Answered step by step

Verified Expert Solution

Question

1 Approved Answer

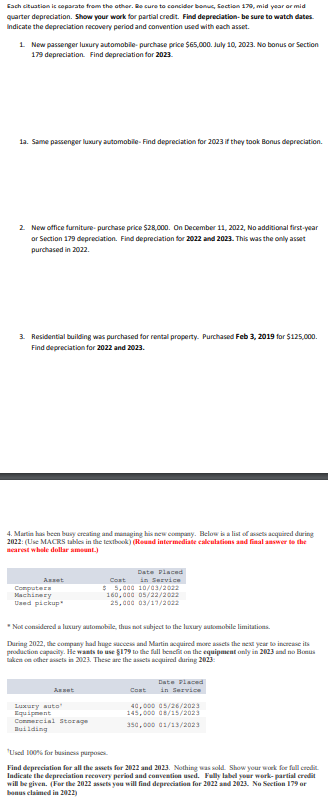

Each eituatien is ceparato frem the other. Re cure to concider benuc, Foction 1 3 0 , mid year or mid Quarter depreciation. Show your

Each eituatien is ceparato frem the other. Re cure to concider benuc, Foction mid year or mid

Quarter depreciation. Show your work for partial credit. Find depreciation be sure to watch dates.

Indicate the depreciation recowery period and convention used with each asset.

New passenger lunury automoble purchase price $ July No bonus or Section

depreciation. Find depreciation for

a Same passenger luxury automobile Find depreciation for if they took Bonus depreciation.

New office furniture purchase price $ On December No additional firstyear

or Section deprediation. Find depreciation for and This was the only asset

purchased in

Residentlal building was purchased for rental property. Purchased Feb for $

Find depreciation for and

Martin his becn buy crealing and managing his new ecenpiny. Below is a list of asces acyuied during

mearst whele dollar ameane.

Nos considered a lusury automobile, thus not subject to the luxury autcenokile limitatioes

biken oe odher ibsets in These are the aseets acquired during

'Used noons fur business purpuies.

Find depreciation for all the awets for and Nothing was sold. Show your ouk foe full crodit

Indicate the depreciation receven period and conventien used. Fully label your work partial crodit

will be given. For the asses you will find deprecialion for and No Soction or

banus elainted in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started