Answered step by step

Verified Expert Solution

Question

1 Approved Answer

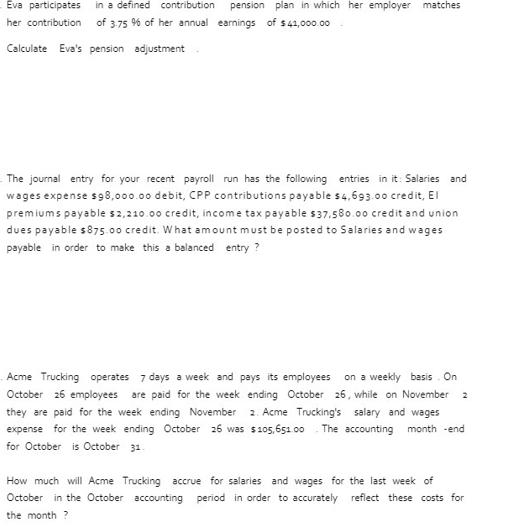

Eva participates in a defined contribution pension plan in which her employer matches her contribution of 3.75 % of her annual earnings of $41,000.00

Eva participates in a defined contribution pension plan in which her employer matches her contribution of 3.75 % of her annual earnings of $41,000.00 Calculate Eva's pension adjustment The journal entry for your recent payroll run has the following entries in it. Salaries and wages expense $98,000.00 debit, CPP contributions payable $4,693.00 credit, El premiums payable $2,210.00 credit, income tax payable $37.580.00 credit and union dues payable $875.00 credit. What amount must be posted to Salaries and wages payable in order to make this a balanced entry? Acme Trucking operates 7 days a week and pays its employees on a weekly basis. On October 26 employees are paid for the week ending October 26, while on November 2 they are paid for the week ending November 2. Acme Trucking's salary and wages expense for the week ending October 26 was $105,651.00 The accounting month -end for October is October 31. How much will Acme Trucking accrue for salaries and wages for the last week of October in the October accounting period in order to accurately reflect these costs for the month?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Evas pension adjustment we need to first determine her total contribution to the pension plan Her contribution is 375 of her annual earni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started