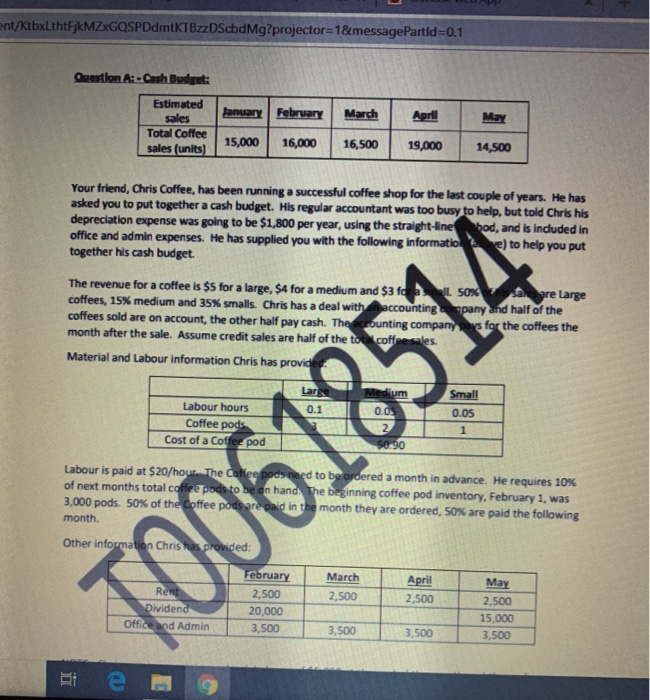

ent/KtbxLthtfjkMZXGQSPDdmtKTBzzDScdMg?projector=1&messagePartid=0.1 Question :-Cash Budget: January February March April Estimated sales Total Coffee sales (units) 15,000 16,000 16,500 19,000 Your friend, Chris Coffee, has been running a successful coffee shop for the last couple of years. He has asked you to put together a cash budget. His regular accountant was too busy to help, but told Chris his depreciation expense was going to be $1,800 per year, using the straight-linehod, and is included in office and admin expenses. He has supplied you with the following information e) to help you put together his cash budget. The revenue for a coffee is $5 for a large, S4 for a medium and $3 tl som sagre Large coffees, 15% medium and 35% smalls. Chris has a deal with accounting Lapany and half of the coffees sold are on account, the other half pay cash. The accounting company for the coffees the month after the sale. Assume credit sales are half of the tone coffee sales. Material and Labour information Chris has provides Labour hours Coffee pods 0.05 1 Labour is paid at $20/hour. The coltee pods need to be ordered a month in advance. He requires 10% of next months total coffee pods to be on hand. The beginning coffee pod inventory, February 1, was 3,000 pods. 50% of the Coffee pods are paid in the month they are ordered, 50% are paid the following month 006185 March 2,500 April 2,500 2,500 20,000 3,500 May 2,500 15,000 3,500 3,500 3.500 NOTE: Chris requires a minimum bank balance of $5,000 at the end of the month and the ending January bank balance is $10,000. Chris has access to a line of credit of $500,000 at an interest rate of 10%. Borrowings are made at the beginning of the month and repayments are made at the end of the month. REQUIRED: Submitting either an Excel or a hand written PDF file, for the months of February March and April prepare: . Sales Budget, with a cash receipts. 0 What is the A/R at the end of the month? Materials Budget, with cash disbursements. What is the A/P at the end of the month? Direct Labour Budget Cash budget . ent/KtbxLthtfjkMZXGQSPDdmtKTBzzDScdMg?projector=1&messagePartid=0.1 Question :-Cash Budget: January February March April Estimated sales Total Coffee sales (units) 15,000 16,000 16,500 19,000 Your friend, Chris Coffee, has been running a successful coffee shop for the last couple of years. He has asked you to put together a cash budget. His regular accountant was too busy to help, but told Chris his depreciation expense was going to be $1,800 per year, using the straight-linehod, and is included in office and admin expenses. He has supplied you with the following information e) to help you put together his cash budget. The revenue for a coffee is $5 for a large, S4 for a medium and $3 tl som sagre Large coffees, 15% medium and 35% smalls. Chris has a deal with accounting Lapany and half of the coffees sold are on account, the other half pay cash. The accounting company for the coffees the month after the sale. Assume credit sales are half of the tone coffee sales. Material and Labour information Chris has provides Labour hours Coffee pods 0.05 1 Labour is paid at $20/hour. The coltee pods need to be ordered a month in advance. He requires 10% of next months total coffee pods to be on hand. The beginning coffee pod inventory, February 1, was 3,000 pods. 50% of the Coffee pods are paid in the month they are ordered, 50% are paid the following month 006185 March 2,500 April 2,500 2,500 20,000 3,500 May 2,500 15,000 3,500 3,500 3.500 NOTE: Chris requires a minimum bank balance of $5,000 at the end of the month and the ending January bank balance is $10,000. Chris has access to a line of credit of $500,000 at an interest rate of 10%. Borrowings are made at the beginning of the month and repayments are made at the end of the month. REQUIRED: Submitting either an Excel or a hand written PDF file, for the months of February March and April prepare: . Sales Budget, with a cash receipts. 0 What is the A/R at the end of the month? Materials Budget, with cash disbursements. What is the A/P at the end of the month? Direct Labour Budget Cash budget