Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example 1 : There is an expected payment one year from today of $ 1 0 0 0 and interest rates for the 1 -

Example :

There is an expected payment one year from today of $ and interest rates for the ear period are vielding what is the present value for the future payment?

Example :

A bank wants to increase deposits and is looking to incresase their savings interest rate to achieve this goal. The bank wants to raise $ through this program and is willing to pay to achieve the goal. The bank expects to reduce this introductory offer in years and thus all depositors will remove their funds from their account. How much will they have to pay out in interest to achieve their goal?

Interest

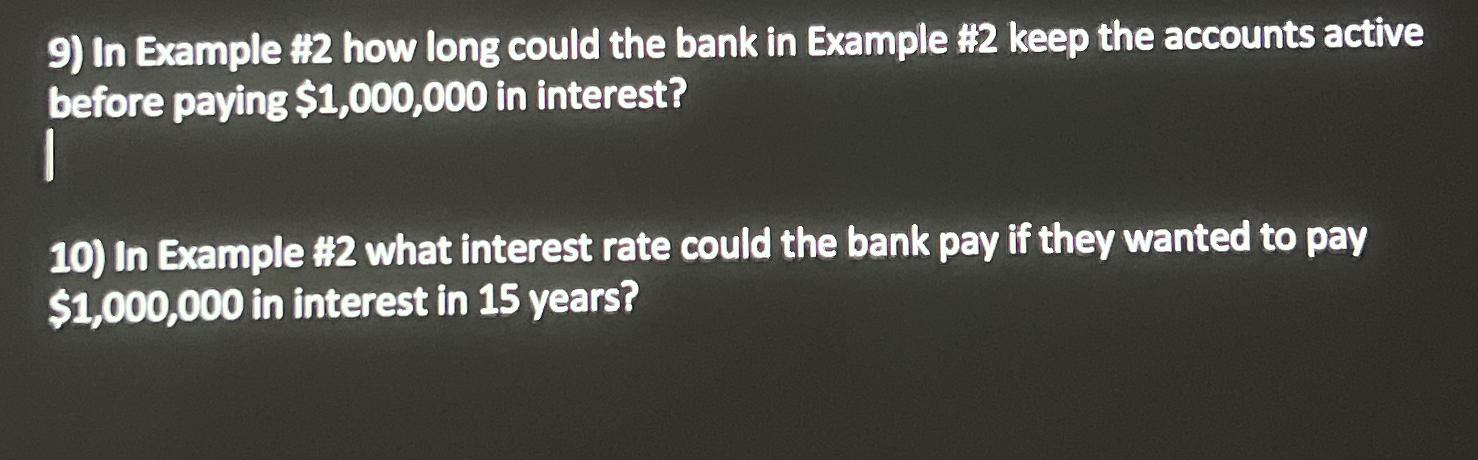

In Example $ how long could the bank in Example $ keep the accounts active before paying $ in interest?

In Example # what interest rate could the bank pay if they wanted to pay $ in interest in years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started