Answered step by step

Verified Expert Solution

Question

1 Approved Answer

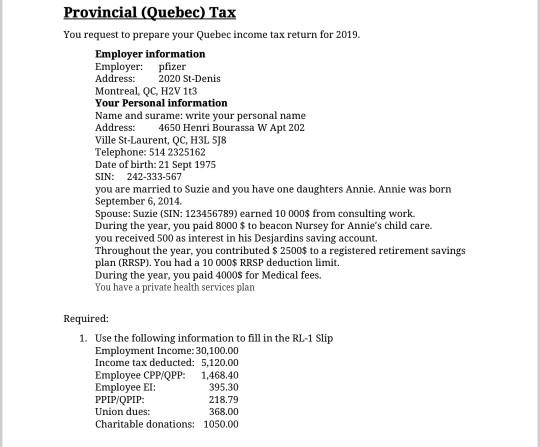

Provincial (Quebec) Tax You request to prepare your Quebec income tax return for 2019. Employer information Employer: pfizer Address: 2020 St-Denis Montreal, QC, H2V 1t3

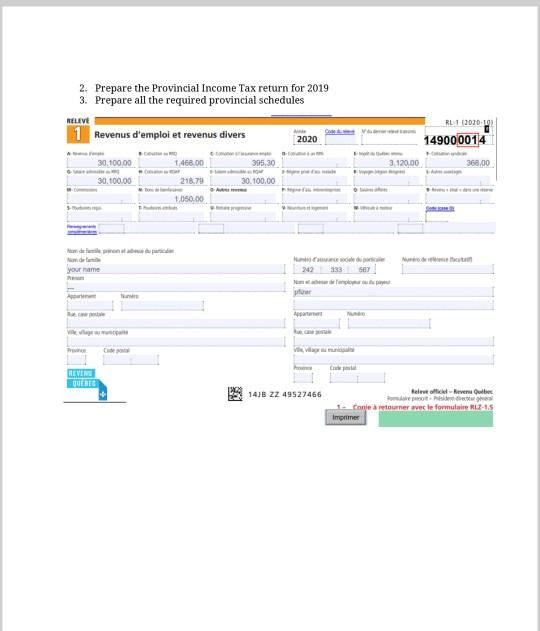

Provincial (Quebec) Tax You request to prepare your Quebec income tax return for 2019. Employer information Employer: pfizer Address: 2020 St-Denis Montreal, QC, H2V 1t3 Your Personal information Name and surame: write your personal name Address: 4650 Henri Bourassa W Apt 202 Ville St-Laurent, QC, H3L 5J8 Telephone: 514 2325162 Date of birth: 21 Sept 1975 SIN: 242-333-567 you are married to Suzie and you have one daughters Annie, Annie was born September 6, 2014 Spouse: Suzie (SIN: 123456789) earned 10 000$ from consulting work During the year, you paid 8000 $ to beacon Nursey for Annie's child care. you received 500 as interest in his Desjardins saving account Throughout the year, you contributed $ 2500$ to a registered retirement savings plan (RRSP). You had a 10 000$ RRSP deduction limit. During the year, you paid 4000s for Medical fees. You have a private health services plan Required: 1. Use the following information to fill in the RL-1 Slip Employment Income: 30,100.00 Income tax deducted: 5,120.00 Employee CPP/QPP: 1,468.40 Employee EI: 395.30 PPIP/QPIP: 218.79 Union dues: 368.00 Charitable donations: 1050.00 2. Prepare the Provincial Income Tax return for 2019 3. Prepare all the required provincial schedules RELEVE RL-1 (2020) 1 Revenus d'emploi et revenus divers 2020 149000014 395,30 3.120,00 368.00 30,100.00 30,100.00 1,468.00 218.75 30.100,00 1,050.00 your name 242 233 567 REVINE 14JB ZZ 49527466 Beltolice - Rever Owlbec Fotos 1 - Conapetourner avec le formulaire LZ-3,5 Imprimer Provincial (Quebec) Tax You request to prepare your Quebec income tax return for 2019. Employer information Employer: pfizer Address: 2020 St-Denis Montreal, QC, H2V 1t3 Your Personal information Name and surame: write your personal name Address: 4650 Henri Bourassa W Apt 202 Ville St-Laurent, QC, H3L 5J8 Telephone: 514 2325162 Date of birth: 21 Sept 1975 SIN: 242-333-567 you are married to Suzie and you have one daughters Annie, Annie was born September 6, 2014 Spouse: Suzie (SIN: 123456789) earned 10 000$ from consulting work During the year, you paid 8000 $ to beacon Nursey for Annie's child care. you received 500 as interest in his Desjardins saving account Throughout the year, you contributed $ 2500$ to a registered retirement savings plan (RRSP). You had a 10 000$ RRSP deduction limit. During the year, you paid 4000s for Medical fees. You have a private health services plan Required: 1. Use the following information to fill in the RL-1 Slip Employment Income: 30,100.00 Income tax deducted: 5,120.00 Employee CPP/QPP: 1,468.40 Employee EI: 395.30 PPIP/QPIP: 218.79 Union dues: 368.00 Charitable donations: 1050.00 2. Prepare the Provincial Income Tax return for 2019 3. Prepare all the required provincial schedules RELEVE RL-1 (2020) 1 Revenus d'emploi et revenus divers 2020 149000014 395,30 3.120,00 368.00 30,100.00 30,100.00 1,468.00 218.75 30.100,00 1,050.00 your name 242 233 567 REVINE 14JB ZZ 49527466 Beltolice - Rever Owlbec Fotos 1 - Conapetourner avec le formulaire LZ-3,5 Imprimer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started