Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel can be used. I need Excel file too. QUESTION 1 Suppose that you are working as a capital budgeting analyst in a finance department

Excel can be used. I need Excel file too.

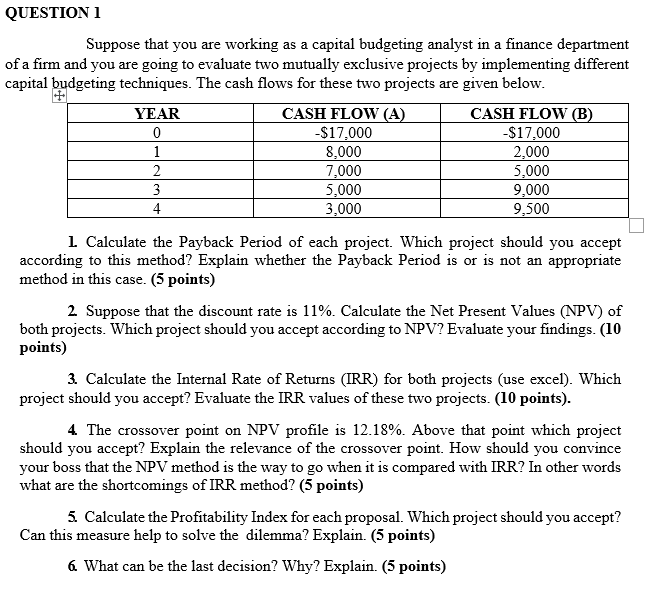

QUESTION 1 Suppose that you are working as a capital budgeting analyst in a finance department of a firm and you are going to evaluate two mutually exclusive projects by implementing different capital budgeting techniques. The cash flows for these two projects are given below. YEAR CASH FLOW (A) CASH FLOW (B) $17,000 -$17,000 8,000 2,000 2 7,000 5,000 3 5,000 9,000 4 3,000 9,500 1 i Calculate the Payback Period of each project. Which project should you accept according to this method? Explain whether the Payback Period is or is not an appropriate method in this case. (5 points) 2. Suppose that the discount rate is 11%. Calculate the Net Present Values (NPV) of both projects. Which project should you accept according to NPV? Evaluate your findings. (10 points) 3. Calculate the Internal Rate of Returns (IRR) for both projects (use excel). Which project should you accept? Evaluate the IRR values of these two projects. (10 points). 4. The crossover point on NPV profile is 12.18%. Above that point which project should you accept? Explain the relevance of the crossover point. How should you convince your boss that the NPV method is the way to go when it is compared with IRR? In other words what are the shortcomings of IRR method? (5 points) 5. Calculate the Profitability Index for each proposal. Which project should you accept? Can this measure help to solve the dilemma? Explain. (5 points) 6 What can be the last decision? Why? Explain. (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started