projected sales x Bad (projected sales x _%) Budgeted Sales in Units x Unit Sales Price Budgeted Sales in Pesos B. PRODUCTION BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Sales in Units + Finished Goods, End Total Needs - Finished Goods, Beg. Budgeted Production C. MATERIALS USAGE BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Production x Standard Materials per Unit (in lbs.) Budgeted Direct Materials Usage (in lbs.) x Cost per lb. Budgeted Direct Materials Cost D. MATERIALS PURCHASES BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Direct Materials Usage (in lbs. + Direct Materials Inventory, End Total Direct Materials Needs - Direct Materials Inventory, Beg Budgeted Direct Materials Purchases (in lbs.) x Cost per lb. Budgeted Direct Materials Purchases in Pesos E. DIRECT LABOR COST BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Production x Standard Direct Labor Hours per Unit Budgeted Labor Hours x Direct Labor Rate per Hour Budgeted Direct Labor Cost F. FACTORY OVERHEAD BUDGET Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 2016 Budgeted Labor Hours x Standard Variable Overhead rate Budgeted Variable Factory Overhead Fixed Factory Overhead Budgeted Factory Overhead