Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise Part A: What are the limitations of comparing the two years of performance of the company by only looking at: Total assets: In 2014,

Exercise

Exercise

Part A:

What are the limitations of comparing the two years of performance of the company by only looking at:

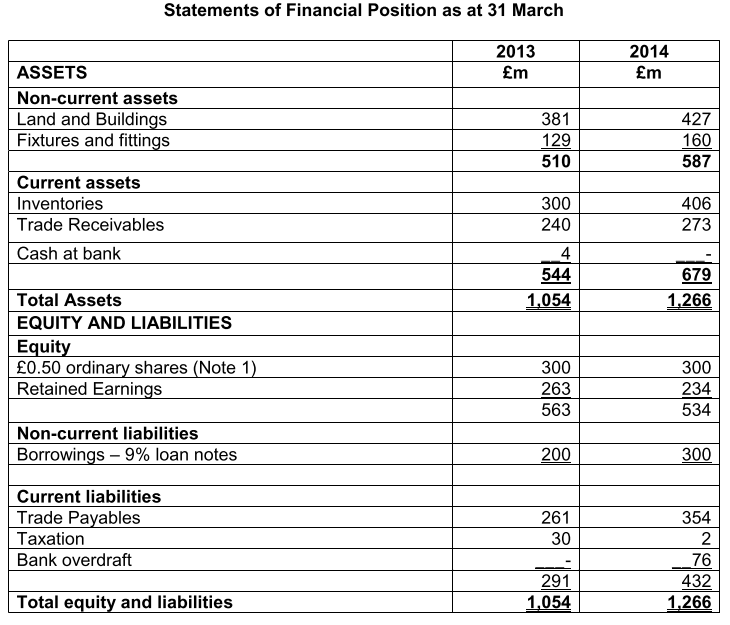

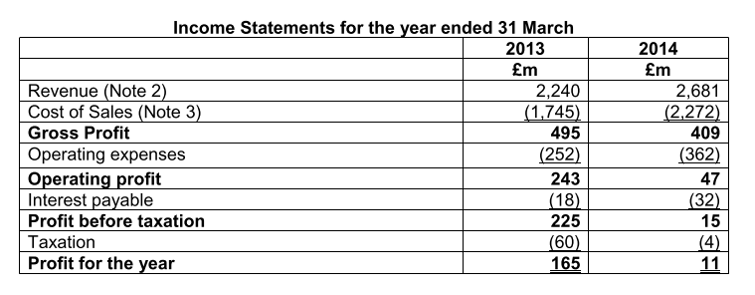

- Total assets: In 2014, the company has more total assets (1,266m) than in 2013 (1,054m), so the performance is better.

- Gross profit: In 2013, the company has more gross profit (495m) than in 2014 (409m), so the performance has worsened.

- Net profit: In 2013, the company has more net profit (165m) than in 2014 (11m), so the performance has worsened.

Part B:

Find the following ratios for the year 2013 and 2014 respectively:

- Gross Profit Margin

- Net Profit Margin

- Return on Net Assets Employed

- Return on Capital Employed

Part C:

For each of the above ratios, has the companys performance improved or worsened? Try to think of a reason for such change.

Example:

One possible reason for increase in Gross Profit Margin is that the company has increase the price of goods in sale but keep the costs of purchase of goods the same.

Statements of Financial Position as at 31 March 2013 m 2014 m ASSETS Non-current assets Land and Buildings Fixtures and fittings 381 129 510 427 160 587 Current assets Inventories Trade Receivables Cash at bank 406 273 300 240 4 544 1,054 679 1.266 Total Assets EQUITY AND LIABILITIES Equity 0.50 ordinary shares (Note 1) Retained Earnings 300 263 563 300 234 534 Non-current liabilities Borrowings - 9% loan notes 200 300 Current liabilities Trade Payables Taxation Bank overdraft 261 30 354 2 76 432 1,266 291 1,054 Total equity and liabilities Income Statements for the year ended 31 March 2013 m Revenue (Note 2) 2,240 Cost of Sales (Note 3) (1,745) Gross Profit 495 Operating expenses (252) Operating profit 243 Interest payable (18) Profit before taxation 225 Taxation (60) Profit for the year 165 2014 m 2,681 (2.272) 409 (362) 47 (32) 15 (4) 11Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started