Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXPLAIN THREE MAIN REASONS WHY JOYSON COMPANY LIMITED ACQUIRED HAUDE PLASTICS CORP. Justify your answers. In 2004 Jeff Wang started Joyson Company Ltd., in the

EXPLAIN THREE MAIN REASONS WHY JOYSON COMPANY LIMITED ACQUIRED HAUDE PLASTICS CORP. Justify your answers.

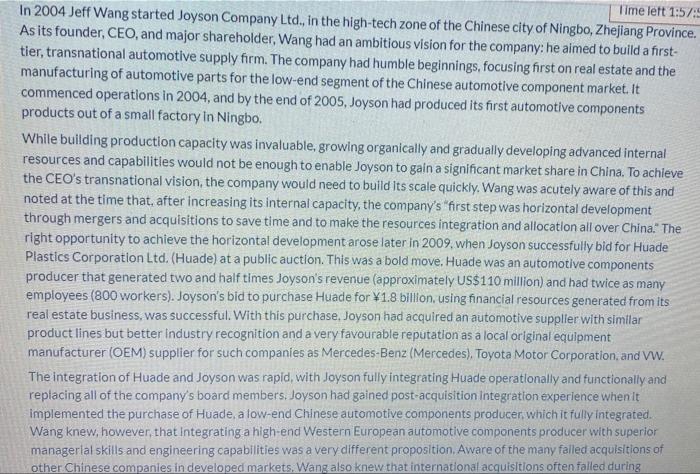

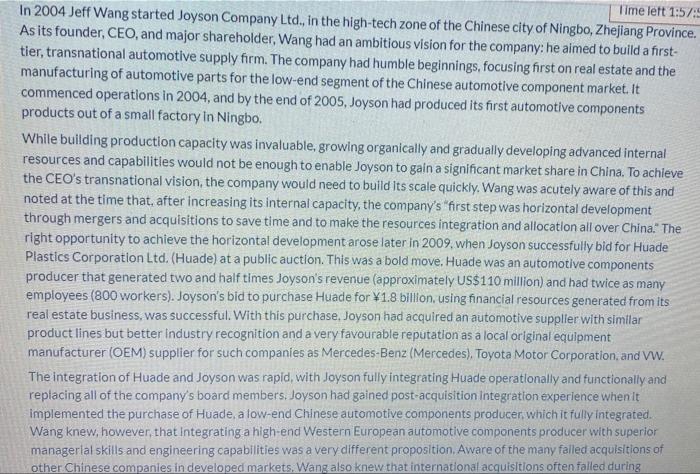

In 2004 Jeff Wang started Joyson Company Ltd., in the high-tech zone of the Chinese city of Ningbo, Zhejiang Province As its founder, CEO, and major shareholder, Wang had an ambitious vision for the company: he aimed to build a firsttier, transnational automotive supply firm. The company had humble beginnings, focusing first on real estate and the manufacturing of automotive parts for the low-end segment of the Chinese automotive component market. It commenced operations in 2004, and by the end of 2005, Joyson had produced its first automotive components products out of a small factory in Ningbo. While building production capacity was invaluable, growing organically and gradually developing advanced internal resources and capabilities would not be enough to enable Joyson to gain a significant market share in China. To achleve the CEO's transnational vision, the company would need to build its scale quickly. Wang was acutely aware of this and noted at the time that, after increasing its internal capacity, the company's first step was horizontal development through mergers and acquisitions to save time and to make the resources integration and allocation all over China." The right opportunity to achieve the horizontal development arose later in 2009 , when Joyson successfully bid for Huade Plastics Corporation Ltd. (Huade) at a public auction. This was a bold move. Huade was an automotive components producer that generated two and half times Joyson's revenue (approximately US\$110 million) and had twice as many employees (800 workers). Joyson's bid to purchase Huade for 1.8 billion. using financial resources generated from its real estate business, was successful. With this purchase, Joyson had acquired an automotive supplier with similar product lines but better industry recognition and a very favourable reputation as a local original equipment manufacturer (OEM) supplier for such companies as Mercedes-Benz (Mercedes), Toyota Motor Corporation, and WW. The integration of Huade and Joyson was rapid, with Joyson fully integrating Huade operationally and functionally and replacing all of the company's board members. Joyson had gained post-acquisition integration experience when it implemented the purchase of Huade, a low-end Chinese automotive components producer which it fully integrated. Wang knew, however, that integrating a high-end Western European automotive components producer with superior managerial skills and engineering capabilities was a very different proposition. Aware of the many falled acquisitions of other Chinese companies in developed markets. Wang also knew that international acquisitions often falled during integration due to cultural clashes and a lack of managerial skills and capabilities needed to integrate foreign firms. Wang and his team had repeatedly asked themselves how a low-capability company like Joyson could effectively manage and successfully integrate a firm from Germany with superior managerial and engineering skills and capabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started