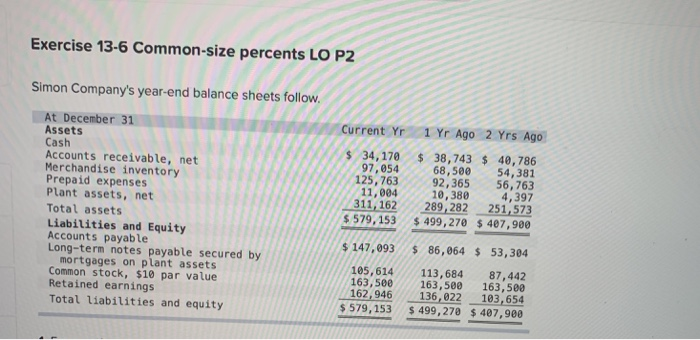

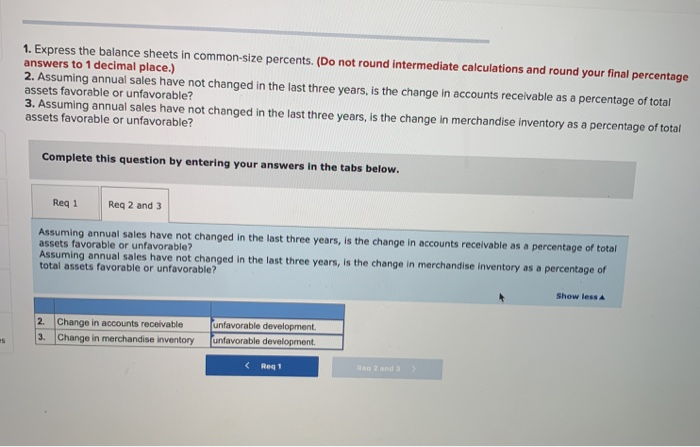

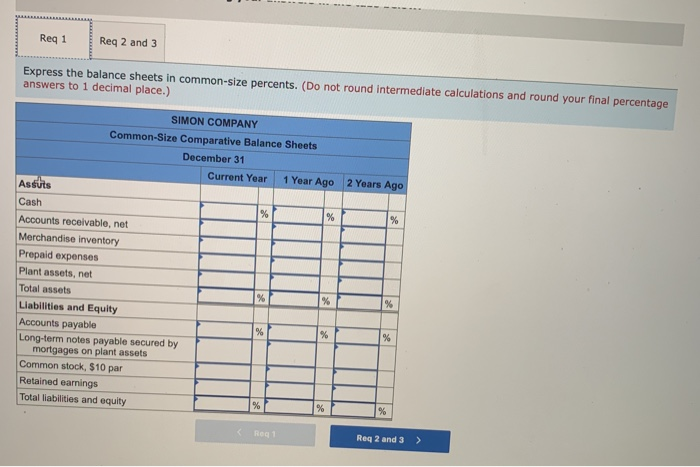

Exercise 13-6 Common-size percents LO P2 Simon Company's year-end balance sheets follow Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 34,170 97,054 125,763 11,004 311,162 $ 579,153 $ 38,743 $ 40,786 68,500 54,381 92,365 56, 763 10,380 4,397 289, 282 251, 573 $ 499,270 $ 407,900 $ 147,093 $ 86,064 $ 53,304 105,614 163,500 162,946 $ 579,153 113,684 87,442 163,500 163,500 136,022 103,654 $ 499,270 $ 407,900 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. 3. Change in accounts receivable Change in merchandise inventory unfavorable development. unfavorable development. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2 Years Ago SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago Astuts Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity Reg1 Reg 2 and 3 >