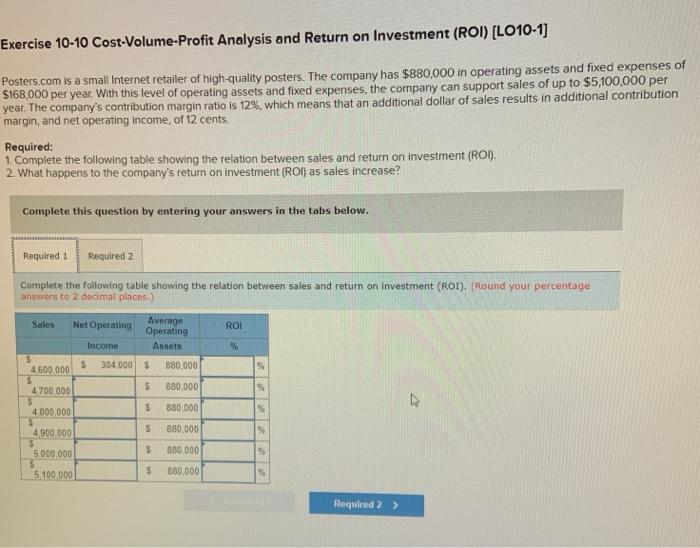

Exercise 10-10 Cost-Volume-Profit Analysis and Return on Investment (ROI) (LO10-1] Posters.com is a small Internet retailer of high-quality posters. The company has $880,000 in operating assets and fixed expenses of $168,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $5,100,000 per year. The company's contribution margin ratio is 12%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 12 cents, Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) ROI % Sales Net Operating Average Operating Income Assets 5 4.600.000 384.000 $ 880.000 4,700,000 $ 680,000 $ 5 4,800,000 880.000 3 5 880.000 4.900.000 5 5 5000,000 880.000 5 5 5.100.000 880,000 - 5 Required 2 > Exercise 10-10 Cost-Volume-Profit Analysis and Return on Investment (ROI) (LO10-1] Posters.com is a small Internet retailer of high-quality posters. The company has $880,000 in operating assets and fixed expenses of $168,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $5,100,000 per year. The company's contribution margin ratio is 12%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 12 cents, Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) ROI % Sales Net Operating Average Operating Income Assets 5 4.600.000 384.000 $ 880.000 4,700,000 $ 680,000 $ 5 4,800,000 880.000 3 5 880.000 4.900.000 5 5 5000,000 880.000 5 5 5.100.000 880,000 - 5 Required 2 >