Question

Ellsbury Associates is a recently formed law partnership. Ellsbury Assocates operates at capacity and uses a cost-based approach to pricing (billing) each job. Ellsbury Associates

Ellsbury Associates is a recently formed law partnership. Ellsbury Assocates operates at capacity and uses a cost-based approach to pricing (billing) each job. Ellsbury Associates currently uses a simple costing system.

Currently it uses a single direct-cost category (professional labour-hours) and a single indirect-cost pool (general support). Indirect costs are allocated to cases on the basis of professional labour-hours per case. The case files show the follow:

| Widness Coal | St. Helen's Glass | |

| Professional Labour | 150 Hours | 100 Hours |

Professional labour costs at Ellsbury Assocates are $85 an hour. Indirect costs are allocated to cases at $100 an hour. Total indirect costs in the most recent period were $25,000.

Ellery Hanley, the managing partner of Ellsbury Associates, decided to try and further refine his costing system.

Hanley asks his assistant to collect details on those costs included in the $25,000 indirect-cost pool that can be traced to each individual case. After further analysis, Ellsbury is able to reclassify $15,000 of the $25,000 as direct costs.

| Other Direct Costs | Widness Coal | St. Helen's Glass |

| Research Support Labour | $1,500 | $3,900 |

| Computer time | 600 | 1,700 |

| Travel and Allowances | 600 | 4,200 |

| Telephone/Faxes | 300 | 1,200 |

| Photocopying | 250 | 750 |

| Total | 3,250 | 11,750 |

Hanley decides to calculate the costs of each case had Ellsbury used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have $10,000 of costs and would be allocated to each case using the professional labour-hours base.

Ellsbury Associates has two classifications of professional staffpartners and managers. Hanley asks his assistant to examine the relative use of partners and managers on the recent Widnes Coal and St. Helen's cases.

The Widnes case used 65 partner-hours and 85 manager-hours. The St. Helen's case used 60 partner-hours and 40 manager-hours. Hanley decides to examine how the use of separate direct-cost and indirect-cost pools for partners and managers would have affected the costs of the Widnes and St. Helen's cases. Indirect costs in each cost pool would be allocated based on total hours of that category of professional labour. The rates per category of professional labour are as follows.

| Category of Professional Labour | Direct Cost per Hour | Calculation | Indirect Cost per Hour |

| Partner | $110.00 | $6,050/125 | $48.40 |

| Manager | $60.00 | $3950/125 hours | $31.60 |

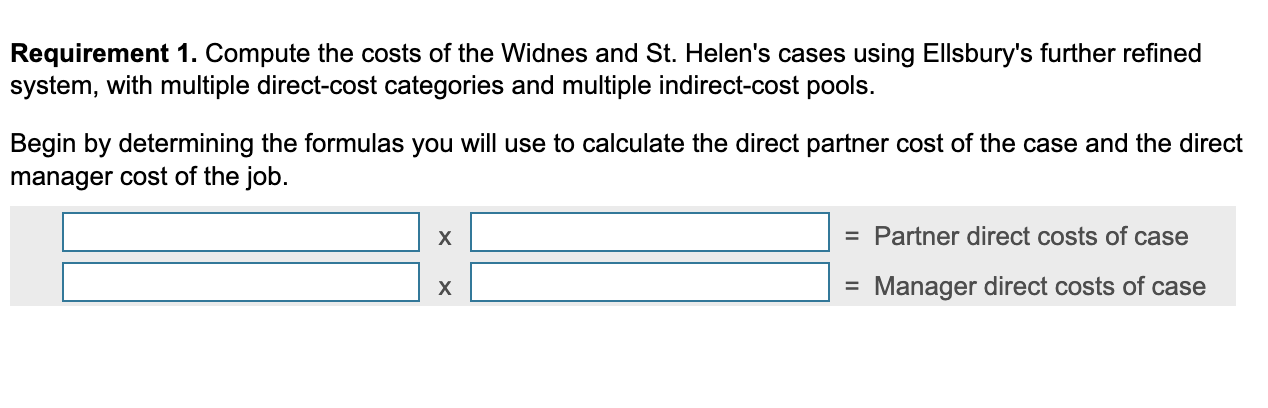

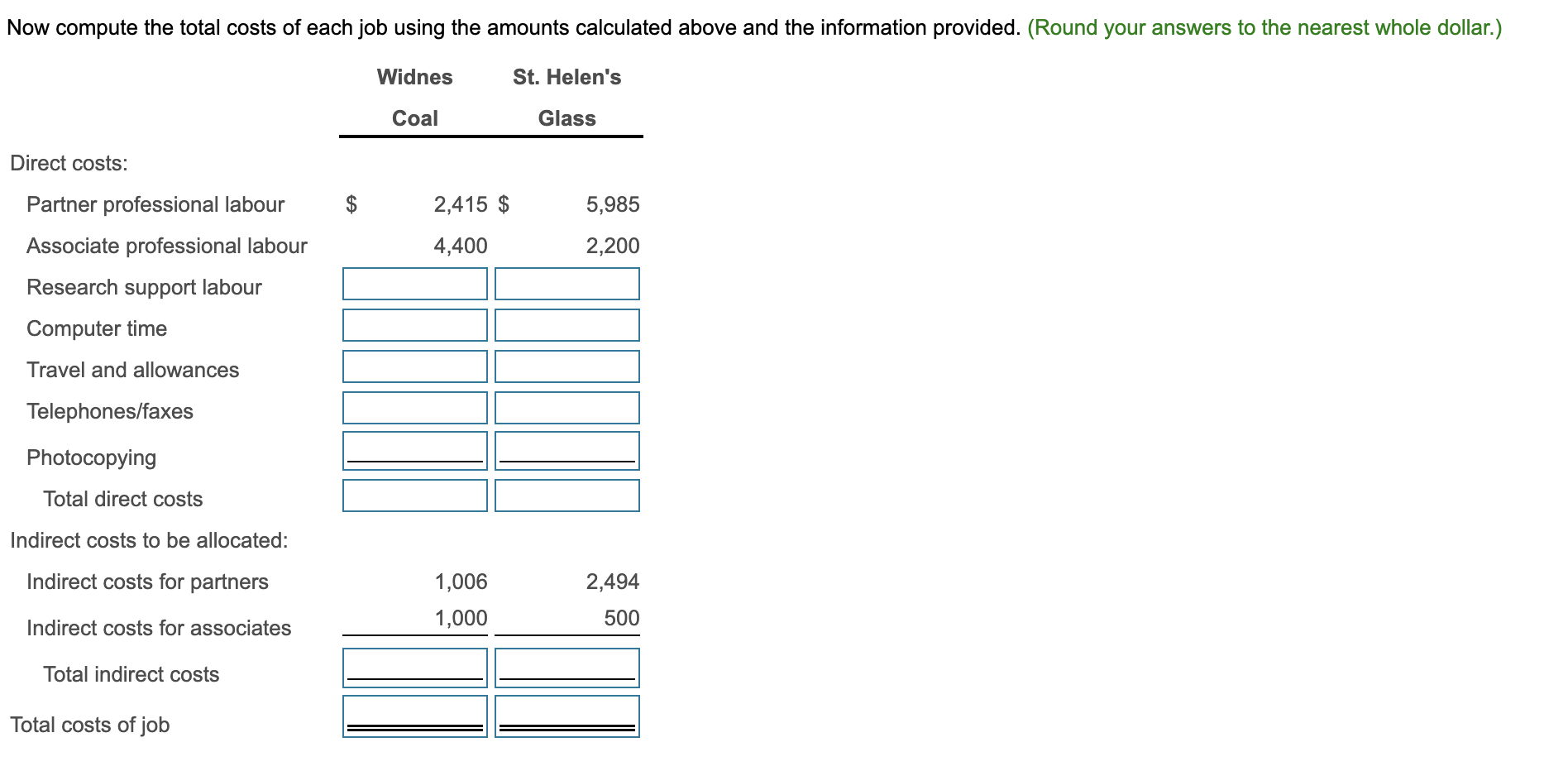

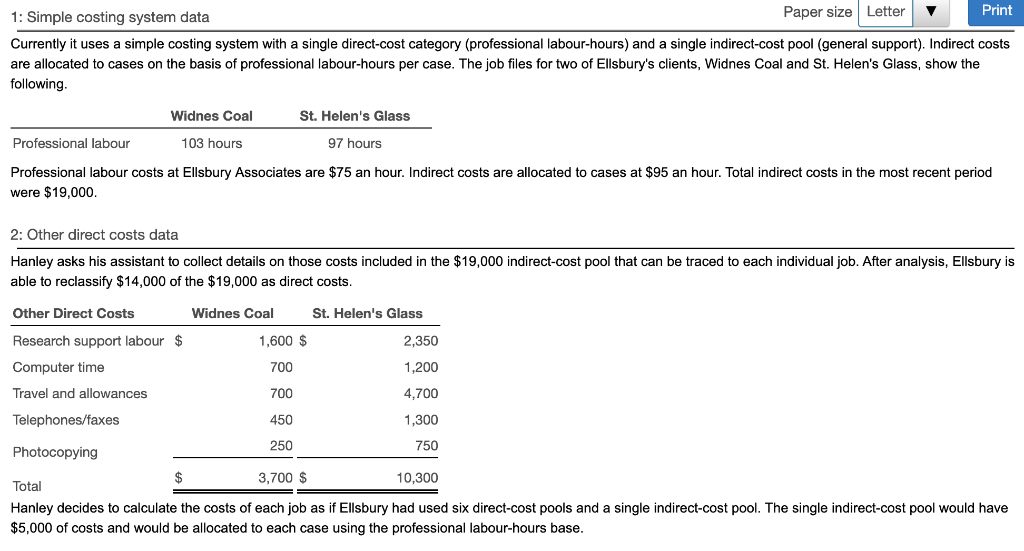

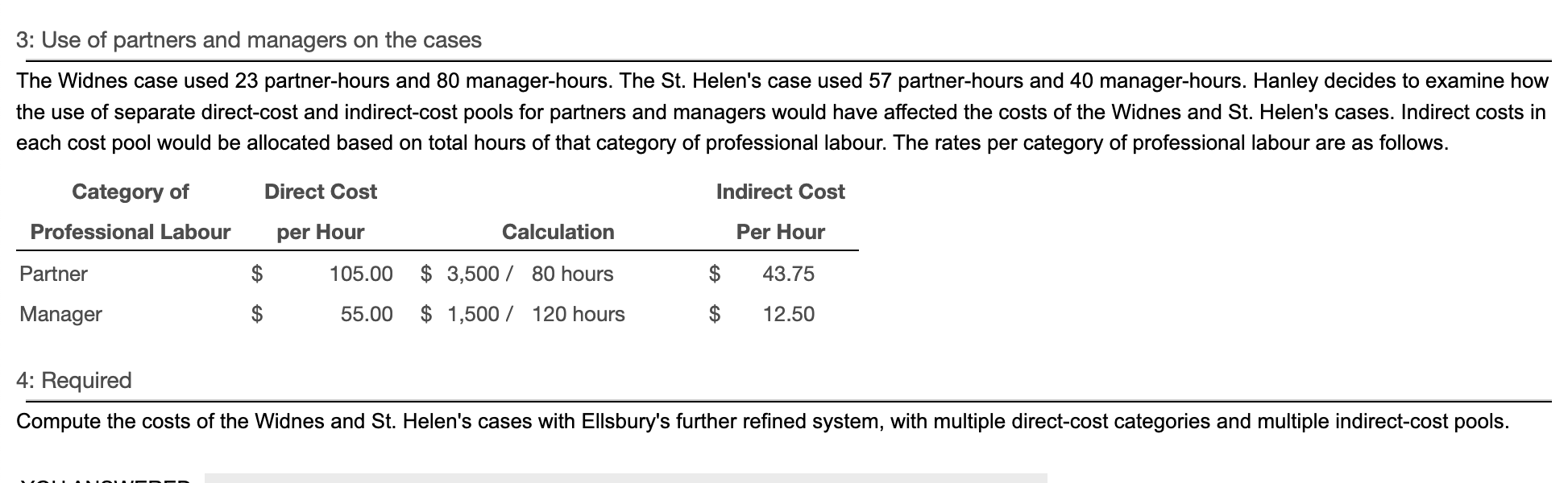

Requirement 1. Compute the costs of the Widnes and St. Helen's cases using Ellsbury's further refined system, with multiple direct-cost categories and multiple indirect-cost pools. Begin by determining the formulas you will use to calculate the direct partner cost of the case and the direc manager cost of the job. Now compute the total costs of each job using the amounts calculated above and the information provided. (Round your answers to the nearest whole dollar.) \begin{tabular}{cc} Widnes & St. Helen's \\ Coal & Glass \\ \hline \end{tabular} Direct costs: Partner professional labour $2,415$5,985 Associate professional labour 4,400 Research support labour Computer time Travel and allowances Telephones/faxes Photocopying Total direct costs Indirect costs to be allocated: Indirect costs for partners Indirect costs for associates Total indirect costs Total costs of job Currently it uses a simple costing system with a single direct-cost category (professional labour-hours) and a single indirect-cost pool (general support). Indirect costs are allocated to cases on the basis of professional labour-hours per case. The job files for two of Ellsbury's clients, Widnes Coal and St. Helen's Glass, show the following. Professional labour costs at Ellsbury Associates are $75 an hour. Indirect costs are allocated to cases at $95 an hour. Total indirect costs in the most recent period were $19,000. 2: Other direct costs data Hanley asks his assistant to collect details on those costs included in the $19,000 indirect-cost pool that can be traced to each individual job. After analysis, Ellsbury is able to reclassify $14,000 of the $19,000 as direct costs. Hanley decides to calculate the costs of each job as if Ellsbury had used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have $5,000 of costs and would be allocated to each case using the professional labour-hours base. The Widnes case used 23 partner-hours and 80 manager-hours. The St. Helen's case used 57 partner-hours and 40 manager-hours. Hanley decides to examine how the use of separate direct-cost and indirect-cost pools for partners and managers would have affected the costs of the Widnes and St. Helen's cases. Indirect costs in each cost pool would be allocated based on total hours of that category of professional labour. The rates per category of professional labour are as follows. 4: Required Compute the costs of the Widnes and St. Helen's cases with Ellsbury's further refined system, with multiple direct-cost categories and multiple indirect-cost pools

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started