Answered step by step

Verified Expert Solution

Question

1 Approved Answer

excerise 5-3 perpetual inventory costing methods LO P1 & Excerise 5-4 perpetual: income effects of inventory methods LO A1 ! Required information Use the following

excerise 5-3 perpetual inventory costing methods LO P1

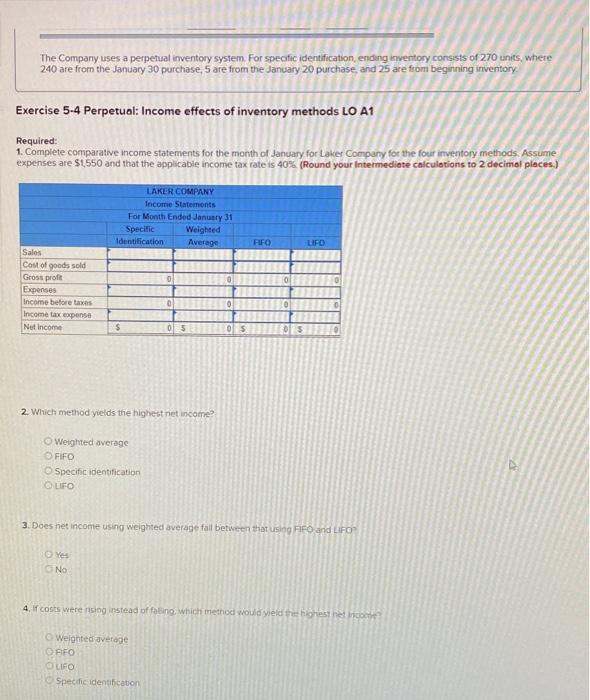

& Excerise 5-4 perpetual: income effects of inventory methods LO A1

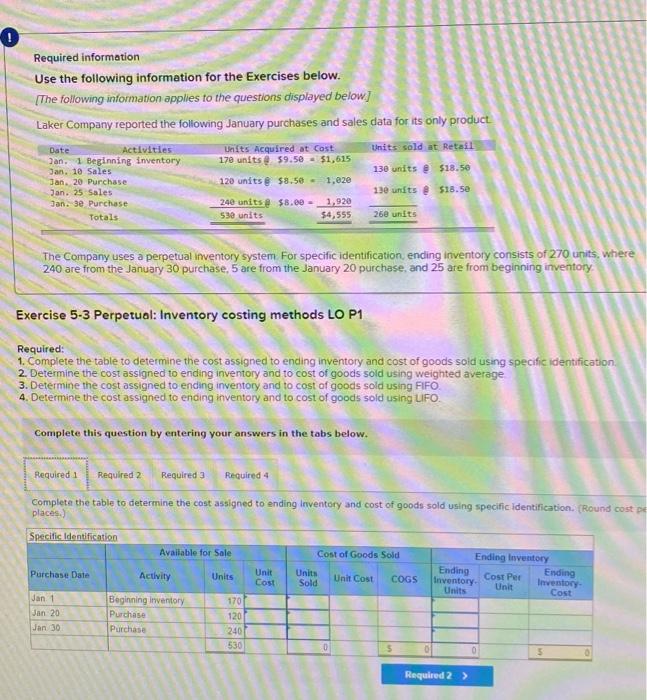

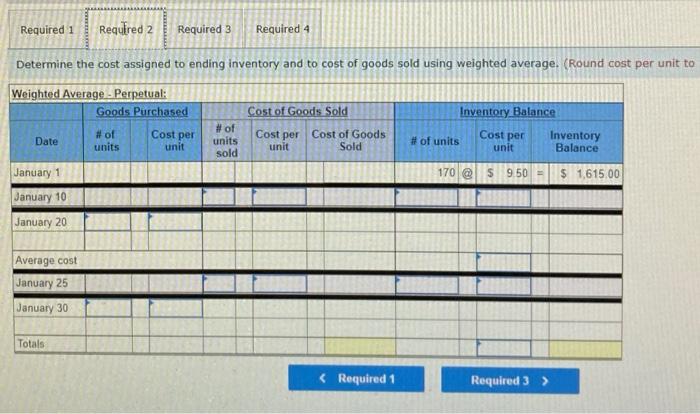

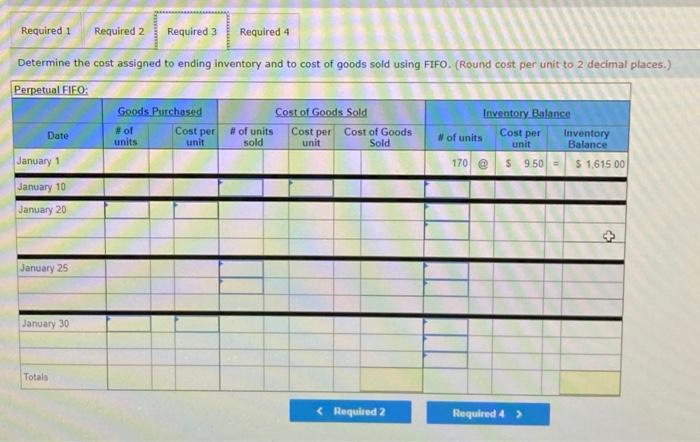

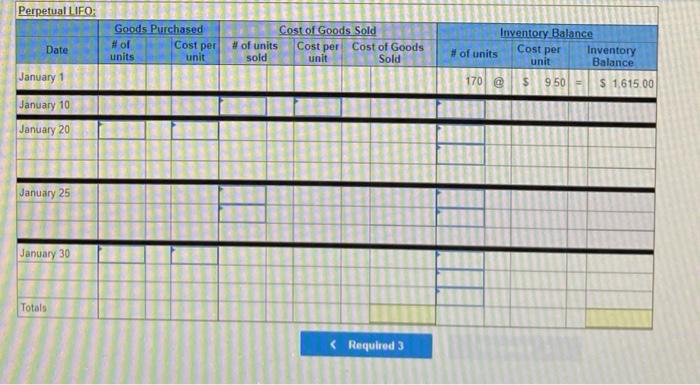

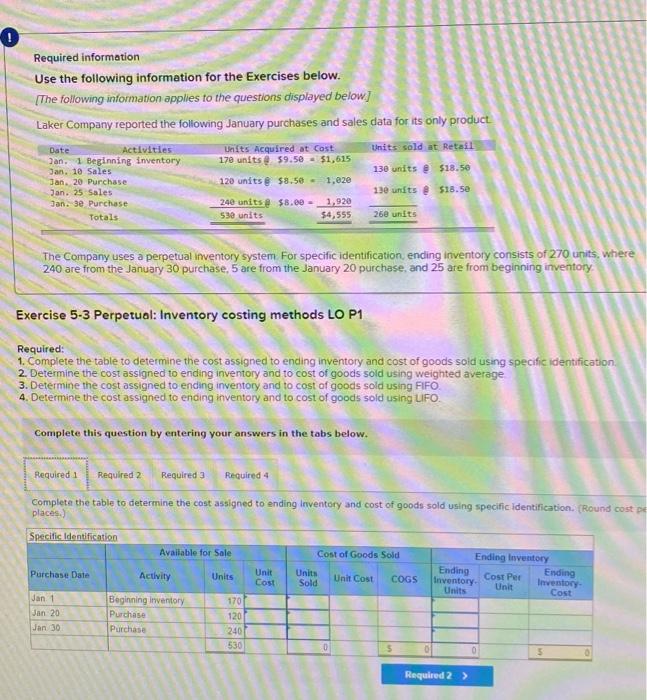

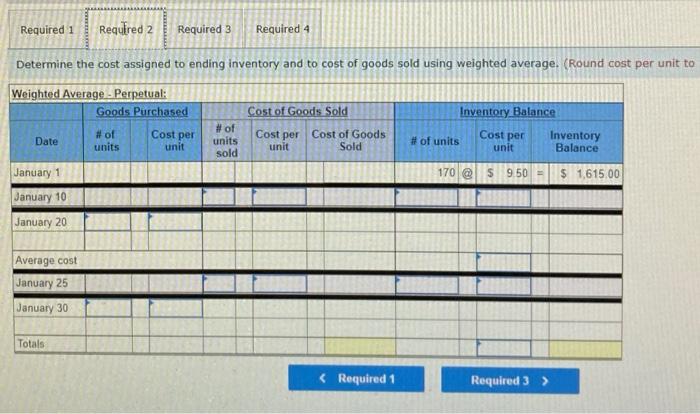

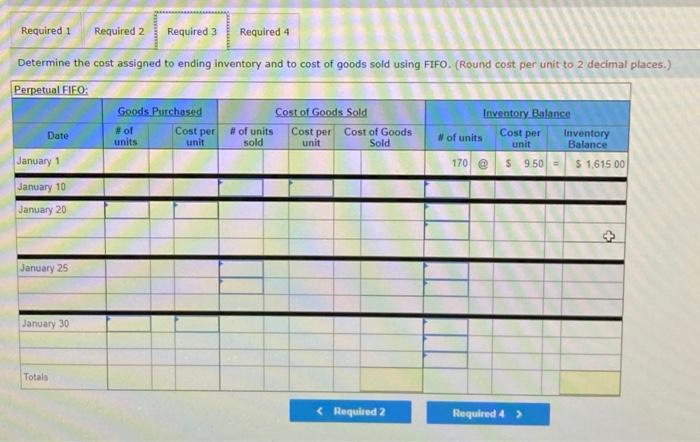

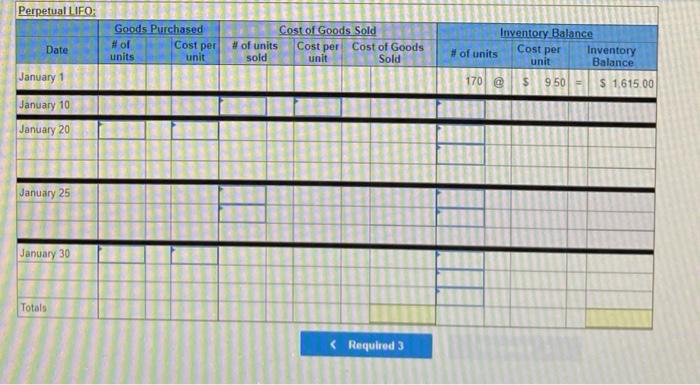

! Required information Use the following information for the Exercises below. The following information applies to the questions displayed below] Laker Company reported the following January purchases and sales data for its only product Activities Units Acquired at Cost Units sold at Retail Dan. 1 Beginning inventory 178 units 39.50 - $1,615 130 units $18.50 120 units @ $8.50 - 1,020 130 units @ $18.50 Jan. 3e Purchase 240 units $8.00 - 1,920 538 units Date Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Totals 54,555 26e units The Company uses a perpetual inventory system for specific identification ending inventory consists of 270 units, where 240 are from the January 30 purchase, 5 are from the January 20 purchase, and 25 are from beginning inventory Exercise 5-3 Perpetual: Inventory costing methods LO P1 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO 4. Determine the cost assigned to ending inventory and to cost of goods sold using UFO Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Complete the table to determine the cast assigned to ending Inventory and cost of goods sold using specific identification. (Round cost pe places) Specific Identification Available for Sale Cost of Goods Sold Ending Inventory Purchase Date Unit Ending Units Units Ending Activity Cost Sold Unit Cost Cost Per COGS Inventory Units Unit Inventory Cost Jan 1 Beginning inventory 170 Jan 20 Purchase 120 Jan 30 Purchase 240 530 5 5 Required 2 > Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to Weighted Average - Perpetual: Goods Purchased # of Date units unit Inventory Balance #of Cost per Cost of Goods Sold Cost per Cost of Goods unit Sold Cost per units sold # of units Inventory Balance unit 170 @s 9.50 = $ 1,615.00 January 1 January 10 January 20 Average cost January 25 January 30 Totals Required 1 Required 3 > Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. (Round cost per unit to 2 decimal places.) Perpetual FIFO: Goods Purchased Date Cost per # of units Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold unit Inventory Balance Cost per Inventory W of units unit Balance 170 @ $ 9.50 - $ 1,615.00 January 1 January 10 January 20 + January 25 January 30 Totals Perpetual LIFO: Goods Purchased # of units unit Cost per Cost of Goods Sold # of units Cost per Cost of Goods sold unit Date Cost per Sold Inventory Balance #of units Inventory unit Balance 170 @ $ 950 = $ 1.615.00 January 1 January 10 January 20 January 25 January 30 Totals Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started