Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio approach is proposed to estimate the cost of capital, to account for different industry types and risks of the multiple divisions. The following

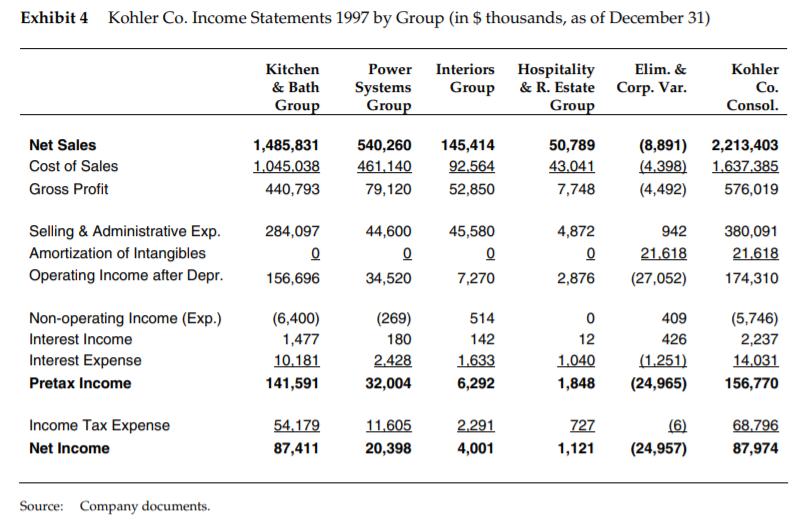

A portfolio approach is proposed to estimate the cost of capital, to account for different industry types and risks of the multiple divisions. The following table presents the portfolio construction and weights proposed to estimate the cost of capital.

Kohler Group/Division Portfolio Weights

Kitchen & Bath 80%

Power System 20%

- What might be the rationale for including only two divisions in the portfolio? Use the information presented in Exhibit 4 to justify the portfolio weights.

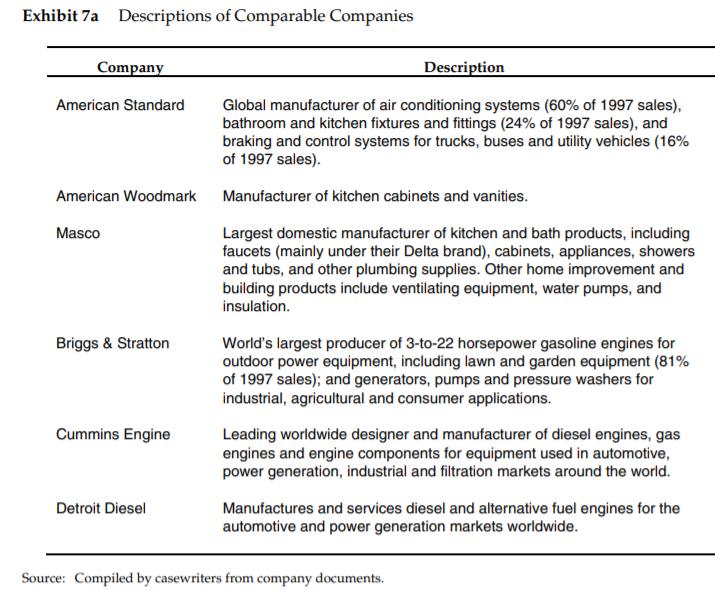

- Use the comparable data in Exhibit 7a, determine which comparable belong to the “Kitchen & Bath” group and which belong to the “Power System” group.

Exhibit 4 Kohler Co. Income Statements 1997 by Group (in $ thousands, as of December 31) Net Sales Cost of Sales Gross Profit Selling & Administrative Exp. Amortization of Intangibles Operating Income after Depr. Non-operating Income (Exp.) Interest Income Interest Expense Pretax Income Income Tax Expense Net Income Source: Company documents. Kitchen & Bath Group 1,485,831 1,045,038 440,793 284,097 0 156,696 (6,400) 1,477 10,181 141,591 54,179 87,411 Power Interiors Group Systems Group 540,260 145,414 461,140 92.564 79,120 52,850 44,600 45,580 0 0 34,520 7,270 (269) 180 2.428 32,004 11,605 20,398 514 142 1.633 6,292 2,291 4,001 Hospitality & R. Estate Group 50,789 43,041 7,748 4,872 0 2,876 0 12 Elim. & Corp. Var. 727 1,121 (8,891) (4,398) (4,492) 942 21,618 (27,052) 409 426 1,040 (1.251) 1,848 (24,965) (6) (24,957) Kohler Co. Consol. 2,213,403 1.637,385 576,019 380,091 21,618 174,310 (5,746) 2,237 14,031 156,770 68.796 87,974

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

What might be the rationale for including only two divisions in the portfolio Use the information presented in Exhibit 4 to justify the portfolio weig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started