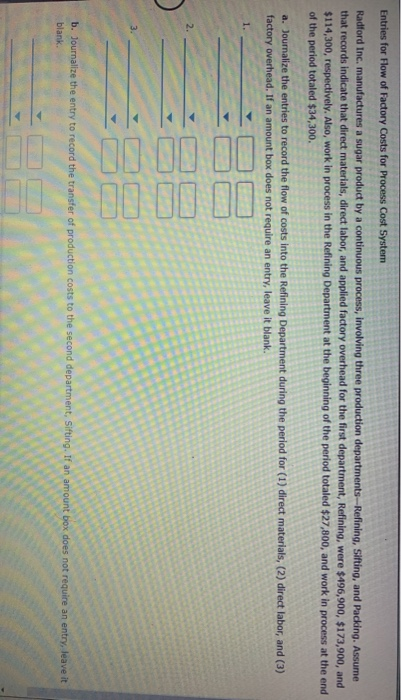

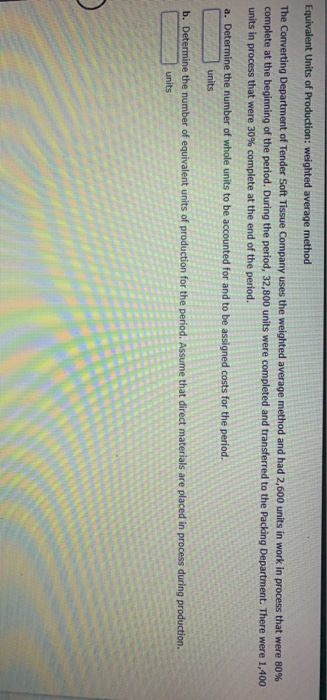

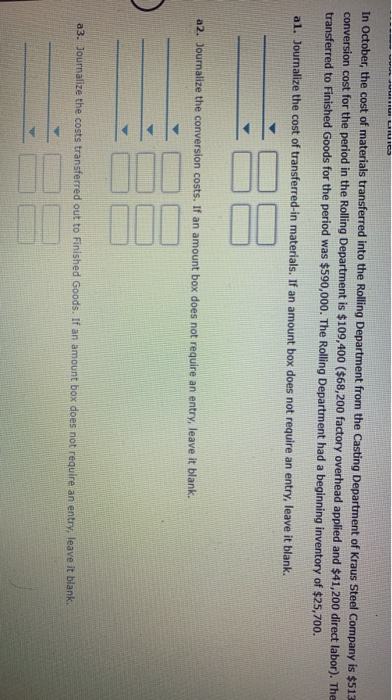

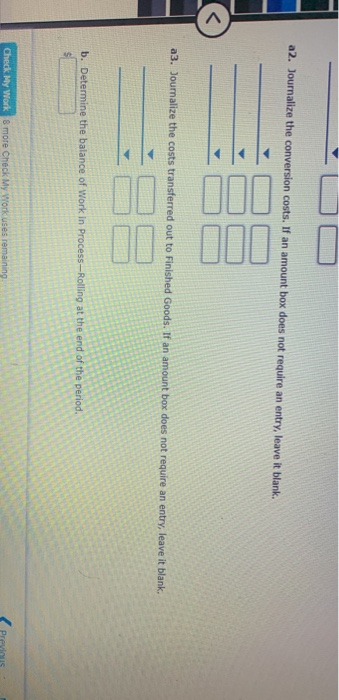

Entries for Flow of Factory Costs for Process Cost System Radford Inc, manufactures a sugar product by a continuous process, involving three production departments --Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $496,900, $173,900, and $114,300, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $27,800, and work in process at the end of the period totaled $34,300. a. Journalize the entries to record the flow of costs into the Refining Department during the period for (1) direct materials, (2) direct labor, and (3) factory overhead. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the transfer of production costs to the second department, Sifting. If an amount box does not require an entry, leave it blank. Equivalent Units of Production: weighted average method The Converting Department of Tender Soft Tissue Company uses the weighted average method and had 2,600 units in work in process that were 80% complete at the beginning of the period. During the period, 32,800 units were completed and transferred to the Packing Department. There were 1,400 units in process that were 30% complete at the end of the period. a. Determine the number of whole units to be accounted for and to be assigned costs for the period. units b. Determine the number of equivalent units of production for the period. Assume that direct materials are placed in process during production. units RISIS In October, the cost of materials transferred into the Rolling Department from the Casting Department of Kraus Steel Company is $513 conversion cost for the period in the Rolling Department is $109,400 ($68,200 factory overhead applied and $41,200 direct labor). The transferred to Finished Goods for the period was $590,000. The Rolling Department had a beginning inventory of $25,700. al. Journalize the cost of transferred-in materials. If an amount box does not require an entry, leave it blank. a2. Journalize the conversion costs. If an amount box does not require an entry, leave it blank. a3. Journalize the costs transferred out to Finished Goods. If an amount box does not require an entry, leave it blank. a2. Journalize the conversion costs. If an amount box does not require an entry, leave it blank. 110