Answered step by step

Verified Expert Solution

Question

1 Approved Answer

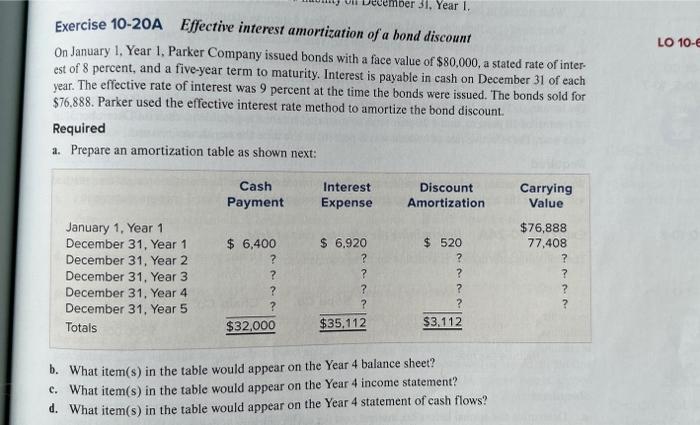

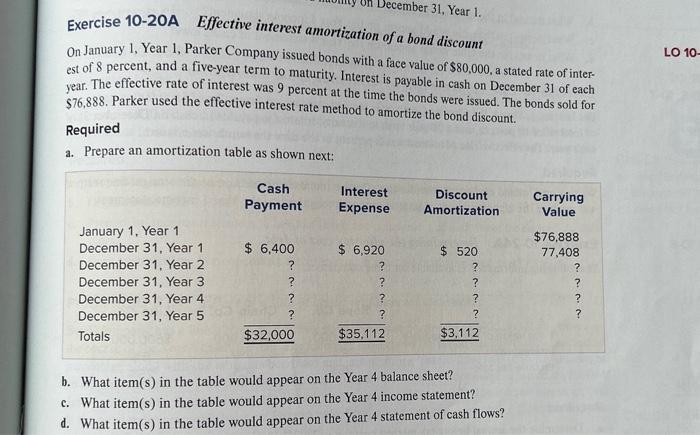

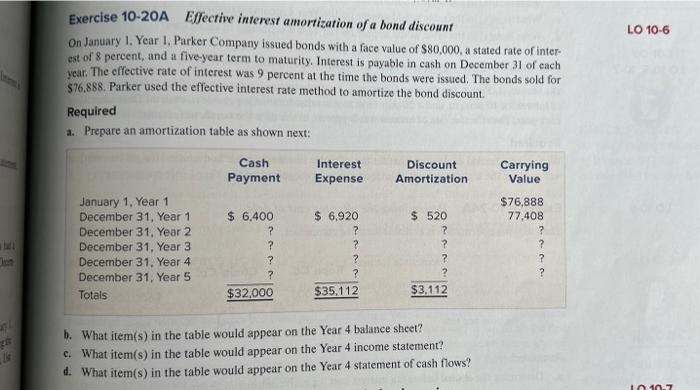

EXERCISE 10-20A Exercise 10-20A Effective interest amortization of a bond discount On January 1, Year 1, Parker Company issued bonds with a face value of

EXERCISE 10-20A

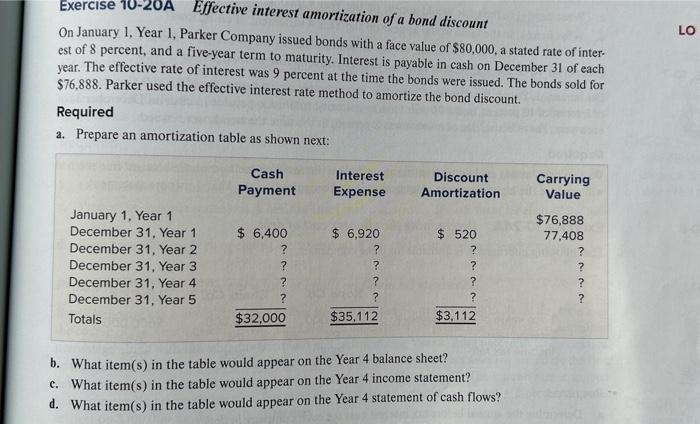

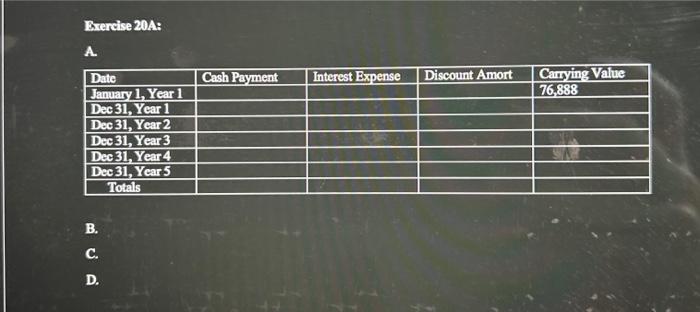

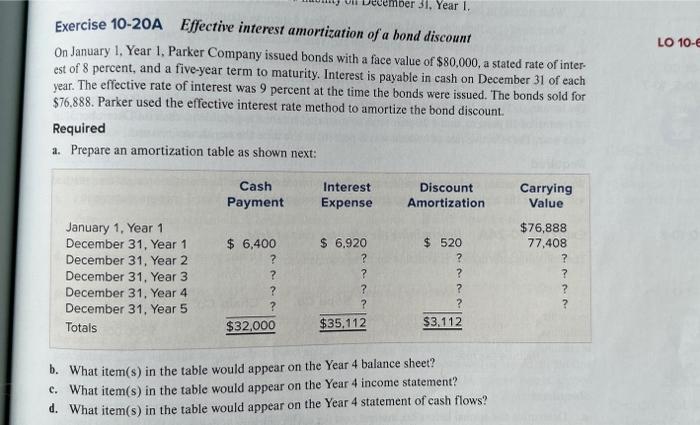

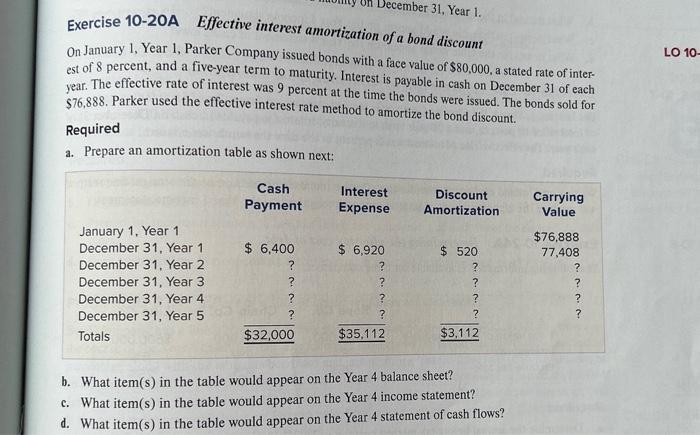

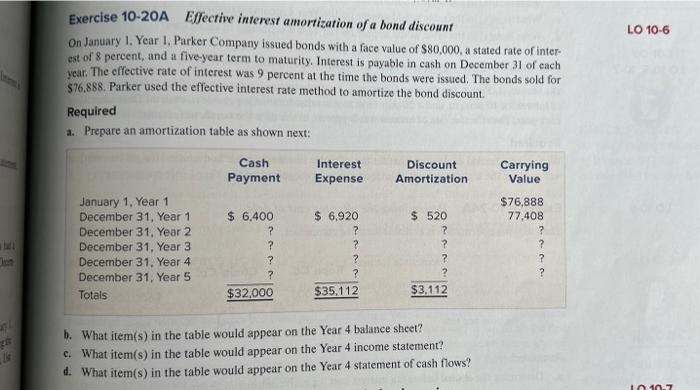

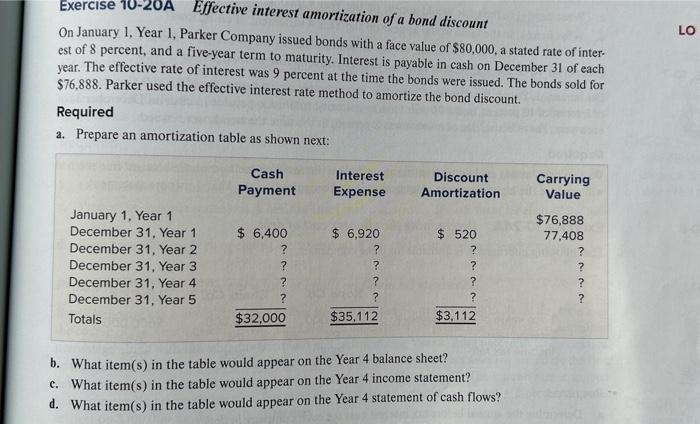

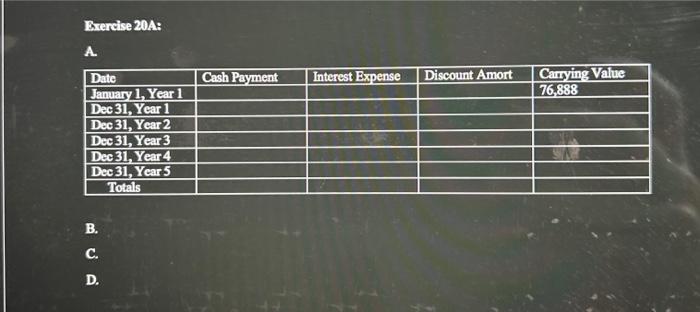

Exercise 10-20A Effective interest amortization of a bond discount On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of inter. est of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for \$76.888. Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare an amortization table as shown next: b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 income statement? d. What item(s) in the table would appear on the Year 4 statement of cash flows? Exercise 10-20A Effective interest amortization of a bond discount On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare an amortization table as shown next: b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 income statement? d. What item(s) in the table would appear on the Year 4 statement of cash flows? Exercise 10-20A Effective interest amortization of a bond discount On January 1. Year I. Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 pereent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for \$76.888. Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare an amortization table as shown next: b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 income statement? d. What item(s) in the table would appear on the Year 4 statement of cash flows? Exercise TU-20A Effective interest amortization of a bond discoumt On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare an amortization table as shown next: b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 income statement? d. What item(s) in the table would appear on the Year 4 statement of cash flows? Brercise 20A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started