Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Sea Hawk Shop had the following inventory data: (Click the icon to view the inventory data.) Read the requirements. Requirement 1. Sea Hawk

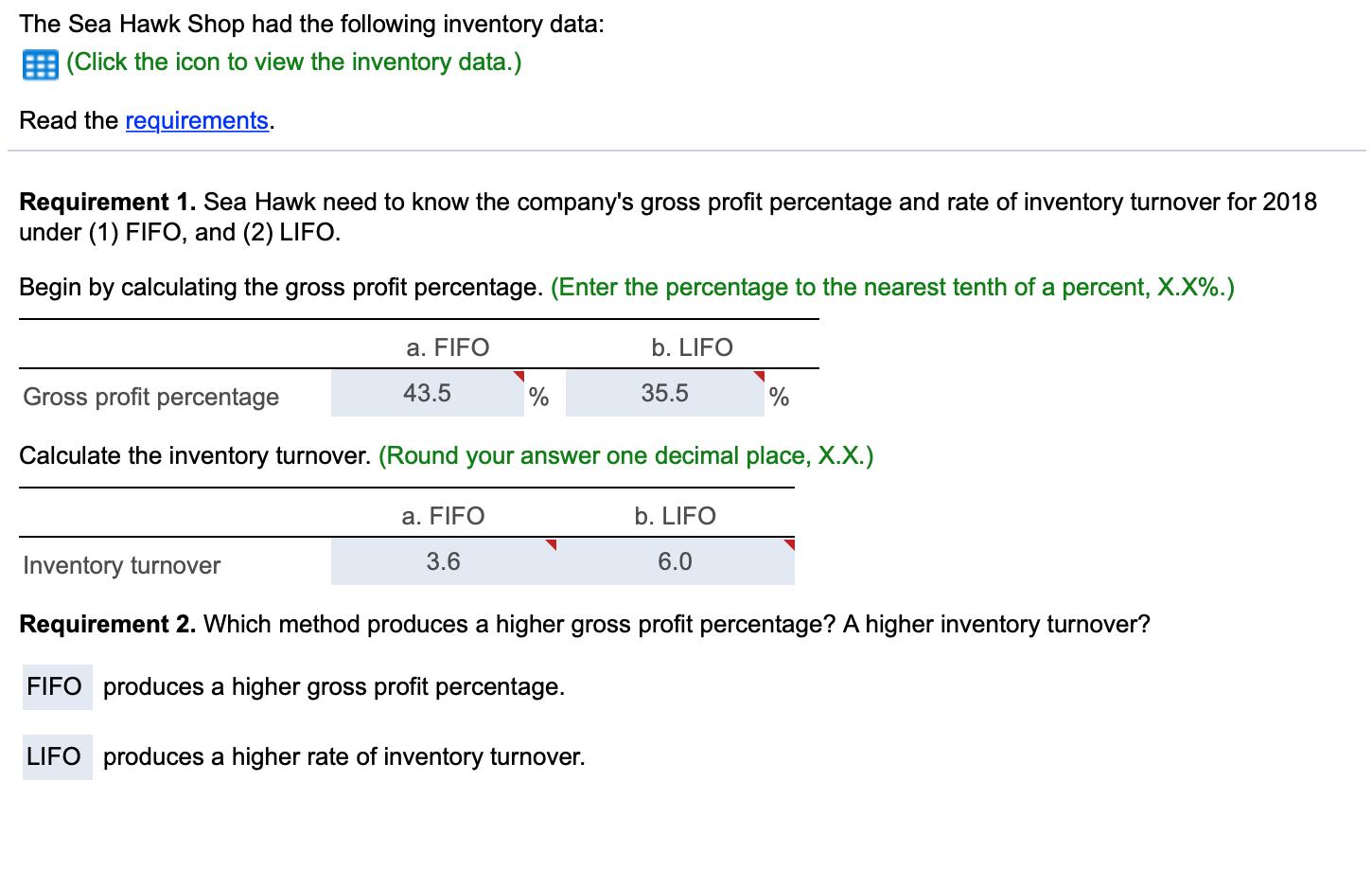

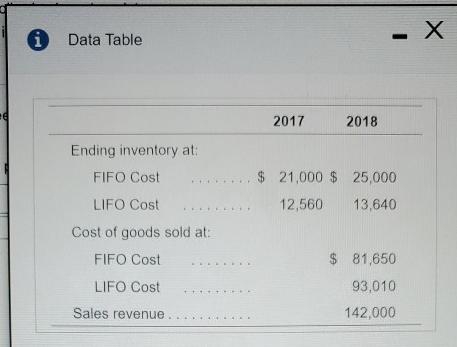

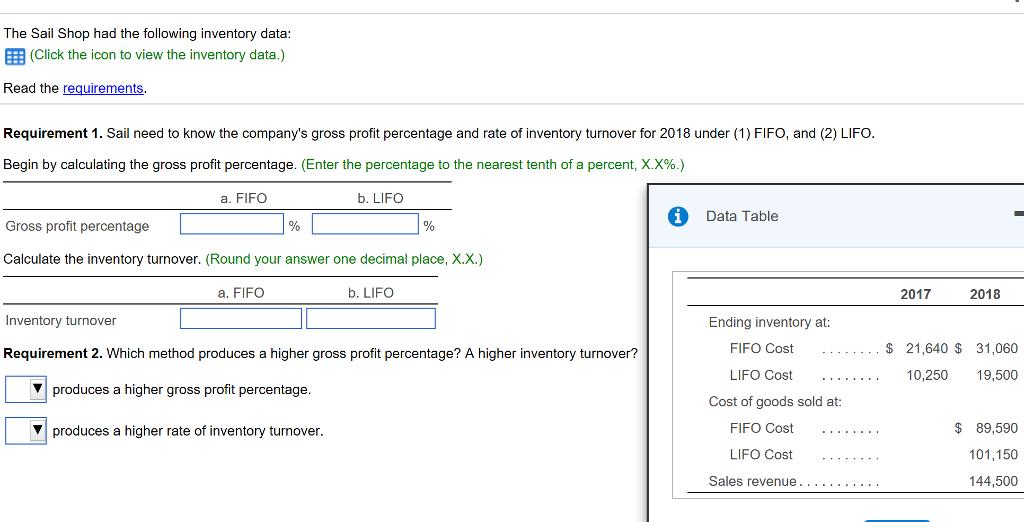

The Sea Hawk Shop had the following inventory data: (Click the icon to view the inventory data.) Read the requirements. Requirement 1. Sea Hawk need to know the company's gross profit percentage and rate of inventory turnover for 2018 under (1) FIFO, and (2) LIFO. Begin by calculating the gross profit percentage. (Enter the percentage to the nearest tenth of a percent, X.X%.) a. FIFO b. LIFO Gross profit percentage 43.5 35.5 Calculate the inventory turnover. (Round your answer one decimal place, X.X.) a. FIFO b. LIFO Inventory turnover 3.6 6.0 Requirement 2. Which method produces a higher gross profit percentage? A higher inventory turnover? FIFO produces a higher gross profit percentage. LIFO produces a higher rate of inventory turnover. Data Table 2017 2018 Ending inventory at: FIFO Cost $21,000 $ 25,000 LIFO Cost 12,560 13,640 Cost of goods sold at: FIFO Cost $ 81,650 LIFO Cost 93,010 Sales revenue. 142,000 The Sail Shop had the following inventory data: EE (Click the icon to view the inventory data.) Read the requirements. Requirement 1. Sail need to know the company's gross profit percentage and rate of inventory turnover for 2018 under (1) FIFO, and (2) LIFO. Begin by calculating the gross profit percentage. (Enter the percentage to the nearest tenth of a percent, X.X%.) a. FIFO b. LIFO Data Table Gross profit percentage Calculate the inventory turnover. (Round your answer one decimal place, X.X.) a. FIFO b. LIFO 2017 2018 Inventory turnover Ending inventory at: FIFO Cost $ 21,640 $ 31,060 Requirement 2. Which method produces a higher gross profit percentage? A higher inventory turnover? LIFO Cost 10,250 19,500 V produces a higher gross profit percentage. Cost of goods sold at: V produces a higher rate of inventory turnover. FIFO Cost $ 89,590 LIFO Cost 101,150 Sales revenue........... 144,500

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Gross Profit percentage Gross Profit Percentage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started