E15-20

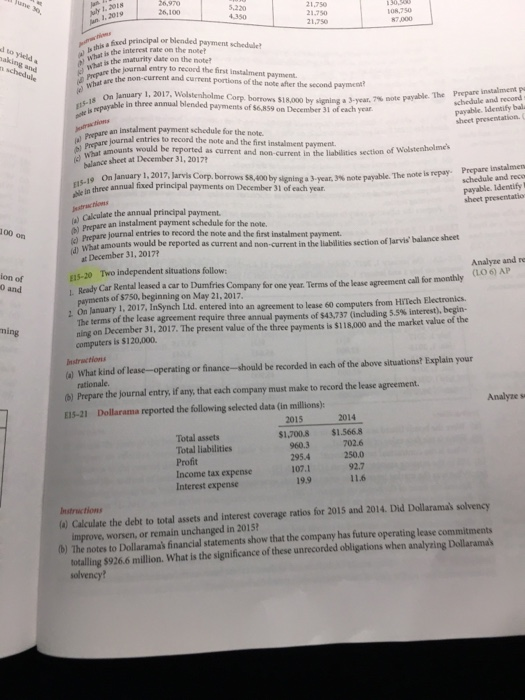

i a L 21,750 21.750 21,750 26,100 ,220 108,750 fsed principal or blended payment schedule Wihat is the maturity date on the note a wur is the interest rate on te joarnal entry to record the first instalment payment pnpakes the non-current and current portions of the note after the second payme schedule 1, 2017, Wolstemholme Corp borrows $18,000 a 3-year. in three annual blended payments of s6,859 on December 31 of each year. -18 On January 2017, by signing a 3-year, 7% note payable. The Prepare instalment P schedule and record payable. Identify bal. sheet presentation. C an instalment payment schedule for the note Pure journal entries to record the note and the first instalment payment. b) Psat amoants would be reported as current and non-current in the liabilities section of What amounts would be balance sheet at December 31, 20172 Wolstenholmes on January 1, 2017. laris Corp. borrows sa 400 by signing a 3-year, y% note payable. The note Prepare instalmen .19 is repay. three annual fixed principal payments on December 31 of each year schedule and rece payable. Identify sheet presentatio a) Calculate the annual principal payment Prcpare an instalment payment schedule for the note. Prepare journal entries to record the note and the first instalment d What amounts would be reported as current and non-current in the liabilities section of larvis' balance sheet at December 31, 2017? E15-20 Two independent situations follow Analyze and re ion of 0 and Redy Car Rental lased a car to Dumfies Company sir one year Terms of the lear agreement call for monthly CLO 6) AP Ready Car payments of $750, beginning on May 21, 2017 The terms of the lease agreement require three annual ning on December 31, The computers is $120,000 entered into an agreement to lease 60 computers from HiTech Electronics payments of S43737 (including 55% interest), begin. 2017. The present value of the three payments is $118,000 and the market value of the ning Instractions a) What kind of lease-operating or finance-should be recorded in each of the above situations? Explain your ) Prepare the Journal entry, if any, that each company must make to record the lease agreement. Analyze s E15-21 Dollarama reported the following selected data (in millions): 2015 2014 $1,700.8 $1.5668 Total assets Total liabilities 960.3 295.4 107.1 19.9 702.6 250.0 92.7 11.6 Income tax expense Interest expense Instructions (a) Calculate the debt to total assets and interest coverage ratios for 2015 and 2014. Did Dollaramas solvency b) The notes to Dollaramas financial statements show that the company has future operating lease commitments improve, worsen, or remain unchanged in 2015 totaling $926.6 million. What is the significance of these unrecornded obligations when analyting Dollaramak solvency