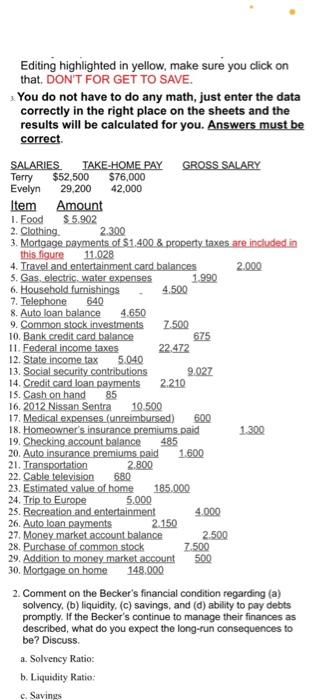

Enter the data correctly in the right place on the sheets

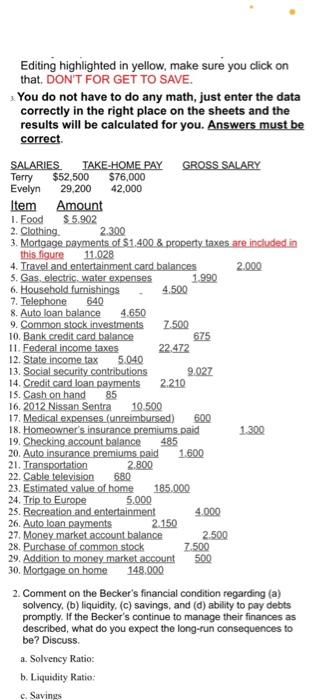

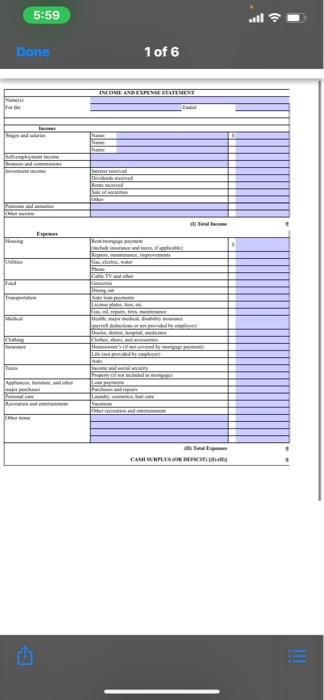

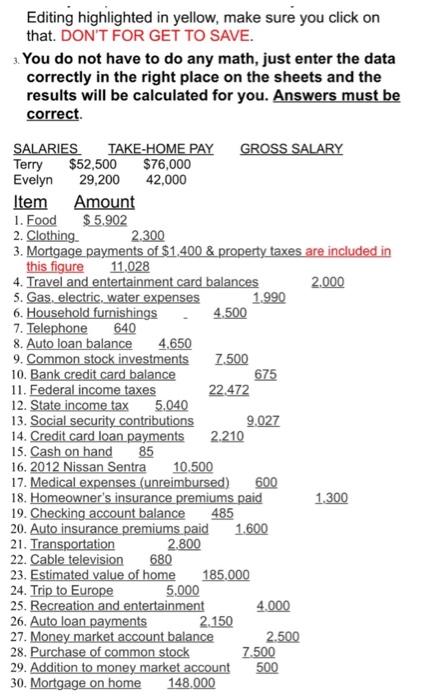

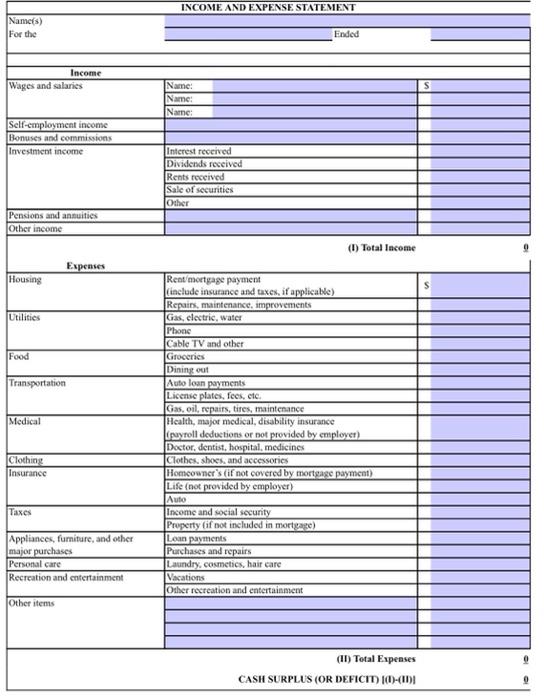

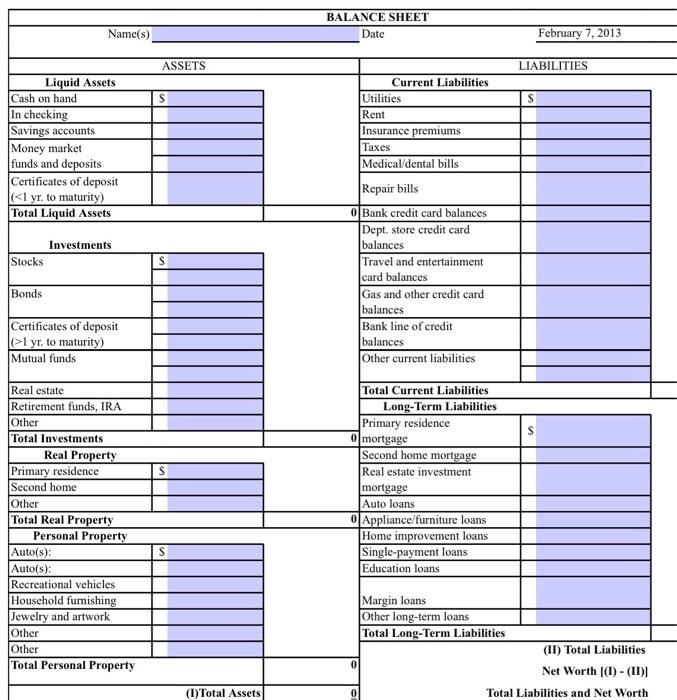

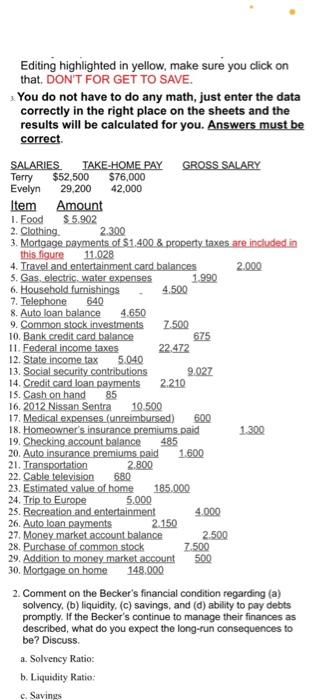

5:59 Done 1 of 6 INGINE ANDERE STATEMENT Wor w . Lancer CMTV he th CASH SHRESORT Editing highlighted in yellow, make sure you click on that. DON'T FOR GET TO SAVE. 3. You do not have to do any math, just enter the data correctly in the right place on the sheets and the results will be calculated for you. Answers must be correct. SALARIES TAKE-HOME PAY GROSS SALARY Terry $52,500 $76,000 Evelyn 29,200 42,000 Item Amount 1. Food $5.902 2. Clothing 2.300 3. Mortgage payments of $1.400 & property taxes are included in this figure 11.028 4. Travel and entertainment card balances 2.000 5. Gas, electric, water expenses 1.990 6. Household furnishings 4.500 7. Telephone 640 8. Auto loan balance 4,650 9. Common stock investments 7.500 10. Bank credit card balance 675 11. Federal income taxes 22.472 12. State income tax 5.040 13. Social security contributions 9.027 14. Credit card loan payments 2.210 15. Cash on hand 85 16. 2012 Nissan Sentra 10.500 17. Medical expenses (unreimbursed) 600 18. Homeowner's insurance premiums paid 1,300 19. Checking account balance 20. Auto insurance premiums paid 21. Transportation 2.800 22. Cable television 680 23. Estimated value of home 185.000 24. Trip to Europe 5.000 25. Recreation and entertainment 4.000 26. Auto loan payments 2.150 27. Money market account balance 2.500 28. Purchase of common stock 7.500 29. Addition to money market account 500 30. Mortgage on home 148.000 485 1.600 INCOME AND EXPENSE STATEMENT Name(s) For the Ended Income Wages and salaries Name: Name: Name: Self-employment income Bonuses and commissions Investment income Interest received Dividends received Rents received Sale of securities Other Pensions and annuities Other income (I) Total Income O Expenses Housing Utilities Food Transportation Medical Rent/mortgage payment (include insurance and taxes, if applicable) Repairs, maintenance, improvements Gas, electric, water Phone Cable TV and other Groceries Dining out Auto loan payments License plates, fees, etc Gasoil, repairs, tires, maintenance Health, major medical, disability insurance upayroll deductions or not provided by employer) Doctor. dentist, hospital, medicines Clothes, Shoes, and accessories Homeowner's (if not covered by mortgage payment) Life (not provided by employer) Auto Income and social security Property fif not included in mortgage) Loan payments Purchases and repairs Laundry.cosmetics, hair care Vacations Other recreation and entertainment Clothing Insurance Taxes Appliances, furniture, and other major purchases Personal care Recreation and entertainment Other items (11) Total Expenses 0 CASH SURPLUS (OR DEFICIT 10-11) BALANCE SHEET Date Name(s) February 7, 2013 ASSETS LIABILITIES S S Liquid Assets Cash on hand In checking Savings accounts Money market funds and deposits Certificates of deposit (