Answered step by step

Verified Expert Solution

Question

1 Approved Answer

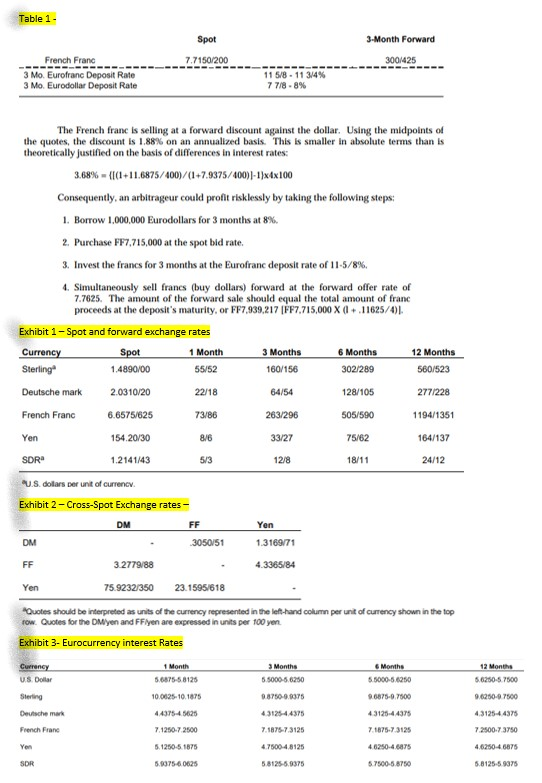

Examine the cross-spot rates shown in Exhibit 2. Are there any triangular arbitrage opportunities among these currencies (assume deviations from theoretical cross rates of 5

Examine the cross-spot rates shown in Exhibit 2. Are there any triangular arbitrage opportunities among these currencies (assume deviations from theoretical cross rates of 5 points or less are attributable to transaction costs)? How much profit could be made on a $5 million transaction? Show and explain.

Table 1- French Franc 3 Mo. Eurofranc Deposit Rate 3 Mo. Eurodollar Deposit Rate SDR The French franc is selling at a forward discount against the dollar. Using the midpoints of the quotes, the discount is 1.88% on an annualized basis. This is smaller in absolute terms than is theoretically justified on the basis of differences in interest rates: Exhibit 1 - Spot and forward exchange rates Currency 1 Month Spot 1.4890/00 Sterling 55/52 Deutsche mark 2.0310/20 22/18 French Franc 6.6575/625 Yen 154.20/30 1.2141/43 DM U.S. dollars per unit of currency. Exhibit 2-Cross-Spot Exchange rates- DM FF Yen Spot 7.7150/200 Currency U.S. Dollar 3.68%-{[(1+11.6875/400)/(1+7.9375/400))-1)x4x100 Consequently, an arbitrageur could profit risklessly by taking the following steps: 1. Borrow 1,000,000 Eurodollars for 3 months at 8%. 2. Purchase FF7,715,000 at the spot bid rate. 3. Invest the francs for 3 months at the Eurofranc deposit rate of 11-5/8%. 4. Simultaneously sell francs (buy dollars) forward at the forward offer rate of 7.7625. The amount of the forward sale should equal the total amount of franc proceeds at the deposit's maturity, or FF7,939.217 [FF7.715,000 X (1+.11625/4)). Sterling Deutsche mark French Franc Yen SDR 3.2779/88 73/86 8/6 FF 3050/51 5/3 1 Month 5.6875-5.8125 10.0625-10.1875 4.4375-4.5625 11 5/8-11 3/4 % 7 7/8-8% 7.1250-7,2500 5.1250-5.1875 5.9375-6.0625 3 Months 160/156 64/54 263/296 33/27 12/8 Yen 1.3169/71 4.3365/84 75.9232/350 23.1595/618 "Quotes should be interpreted as units of the currency represented in the left-hand column per unit of currency shown in the top row Quotes for the DMyen and FF/yen are expressed in units per 100 yen. Exhibit 3- Eurocurrency interest Rates 3 Months 5.5000-5.6250 9.8750-9.9375 3-Month Forward 300/425 4.3125-4.4375 7.1875-7.3125 4.7500-4.8125 5.8125-5.9375 6 Months 302/289 128/105 505/590 75/62 18/11 12 Months 560/523 277/228 1194/1351 6 Months 5.5000-5.6250 164/137 9.6875-9.7500 4.3125-44375 7.1875-7.3125 4.6250-4.6875 5.7500-5.8750 24/12 12 Months 5.6250-5.7500 9.6250-97500 4.3125-4.4375 7.2500-7.3750 4.6250-4.6875 5.8125-5.9375

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To determine if there are any triangular arbitrage opportunities among the given crossspot rates we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started