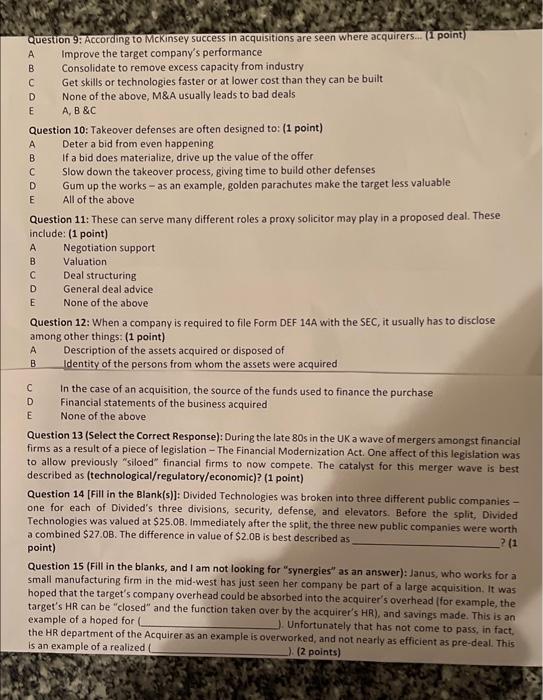

E A Question 9. According to McKinsey success in acquisitions are seen where acquirers... (1 point) Improve the target company's performance B Consolidate to remove excess capacity from industry C Get skills or technologies faster or at lower cost than they can be built D None of the above, M&A usually leads to bad deals E A, B &C Question 10: Takeover defenses are often designed to: (1 point) Deter a bid from even happening B If a bid does materialize, drive up the value of the offer Slow down the takeover process, giving time to build other defenses D Gum up the works - as an example, golden parachutes make the target less valuable All of the above Question 11: These can serve many different roles a proxy solicitor may play in a proposed deal. These include: (1 point) Negotiation support B Valuation C Deal structuring D General deal advice E None of the above Question 12: When a company is required to file Form DEF 14A with the SEC, it usually has to disclose among other things: (1 point) Description of the assets acquired or disposed of Identity of the persons from whom the assets were acquired In the case of an acquisition, the source of the funds used to finance the purchase Financial statements of the business acquired None of the above Question 13 (Select the correct Response): During the late 80s in the UK a wave of mergers amongst financial firms as a result of a piece of legislation - The Financial Modernization Act. One affect of this legislation was to allow previously "siloed" financial firms to now compete. The catalyst for this merger wave is best described as (technological/regulatory/economic)? (1 point) Question 14 (Fill in the Blank(s)]: Divided Technologies was broken into three different public companies - one for each of Divided's three divisions, security, defense, and elevators. Before the split, Divided Technologies was valued at $25.0B. Immediately after the split, the three new public companies were worth a combined $27.0B. The difference in value of $2.0B is best described as point) -? (1 B D E Question 15 (Fill in the blanks, and I am not looking for "synergies" as an answer): Janus, who works for a small manufacturing firm in the mid-west has just seen her company be part of a large acquisition. It was hoped that the target's company overhead could be absorbed into the acquirer's overhead (for example, the target's HR can be "closed" and the function taken over by the acquirer's HR), and savings made. This is an example of a hoped for Unfortunately that has not come to pass, in fact, the HR department of the Acquirer as an example is overworked, and not nearly as efficient as pre-deal. This is an example of a realized _) (2 points)