Entity P acquired 80% of S several years ago. Entity P presents the statement of profit or loss and other comprehensive income as a

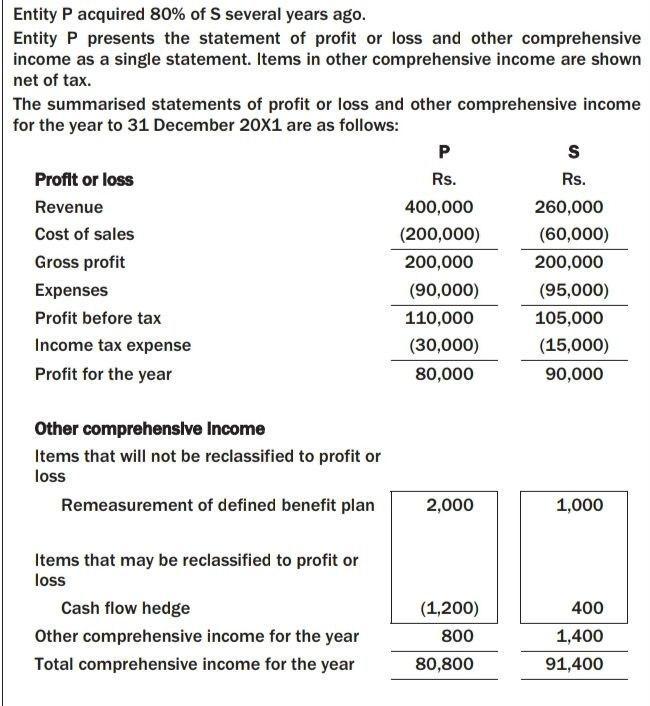

Entity P acquired 80% of S several years ago. Entity P presents the statement of profit or loss and other comprehensive income as a single statement. Items in other comprehensive income are shown net of tax. The summarised statements of profit or loss and other comprehensive income for the year to 31 December 20X1 are as follows: Profit or loss Revenue Cost of sales Gross profit Expenses Profit before tax Income tax expense Profit for the year Other comprehensive Income Items that will not be reclassified to profit or loss Remeasurement of defined benefit plan Items that may be reclassified to profit or loss Cash flow hedge Other comprehensive income for the year Total comprehensive income for the year P Rs. 400,000 (200,000) 200,000 (90,000) 110,000 (30,000) 80,000 2,000 (1,200) 800 80,800 S Rs. 260,000 (60,000) 200,000 (95,000) 105,000 (15,000) 90,000 1,000 400 1,400 91,400

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A consolidated statement of profit or loss and other comprehensive income can be prepared ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started