Question

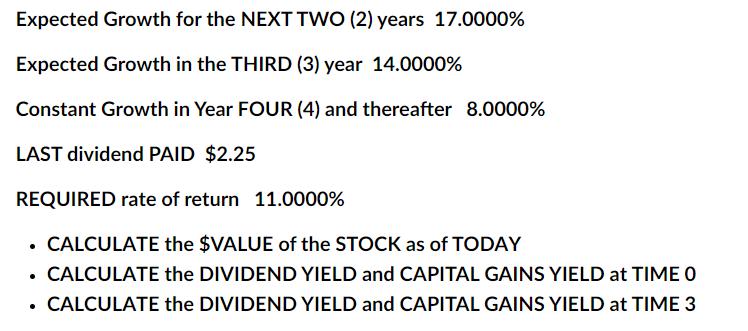

Expected Growth for the NEXT TWO (2) years 17.0000% Expected Growth in the THIRD (3) year 14.0000% Constant Growth in Year FOUR (4) and

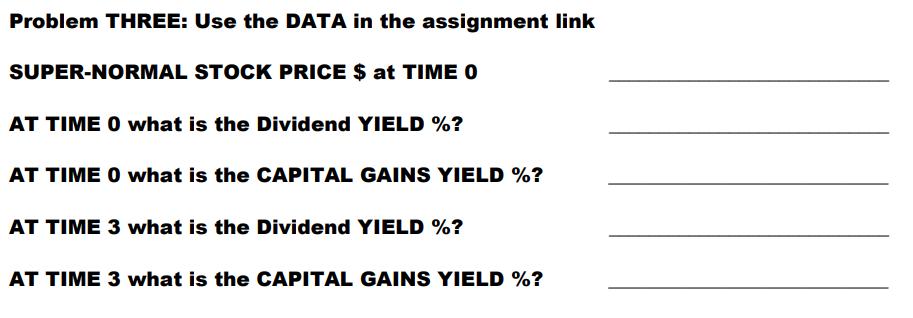

Expected Growth for the NEXT TWO (2) years 17.0000% Expected Growth in the THIRD (3) year 14.0000% Constant Growth in Year FOUR (4) and thereafter 8.0000% LAST dividend PAID $2.25 REQUIRED rate of return 11.0000% . CALCULATE the $VALUE of the STOCK as of TODAY CALCULATE the DIVIDEND YIELD and CAPITAL GAINS YIELD at TIME 0 CALCULATE the DIVIDEND YIELD and CAPITAL GAINS YIELD at TIME 3 . Problem THREE: Use the DATA in the assignment link SUPER-NORMAL STOCK PRICE $ at TIME 0 AT TIME 0 what is the Dividend YIELD %? AT TIME 0 what is the CAPITAL GAINS YIELD %? AT TIME 3 what is the Dividend YIELD %? AT TIME 3 what is the CAPITAL GAINS YIELD %?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the stock as of today we can use the dividend discount model DDM The formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App