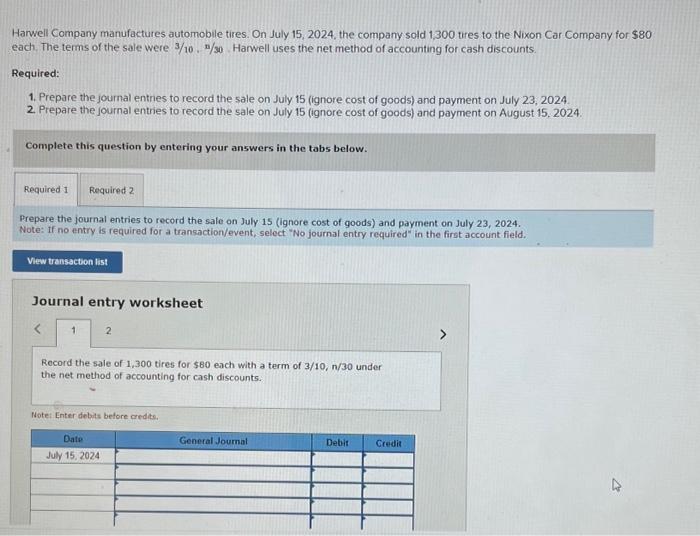

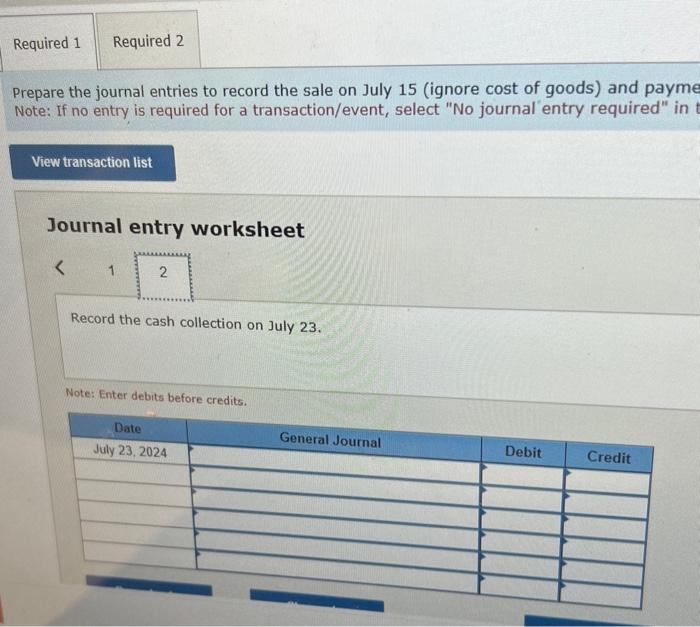

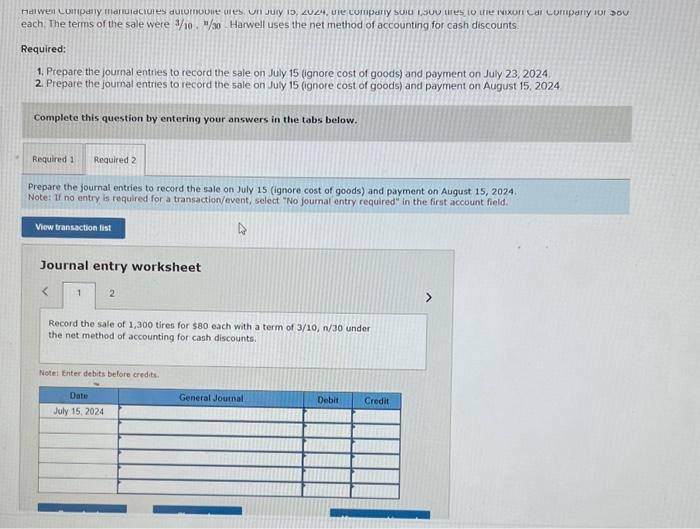

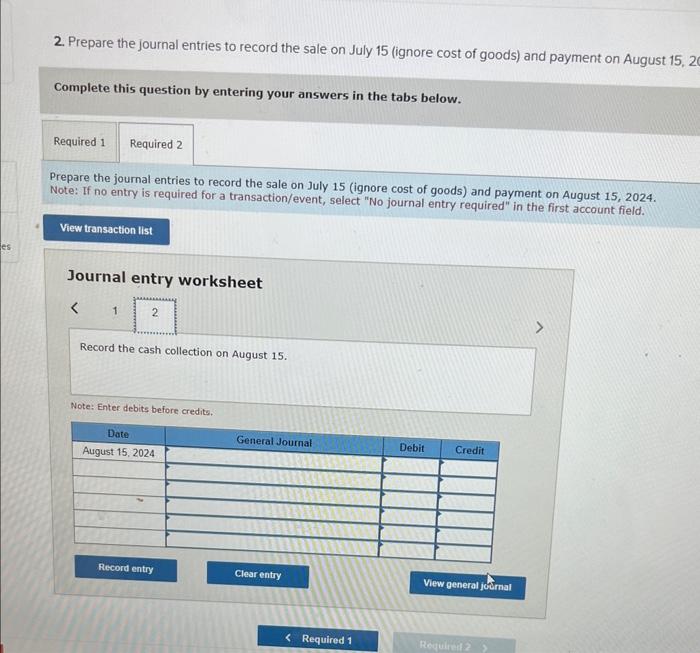

each The terms of the sale were 3/10."1/30. Harwell uses the net method of accounting for cash discounts. Required: 1. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on July 23, 2024. 2. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on August 15, 2024 Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on August 15, 2024. Note: if no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet Record the sale of 1,300 tires for s80 each with a term of 3/10,n/30 under the net method of accounting for cash discounts. Notei tinter debits belore credits. Harwell Company manufactures automobile tires. On July 15, 2024, the company sold 1,300 tires to the Nixon Car Company for $80 each, The terms of the sale were 3/10. n/30. Harwell uses the net method of accounting for cash discounts. Required: 1. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on July 23,2024 . 2. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on August 15, 2024. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on July 23, 2024. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet Record the sale of 1,300 tires for $80 each with a term of 3/10,n/30 under the net method of accounting for cash discounts. Note: Enter debits before credits. 2. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on August 15 , Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payment on August 15, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the cash collection on August 15. Note: Enter debits before credits. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and payme Note: If no entry is required for a transaction/event, select "No journal entry required" in Journal entry worksheet Record the cash collection on July 23. Note: Enter debits before credits