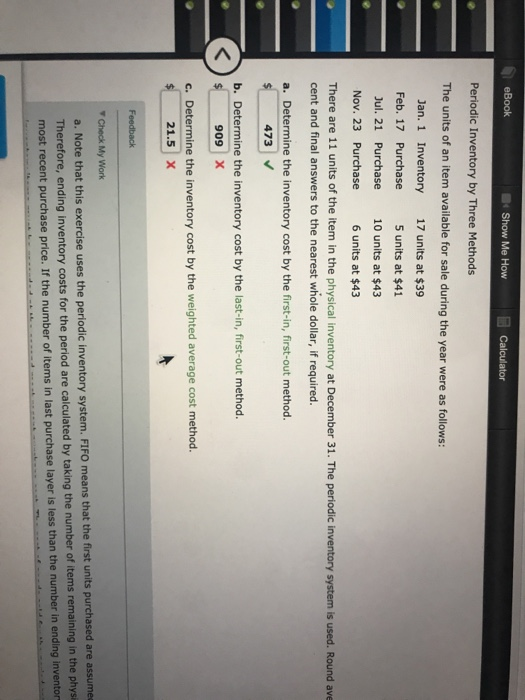

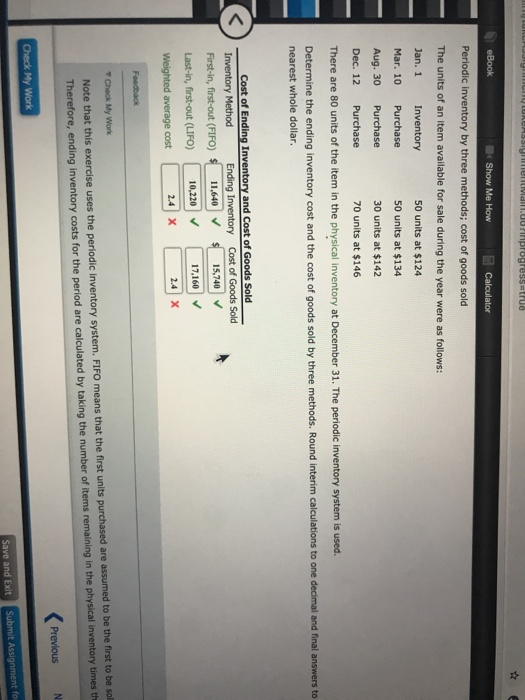

eBook 3 Show Me How Calculator Periodic Inventory by Three Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory Feb. 17 Purchase Jul. 21 Purchase Nov. 23 Purchase 17 units at $39 5 units at $41 10 units at $43 6 units at $43 There are 11 units of the item in the physical inventory at December 31. The periodic inventory system is used. Round ave cent and final answers to the nearest whole dollar, if required. a. Determine the inventory cost by the first-in, first-out method. $ 473 b. Determine the inventory cost by the last-in, first-out method. 909 X c. Determine the inventory cost by the weighted average cost method. $ 21.5 X Feedback Check My Work a. Note that this exercise uses the periodic inventory system. FIFO means that the first units purchased are assume Therefore, ending inventory costs for the period are calculated by taking the number of items remaining in the physi most recent purchase price. If the number of items in last purchase layer is less than the number in ending inventor Hymnendil.dorinprogress=true eBook Show Me How Calculator Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory Mar. 10 Purchase 50 units at $124 50 units at $134 30 units at $142 70 units at $146 Aug. 30 Purchase Dec. 12 Purchase There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. Round interim calculations to one decimal and final answers to nearest whole dollar. Cost of Ending Inventory and cost of Goods Sold Inventory Method Ending Inventory Cost of Goods Sold First-in, first-out (FIFO) $ 11,640 $ 15,740 Last-in, first-out (LIFO) 10,220 17,160 Weighted average cost I 24 x 24 Feedback Check My Work Note that this exercise uses the periodic Inventory system. FIFO means that the first units purchased are assumed to be the first to be sol Therefore, ending inventory costs for the period are calculated by taking the number of items remaining in the physical inventory times in Previous N Check My Work Save and Exit Submit Assignment for