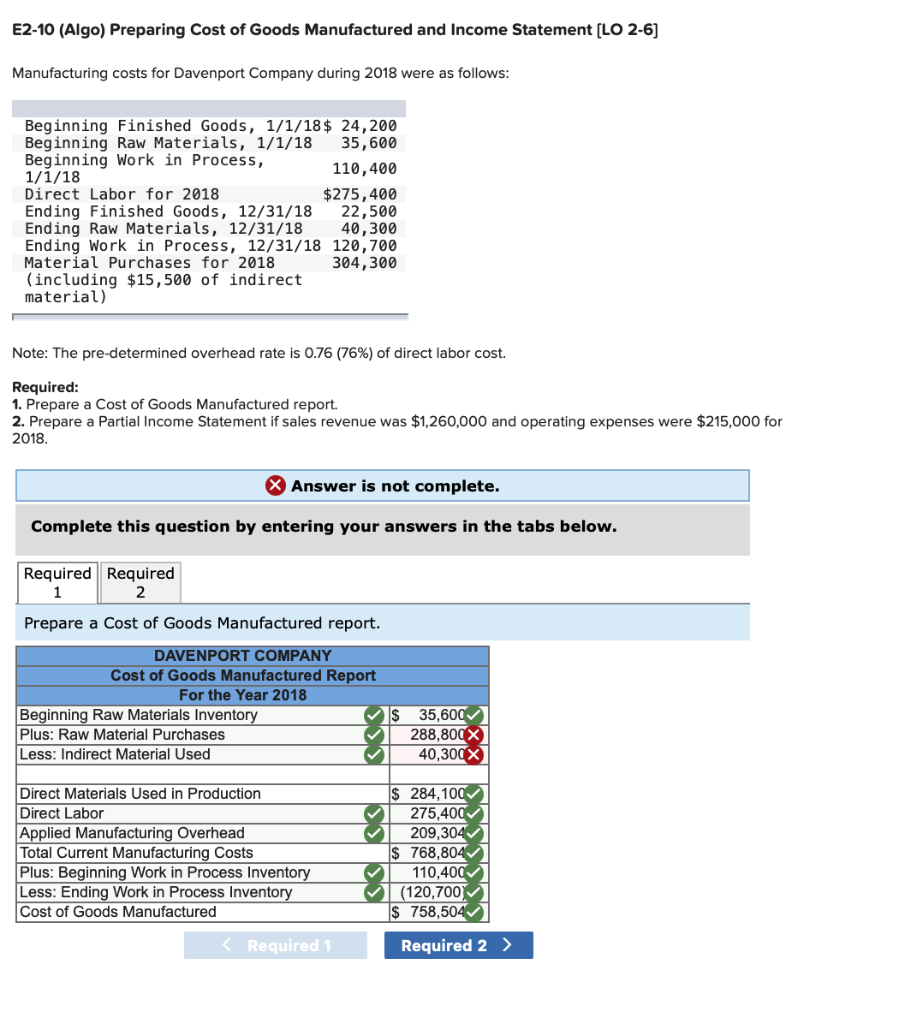

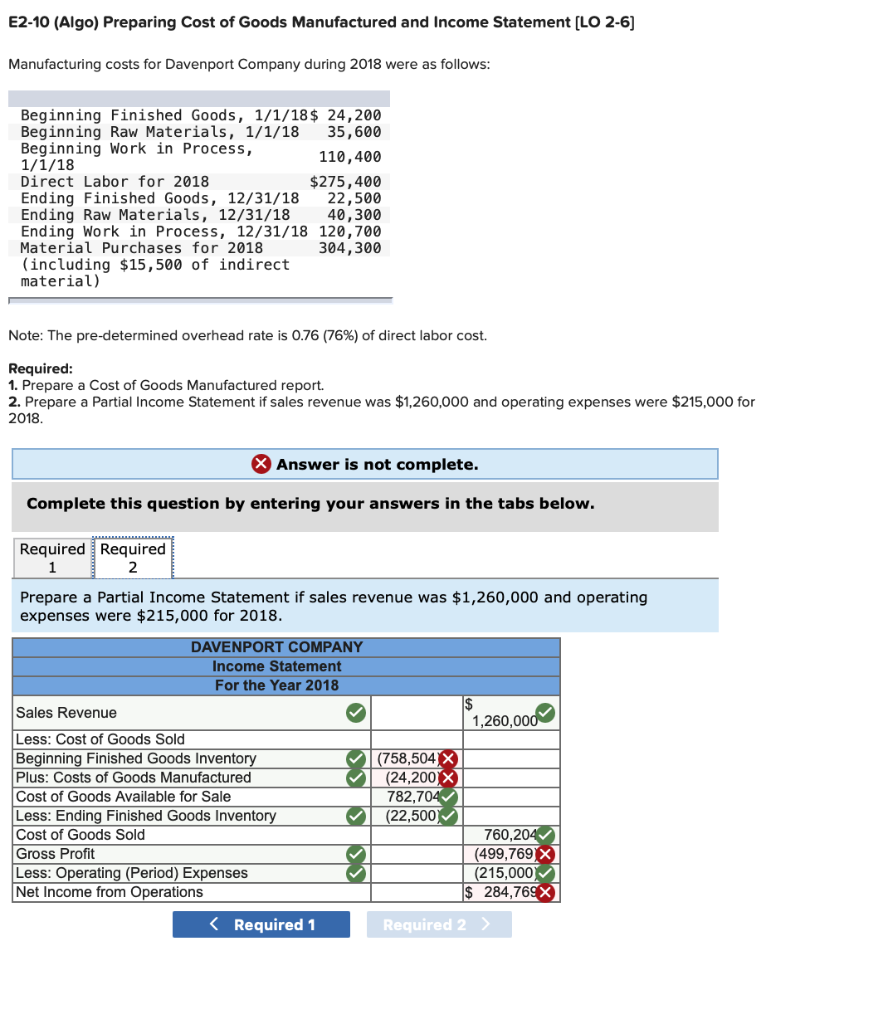

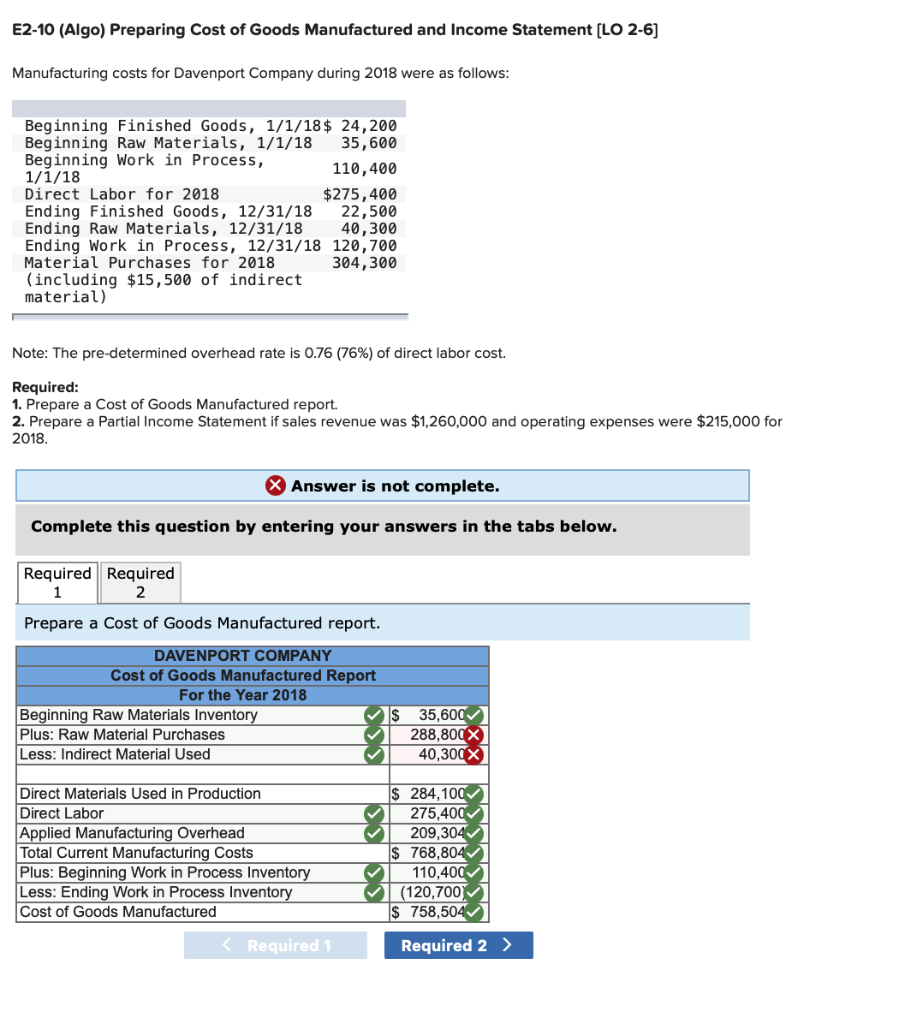

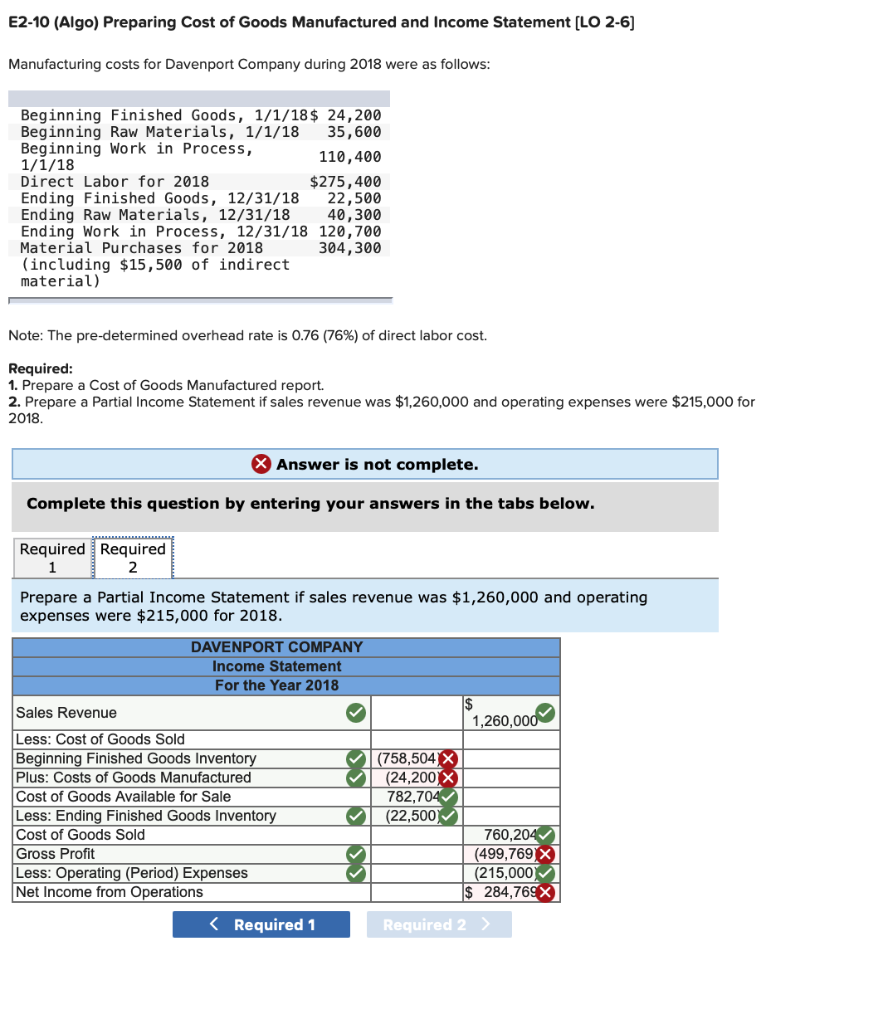

E2-10 (Algo) Preparing Cost of Goods Manufactured and Income Statement (LO 2-6) Manufacturing costs for Davenport Company during 2018 were as follows: Beginning Finished Goods, 1/1/18 $ 24,200 Beginning Raw Materials, 1/1/18 35,600 Beginning Work in Process, 1/1/18 110,400 Direct Labor for 2018 $275,400 Ending Finished Goods, 12/31/18 22,500 Ending Raw Materials, 12/31/18 40,300 Ending Work in Process, 12/31/18 120,700 Material Purchases for 2018 304, 300 (including $15,500 of indirect material) Note: The pre-determined overhead rate is 0.76 (76%) of direct labor cost. Required: 1. Prepare a Cost of Goods Manufactured report. 2. Prepare a Partial Income Statement if sales revenue was $1,260,000 and operating expenses were $215,000 for 2018. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required 2 Prepare a Cost of Goods Manufactured report. DAVENPORT COMPANY Cost of Goods Manufactured Report For the Year 2018 Beginning Raw Materials Inventory Plus: Raw Material Purchases Less: Indirect Material Used $ 35,600 288,800 x 40,300X Direct Materials used in Production Direct Labor Applied Manufacturing Overhead Total Current Manufacturing Costs Plus: Beginning Work in Process Inventory Less: Ending Work in Process Inventory Cost of Goods Manufactured 3 $ 284,100 275,400 209,304 $ 768,804 110,400 (120,700 $ 758,504 E2-10 (Algo) Preparing Cost of Goods Manufactured and Income Statement [LO 2-6) Manufacturing costs for Davenport Company during 2018 were as follows: Beginning Finished Goods, 1/1/18 $ 24,200 Beginning Raw Materials, 1/1/18 35,600 Beginning Work in Process, 1/1/18 110,400 Direct Labor for 2018 $275,400 Ending Finished Goods, 12/31/18 22,500 Ending Raw Materials, 12/31/18 40,300 Ending Work in Process, 12/31/18 120,700 Material Purchases for 2018 304,300 (including $15,500 of indirect material) Note: The pre-determined overhead rate is 0.76 (76%) of direct labor cost. Required: 1. Prepare a Cost of Goods Manufactured report. 2. Prepare a Partial Income Statement if sales revenue was $1,260,000 and operating expenses were $215,000 for 2018. Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required 1 2 Prepare a Partial Income Statement if sales revenue was $1,260,000 and operating expenses were $215,000 for 2018. DAVENPORT COMPANY Income Statement For the Year 2018 $ 1,260,000 Sales Revenue Less: Cost of Goods Sold Beginning Finished Goods Inventory Plus: Costs of Goods Manufactured Cost of Goods Available for Sale Less: Ending Finished Goods Inventory Cost of Goods Sold Gross Profit Less: Operating (Period) Expenses Net Income from Operations SSSSS (758,504 X (24,200 782,704 (22,500 760,204 (499,769 X (215,000 $ 284,769 X