Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the company s ability to sell inventory and pay debts during 2 0 2 2 and 2 0 2 1 . In your analysis,

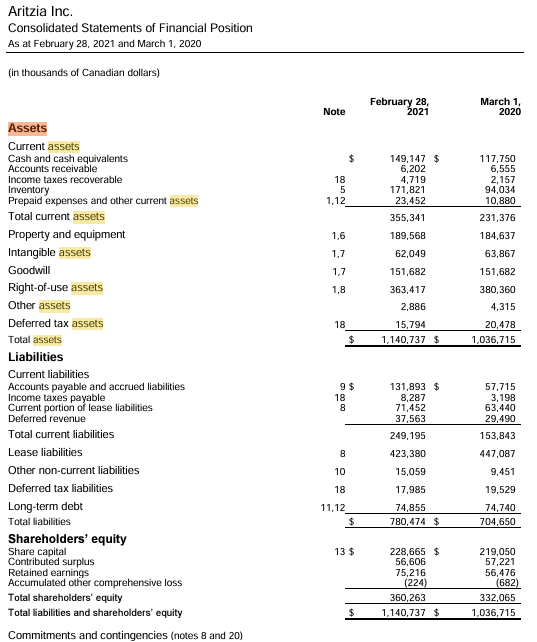

Evaluate the companys ability to sell inventory and pay debts during and In your analysis, you should compute the following ratios, and then comment on what those ratios indicate. Since the annual report only includes the balance sheets for and you will need to look up the annual report for for information about accounts receivable, inventory, and accounts payable. Aritzia Inc.

Consolidated Statements of Financial Position

As at February and February

in thousands of Canadian dollars

tableNote,tableFebruary tableFebruary AssetsCash and cash equivalents,,$$Accounts receivable,,,Income taxes recoverable,,,InventoryPrepaid expenses and other current assets,Total current assets,,,Property and equipment,Intangible assets,GoodwillRightofuse assets,Other assets,,,Deferred tax assets,,,Total assets,,$$LiabilitiesAccounts payable and accrued liabilities,$$Income taxes payable,,,Current portion of contingent consideration,Current portion of lease liabilities,Deferred revenue,,,Total current liabilities,,,Lease liabilities,Other noncurrent liabilities,Contingent consideration,Noncontrolling interest in exchangeable shares liability,Deferred tax liabilities,Longterm debt,Total liabilities,,$$Shareholders equityShare capital,$$Contributed surplus,,,Retained earnings,,,Accumulated other comprehensive loss,,,Total shareholders' equity,,,Total liabilities and shareholders' equity,,$$

Commitments and contingencies note

Accounts receivable turnover

Inventory turnover

Accounts payable turnover and days payable outstanding

Cash conversion cycle

Current ratio

Quick acidtest ratio

Debt ratioAritzia Inc.

Consolidated Statements of Financial Position

As at February and March

in thousands of Canadian dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started