Answered step by step

Verified Expert Solution

Question

1 Approved Answer

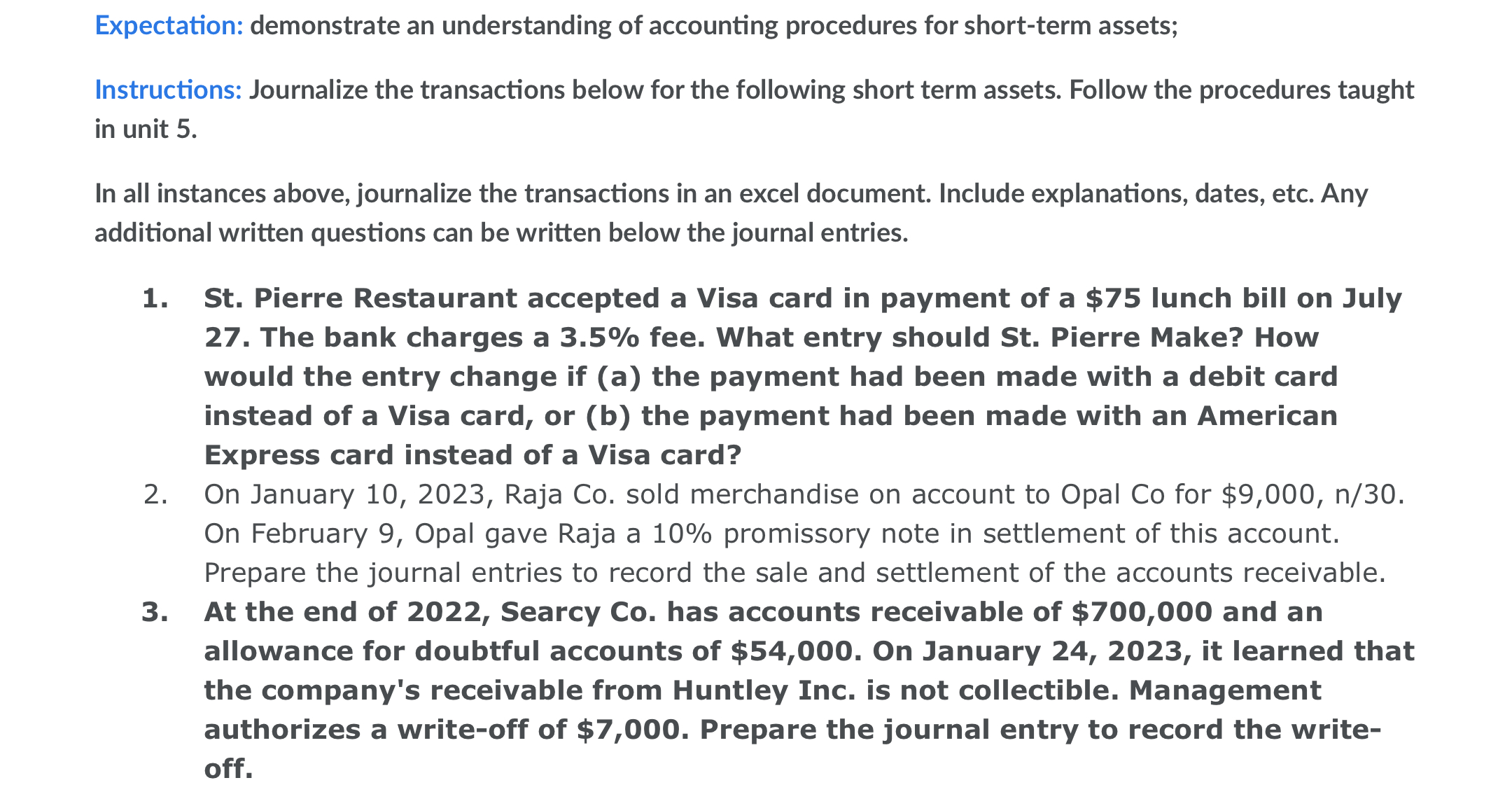

Expectation: demonstrate an understanding of accounting procedures for short-term assets; Instructions: Journalize the transactions below for the following short term assets. Follow the procedures

Expectation: demonstrate an understanding of accounting procedures for short-term assets; Instructions: Journalize the transactions below for the following short term assets. Follow the procedures taught in unit 5. In all instances above, journalize the transactions in an excel document. Include explanations, dates, etc. Any additional written questions can be written below the journal entries. 1. 2. 3. St. Pierre Restaurant accepted a Visa card in payment of a $75 lunch bill on July 27. The bank charges a 3.5% fee. What entry should St. Pierre Make? How would the entry change if (a) the payment had been made with a debit card instead of a Visa card, or (b) the payment had been made with an American Express card instead of a Visa card? On January 10, 2023, Raja Co. sold merchandise on account to Opal Co for $9,000, n/30. On February 9, Opal gave Raja a 10% promissory note in settlement of this account. Prepare the journal entries to record the sale and settlement of the accounts receivable. At the end of 2022, Searcy Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24, 2023, it learned that the company's receivable from Huntley Inc. is not collectible. Management authorizes a write-off of $7,000. Prepare the journal entry to record the write- off.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To properly journalize the transactions described I will provide the entries in a textual format You ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started