Answered step by step

Verified Expert Solution

Question

1 Approved Answer

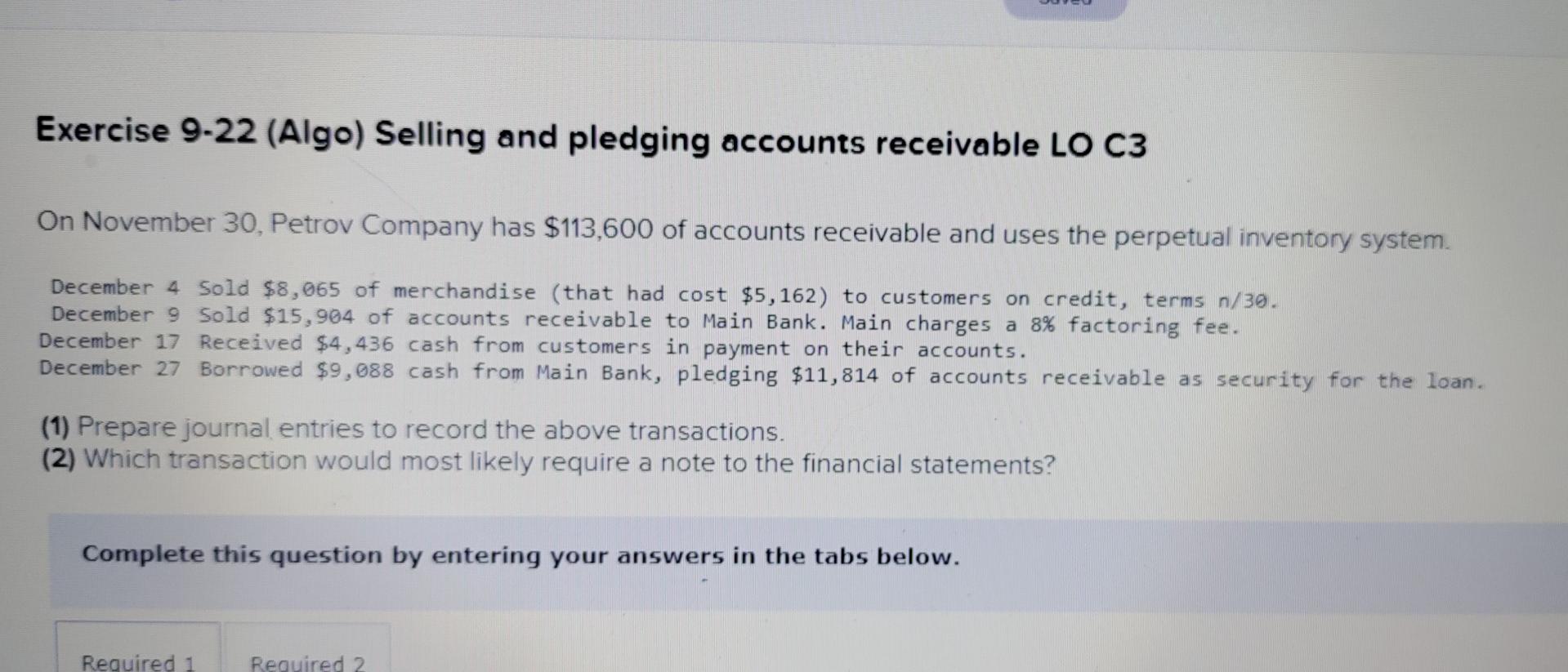

Exercise 9-22 (Algo) Selling and pledging accounts receivable LO C3 On November 30, Petrov Company has $113,600 of accounts receivable and uses the perpetual inventory

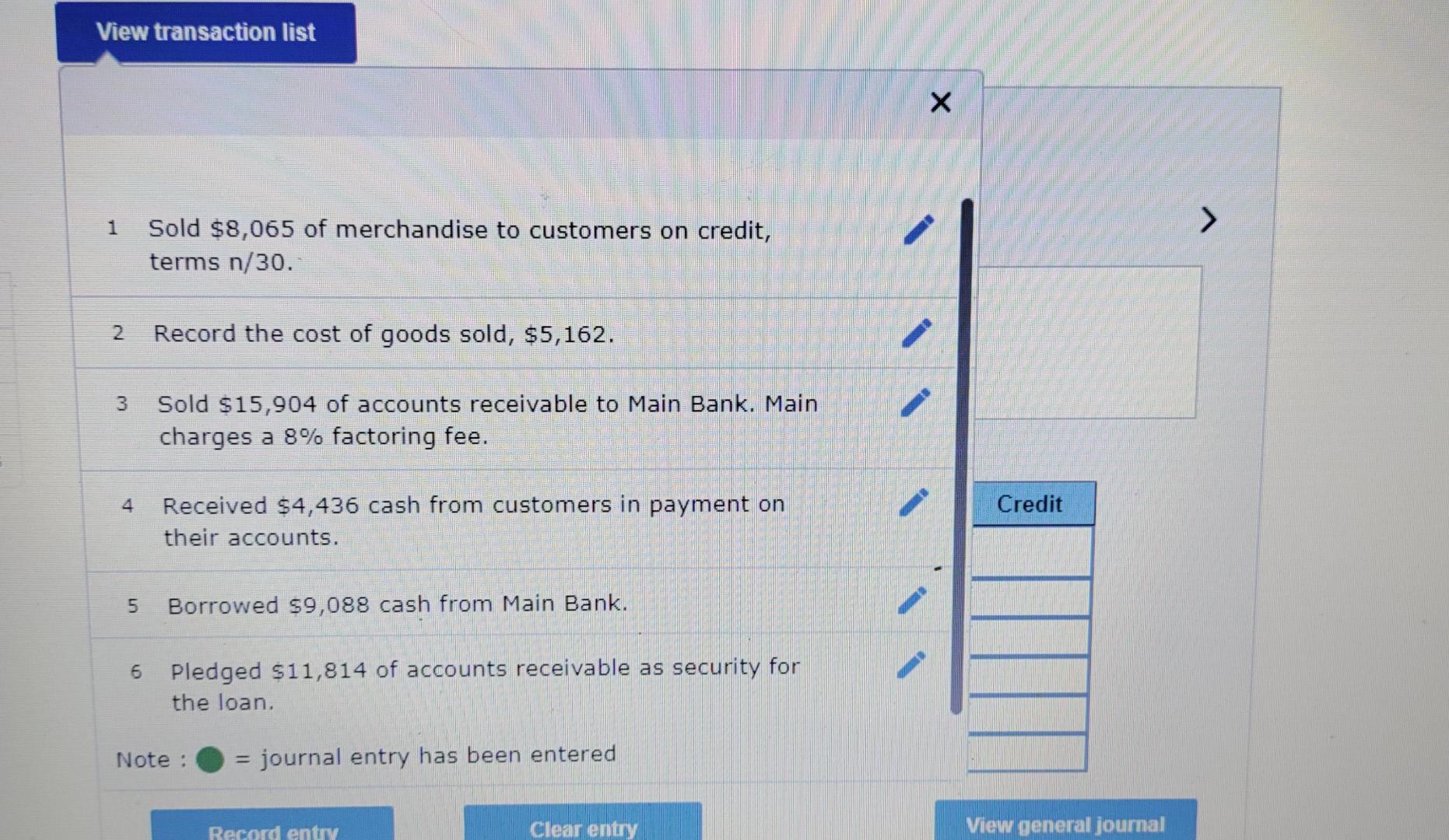

Exercise 9-22 (Algo) Selling and pledging accounts receivable LO C3 On November 30, Petrov Company has $113,600 of accounts receivable and uses the perpetual inventory system. December 4 Sold $8,065 of merchandise (that had cost $5,162) to customers on credit, terms n/30. December 9 Sold $15,904 of accounts receivable to Main Bank. Main charges a 8% factoring fee. December 17 Received $4,436 cash from customers in payment on their accounts. December 27 Borrowed $9,088 cash from Main Bank, pledging $11,814 of accounts receivable as security for the loan. (1) Prepare journal entries to record the above transactions. (2) Which transaction would most likely require a note to the financial statements? Complete this question by entering your answers in the tabs below. Required 1 Required 2 View transaction list > 1 Sold $8,065 of merchandise to customers on credit, terms n/30. 2 Record the cost of goods sold, $5,162. 3 Sold $15,904 of accounts receivable to Main Bank. Main charges a 8% factoring fee. 4 Credit Received $4,436 cash from customers in payment on their accounts. 5 Borrowed $9,088 cash from Main Bank. 6 Pledged $11,814 of accounts receivable as security for the loan. Note : = journal entry has been entered Record entry Clear entry View general journal (1) Prepare journal entries to record the above transactions. (2) Which transaction would most likely require a note to the financial statements? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Which transaction would most likely require a note to the financial statements? Which transaction would most likely require a note to the financial statements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started