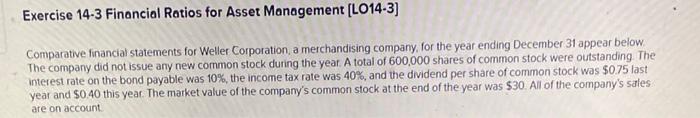

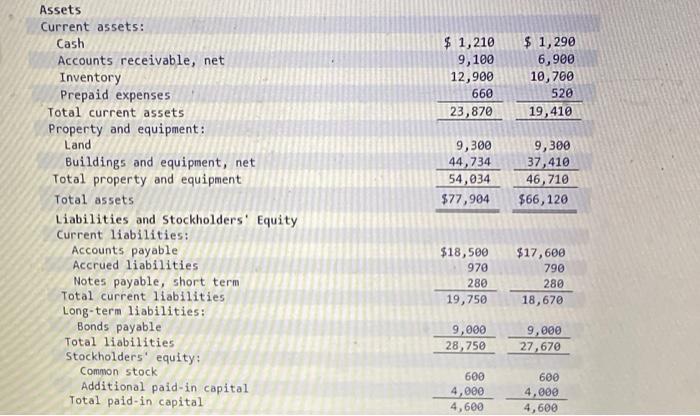

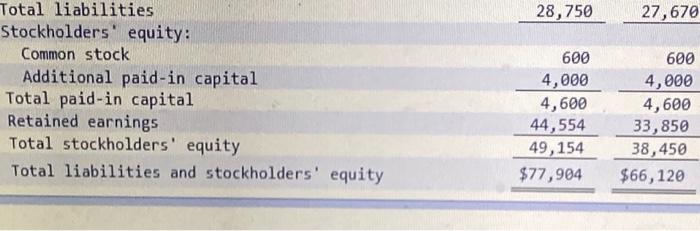

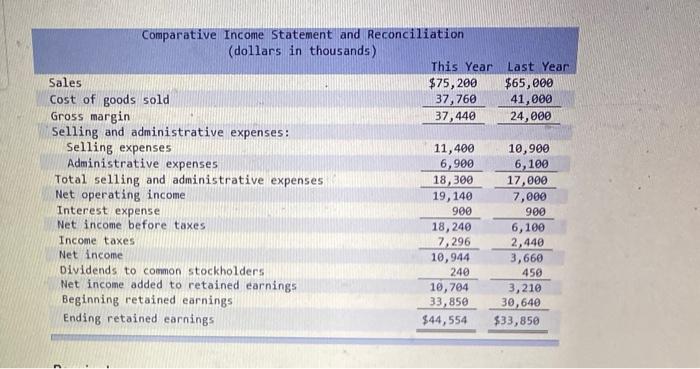

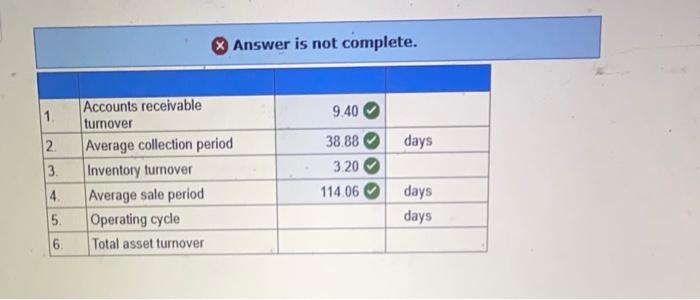

Exercise 14-3 Financial Ratios for Asset Management (L014-3] Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 600,000 shares of common stock were outstanding The Interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of the year was $30. All of the company's sales are on account Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets $ 1,210 9,100 12,900 660 23,870 $ 1,290 6,900 10,700 520 19,410 9,300 44,734 54,034 $77,904 9,300 37,410 46,710 $66,120 $18,500 970 280 19,750 $17,600 790 280 18,670 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity: Common stock Additional paid-in capital Total paid-in capital 9,000 28,750 9,000 27,670 600 4,000 4,600 600 4,000 4,600 28,750 27,670 Total liabilities Stockholders' equity: Common stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 600 4,000 4,600 44,554 49,154 $77,904 600 4,000 4,600 33,850 38,450 $66,120 Comparative Income Statement and Reconciliation (dollars in thousands) This Year Last Year Sales $75,200 $65,000 Cost of goods sold 37,760 41,000 Gross margin 37,440 24,000 Selling and administrative expenses : Selling expenses 11,400 10,900 Administrative expenses 6,900 6,100 Total selling and administrative expenses 18,300 17,000 Net operating income 19,140 7,000 Interest expense 900 Net income before taxes 18,240 6,100 Income taxes 7.296 2,440 Net income 10,944 3,660 Dividends to common stockholders 240 450 Net income added to retained earnings 10,704 3,219 Beginning retained earnings 33,850 30,640 Ending retained earnings $44,554 $33,850 989 X Answer is not complete. Accounts receivable 1 9.40 turnover 2 38.88 days 3. 3.20 Average collection period Inventory turnover Average sale period Operating cycle 114.06 days 4 5. days 6. Total asset turnover