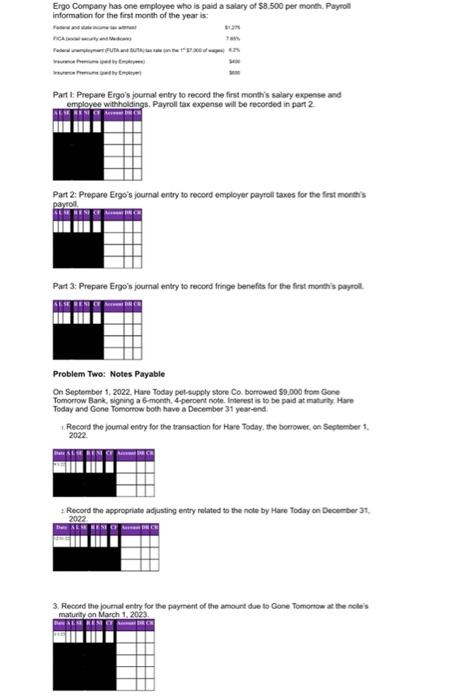

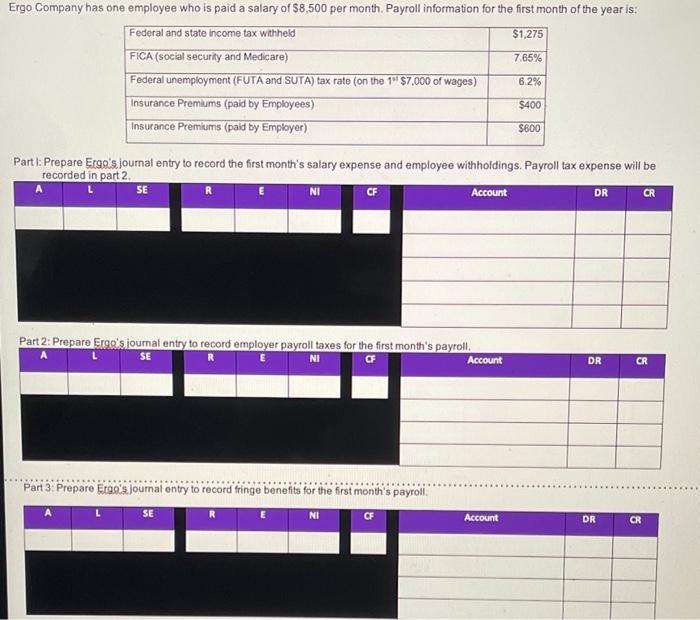

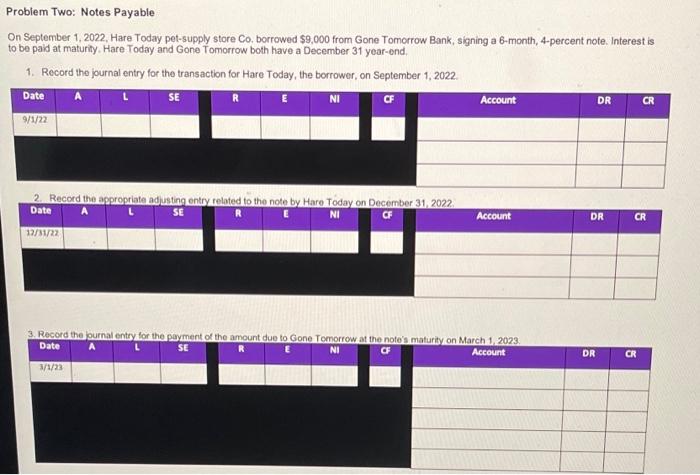

Ergo Company has one employee who is paid a salary of $8.500 per month Payroll information for the first month of the year is: UAB Part Prepare Ergo's journal entry to record the first month's salary expense and employee withholdings. Payroll tax expense will be recorded in part 2 Part 2: Prepare Ergo's journal entry to record employer payroll taxes for the first month's Part 3: Prepare Ergo's journal entry to record fringe benefits for the first month's payroll Problem Two: Notes Payable On September 1, 2022. Hare Today pet-supply store Co. borrowed $9.000 from Gone Tomorrow Bank signing a 6 month. 4-percentnote. Interest is to be paid at maturity Hare Today and Gone Tomorrow both have a December 31 year end 1. Record the joumal entry for the transaction for Hare Today, the borrower, on September 1 2022 Record the appropriate adjusting entry related to the note by Hare Today on December 31. 2022 3. Record the journal entry for the payment of the amount due to Gone Tomontow at the cle's maturity on March 1, 2023. SER RENT Ergo Company has one employee who is paid a salary of $8,500 per month. Payroll information for the first month of the year is: Federal and state income tax withheld $1,275 FICA (social security and Medicare) 7.65% Federal unemployment (FUTA and SUTA) tax rate (on the 1" $7,000 of wages) 6.2% Insurance Premiums (paid by Employees) $400 Insurance Premiums (paid by Employer) $600 Partl: Prepare Erge's journal entry to record the first month's salary expense and employee withholdings. Payroll tax expense will be recorded in part 2 SE E NI CF Account DR CR Part 2: Prepare Ergois journal entry to record employer payroll taxes for the first month's payroll. SE NI OF Account DR CR Part 3: Prepare Erge's journal entry to record fringe benefits for the first month's payroll SE E NI CF Account DR CR Problem Two: Notes Payable On September 1, 2022, Hare Today pet-supply store Co, borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid at maturity. Hare Today and Gone Tomorrow both have a December 31 year-end, 1. Record the journal entry for the transaction for Hare Today, the borrower, on September 1, 2022. Date 1 SE R E NI A Account DR CR 9/17 2. Record the appropriate adusting entry related to the note by Maro Today on December 31, 2022 Date SE NI Account DR CR 12/31/22 3. Record the journal entry for the payment of the amount due to Gone Tomorrow at the noto's maturity on March 1, 2023 Date SE NI Account 3/1/23 DR CR