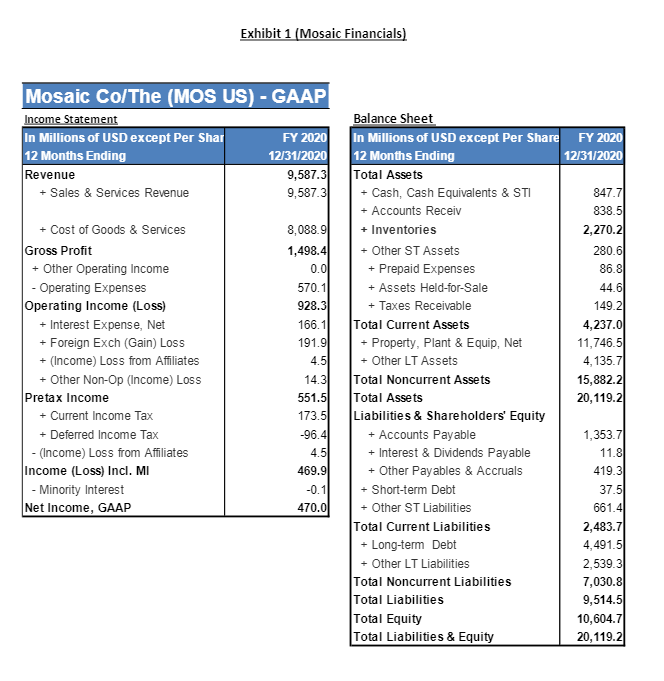

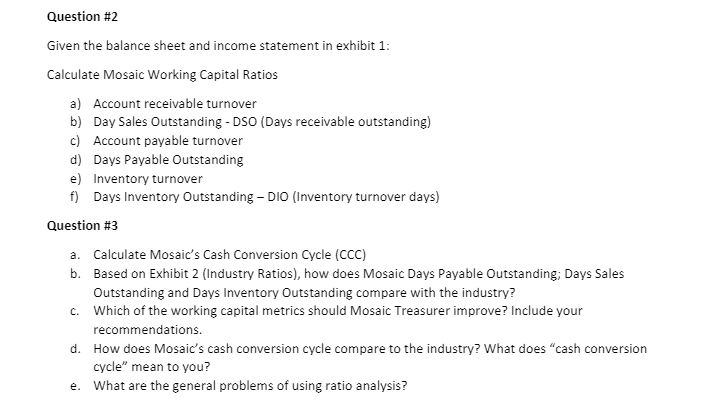

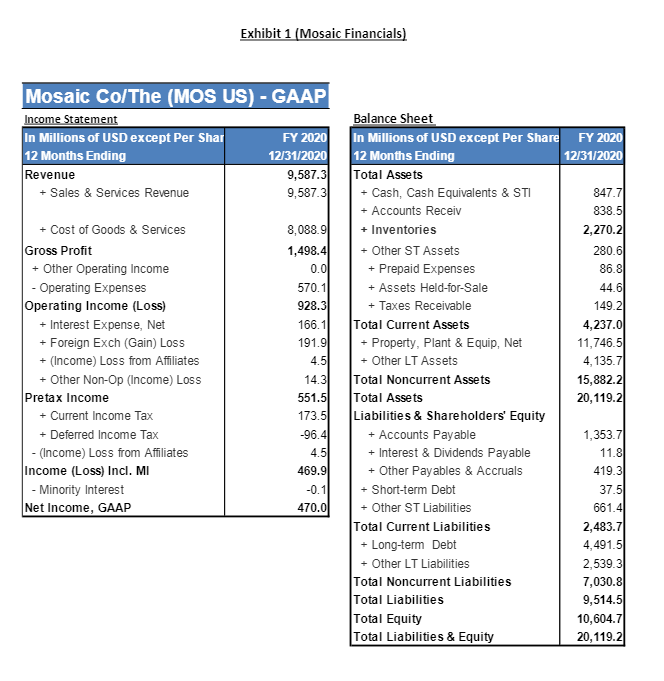

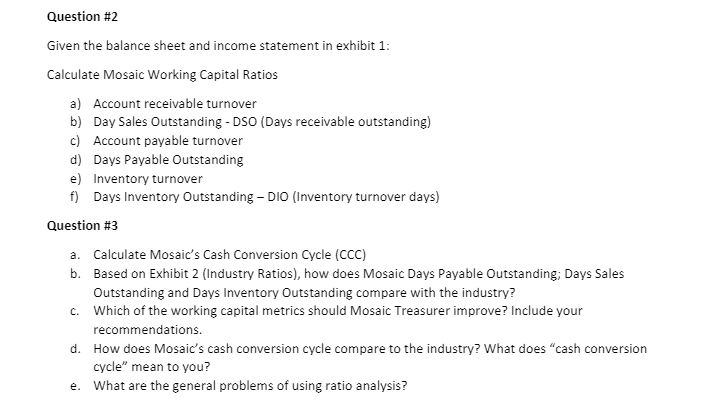

Exhibit 1 (Mosaic Financials) Mosaic Co/The (MOS US) - GAAP Income Statement In Millions of USD except Per Shar FY 2020 12 Months Ending 12/31/2020 Revenue 9,587.3 + Sales & Services Revenue 9,587.31 8,088.91 1,498.4 0.0 570.1 928.3 166.1 191.9 4.5 + Cost of Goods & Services Gross Profit + Other Operating Income - Operating Expenses Operating Income (Loss) + Interest Expense, Net + Foreign Exch (Gain) Loss + (Income) Loss from Affiliates + Other Non-Op (Income) Loss Pretax Income + Current Income Tax + Deferred Income Tax - (Income) Loss from Affiliates Income (Loss) Incl. MI - Minority Interest Net Income, GAAP 14.31 551.50 173.5 -96.4 4.5 469.9 -0.1 470.0 Balance Sheet In Millions of USD except Per Share FY 2020 12 Months Ending 12/31/2020 Total Assets Cash, Cash Equivalents & STI 847.7 + Accounts Receiv 838.5 + Inventories 2,270.21 + Other ST Assets 280.6 + Prepaid Expenses 86.8 + Assets Held-for-Sale 44.6 + Taxes Receivable 149.2 Total Current Assets 4,237.0 + Property, Plant & Equip, Net 11,746.51 + Other LT Assets 4,135.7 Total Noncurrent Assets 15,882.21 Total Assets 20,119.2 Liabilities & Shareholders' Equity + Accounts Payable 1,353.71 + Interest & Dividends Payable 11.8 + Other Payables & Accruals 419.3 + Short-term Debt 37.5 Other ST Liabilities 661.4 Total Current Liabilities 2,483.7 + Long-term Debt 4,491.51 + Other LT Liabilities 2,539.3 Total Noncurrent Liabilities 7,030.8 Total Liabilities 9,514.5 Total Equity 10,604.7 Total Liabilities & Equity 20,119.2 + Question #2 Given the balance sheet and income statement in exhibit 1: Calculate Mosaic Working Capital Ratios a) Account receivable turnover b) Day Sales Outstanding - DSO (Days receivable outstanding) c) Account payable turnover d) Days Payable Outstanding e) Inventory turnover f) Days Inventory Outstanding DIO (Inventory turnover days) Question #3 a. Calculate Mosaic's Cash Conversion Cycle (CCC) b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? C. Which of the working capital metrics should Mosaic Treasurer improve? Include your recommendations. d. How does Mosaic's cash conversion cycle compare to the industry? What does "cash conversion cycle" mean to you? e. What are the general problems of using ratio analysis