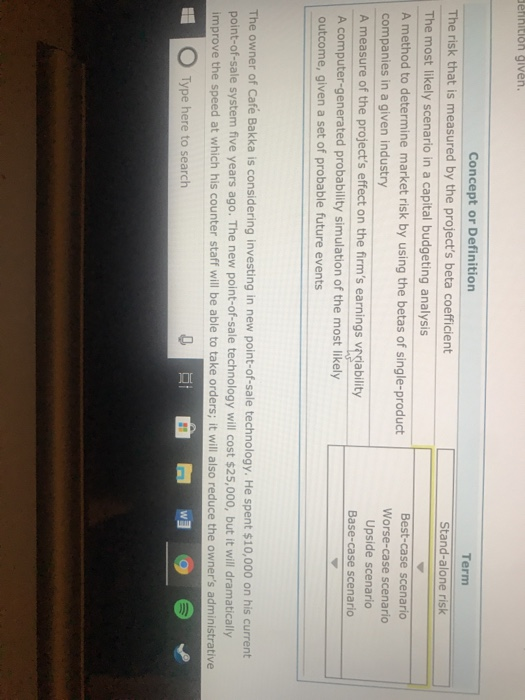

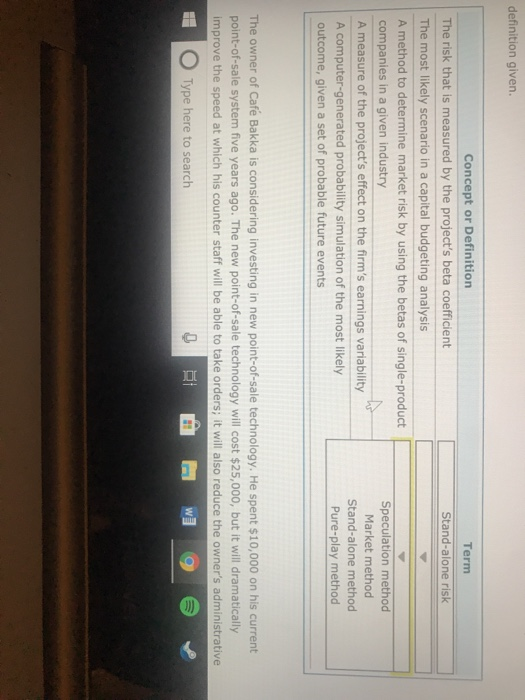

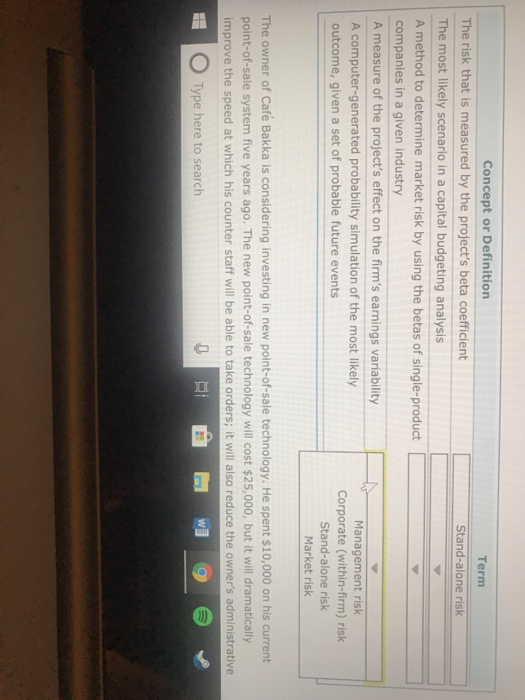

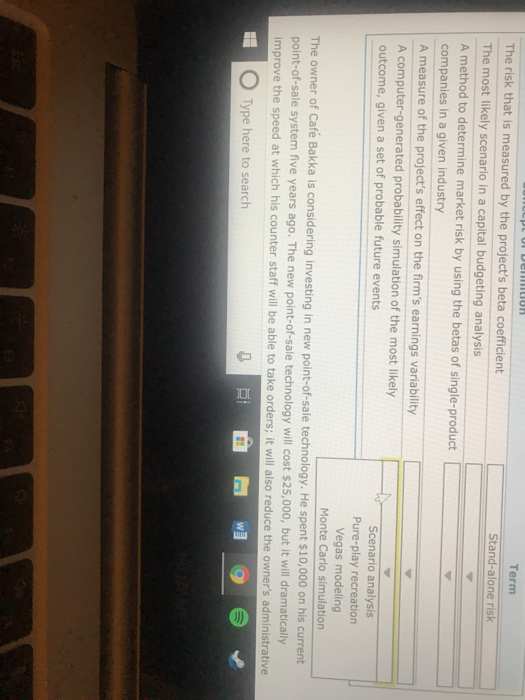

erinltion given. Concept or Definition Term The risk that is measured by the project's beta coefficient The most likely scenario in a capital budgeting analysis A method to determine market risk by using the betas of single-product companies in a given industry A measure of the project's effect on the firm's earnings vpciability A computer-generated probability simulation of the most likely outcome, given a set of probable future events Stand-alone risk Best-case scenario Worse-case scenario Upside scenario Base-case scenario The owner of Cafe Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative O Type here to search definition given Concept or Definition Term The risk that is measured by the project's beta coefficient The most likely scenario in a capital budgeting analysis A method to determine market risk by using the betas of single-product companies in a given industry A measure of the project's effect on the firm's earnings variability A computer-generated probability simulation of the most likely outcome, given a set of probable future events Stand-alone risk Speculation method Market method Stand-alone method Pure-play method The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative O Type here to search Concept or Definition Term The risk that is measured by the project's beta coefficient The most likely scenario in a capital budgeting analysis A method to determine market risk by using the betas of single-product companies in a given industry A measure of the project's effect on the firm's earnings variability A computer-generated probability simulation of the most likely outcome, given a set of probable future events Stand-alone risk Management risk Corporate (within-firm) risk Stand-alone risk Market risk The owner of Cafe Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative Type here to search Term The risk that is measured by the project's beta coefficient The most likely scenario in a capital budgeting analysis A method to determine market risk by using the betas of single-product companies in a given industry A measure of the project's effect on the firm's earnings variability A computer-generated probability simulation of the most likely outcome, given a set of probable future events Stand-alone risk Scenario analysis Pure-play recreation Vegas modeling Monte Carlo simulation The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's adminis trative Type here to search