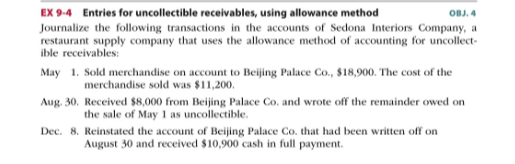

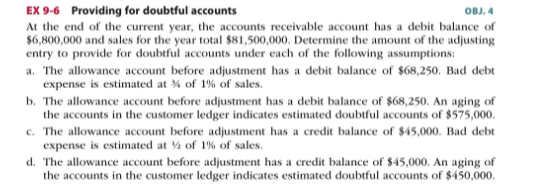

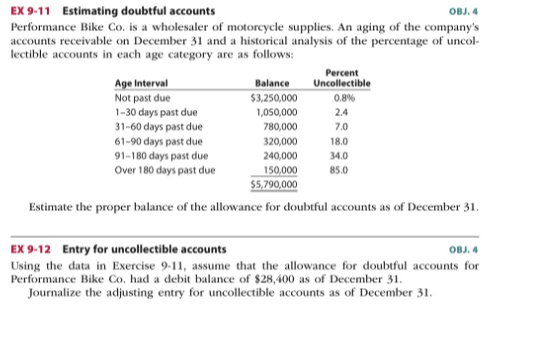

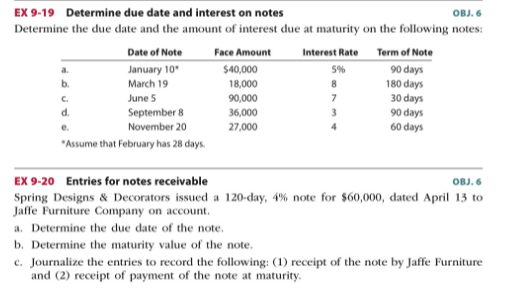

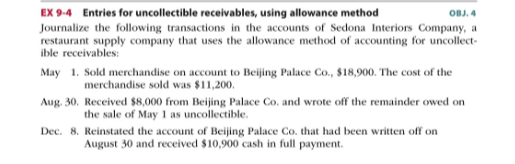

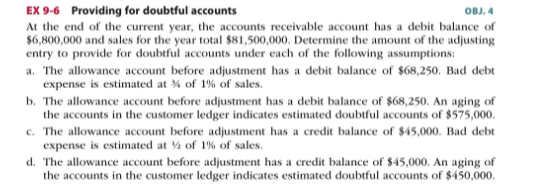

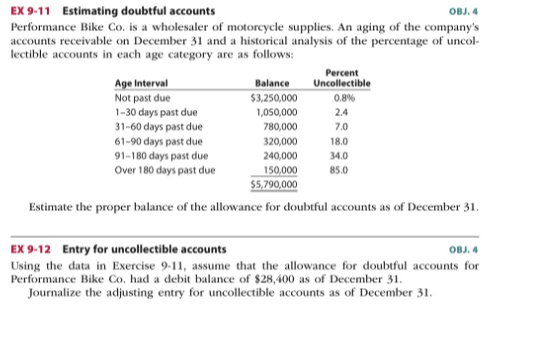

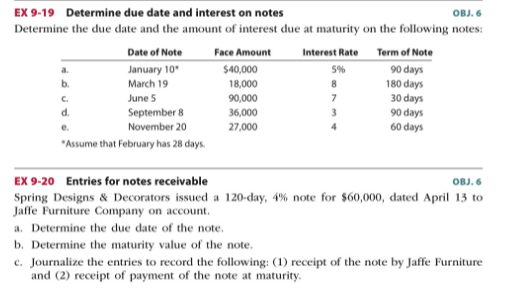

EX 9.4 Entries for uncollectible receivables, using allowance method OBJ. Journalize the following transactions in the accounts of Sedona Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollect ible receivables: May 1 Sold merchandise on account to Beijing Palace Co., $18,900. The cost of the merchandise sold was $11,200. Aug, 30. Received $8,000 from Beijing Palace Co. and wrote off the remainder owed on the sale of May I as uncollectible. Dec. 8. Reinstated the account of Beijing Palace Co. that had been written off on August 30 and received $10,900 cash in full payment EX 9-6 Providing for doubtful accounts OBJ. 4 At the end of the current year, the accounts receivable account has a debit balance of $6,800,000 and sales for the year total $81,500,000. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the following assumptions & The allowance account before adjustment has a debit balance of $68,250, Bad debt expense is estimated at % of 1% of sales. b. The allowance account before adjustment has a debit balance of $68,250. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $575,000 The allowance account before adjustment has a credit balance of $45,000. Bad debt expense is estimated at of 1% of sales. d. The allowance account before adjustment has a credit balance of $45,000. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $150,000 EX 9-11 Estimating doubtful accounts OBJ. 4 Performance Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncol lectible accounts in each age category are as follows: Percent Age Interval Balance Uncollectible Not past due $3,250,000 0.8% 1-30 days past due 1,050,000 31-60 days past due 780,000 61-90 days past due 320,000 18.0 91-180 days past due 240,000 34.0 Over 180 days past due 150,000 85.0 $5,790,000 Estimate the proper balance of the allowance for doubtful accounts as of December 31 70 EX 9-12 Entry for uncollectible accounts OBJ.4 Using the data in Exercise 9-11, assume that the allowance for doubtful accounts for Performance Bike Co, had a debit balance of $28,400 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31 EX 9-19 Determine due date and interest on notes OBJ. 6 Determine the due date and the amount of interest due at maturity on the following notes: Interest Rate Date of Note January 10 March 19 June 5 September 8 November 20 *Assume that February has 28 days. Face Amount $40,000 18,000 90,000 36,000 27,000 Term of Note 90 days 180 days 30 days 90 days 60 days EX 9-20 Entries for notes receivable OBJ. 6 Spring Designs & Decorators issued a 120-day, 4% note for $60,000, dated April 13 to Jalle Furniture Company on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entries to record the following: (1) receipt of the note by Jaffe Furniture and (2) receipt of payment of the note at maturity