(extra information added)

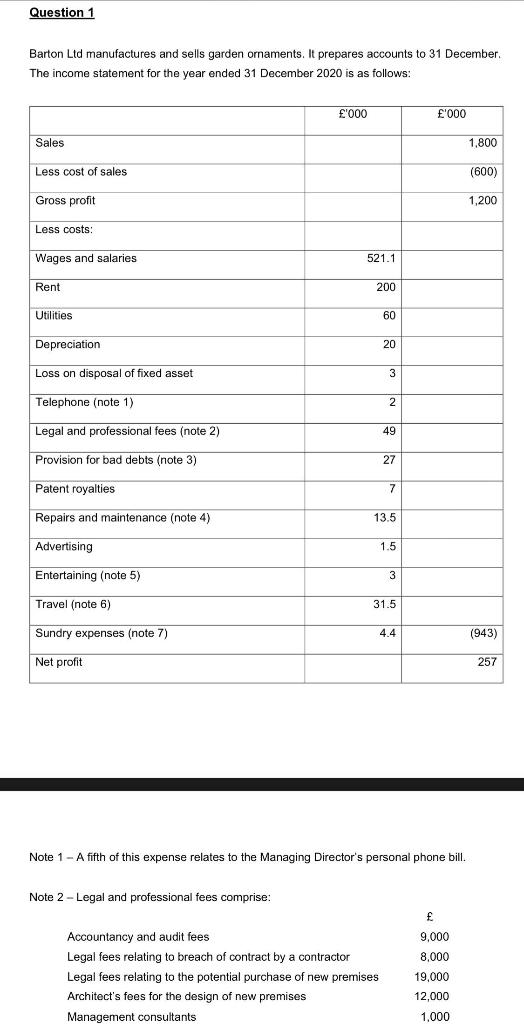

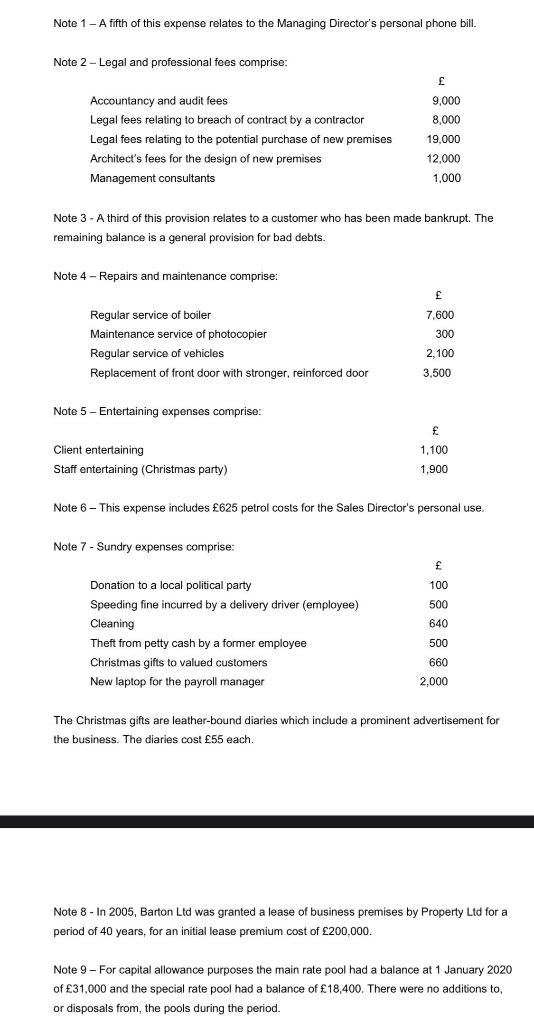

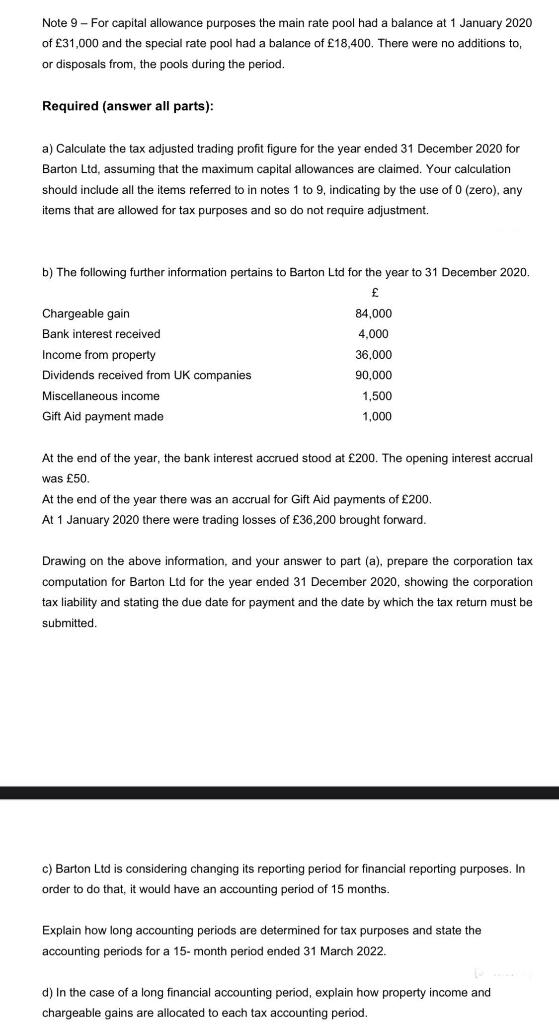

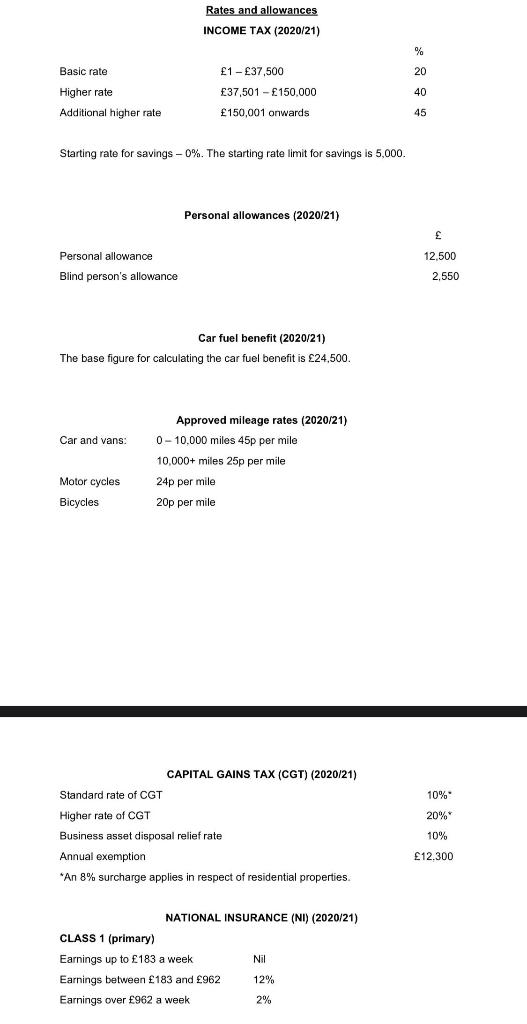

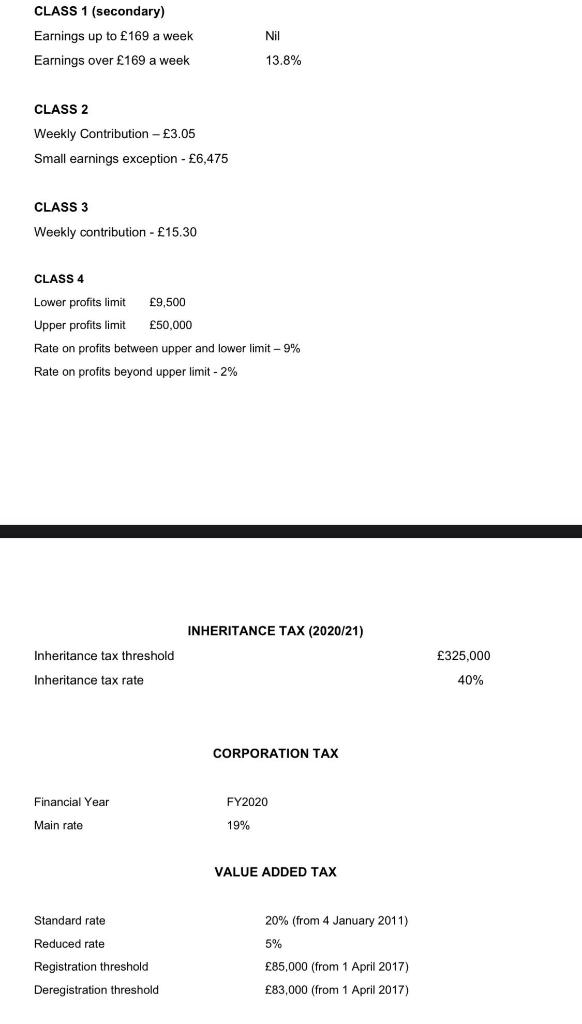

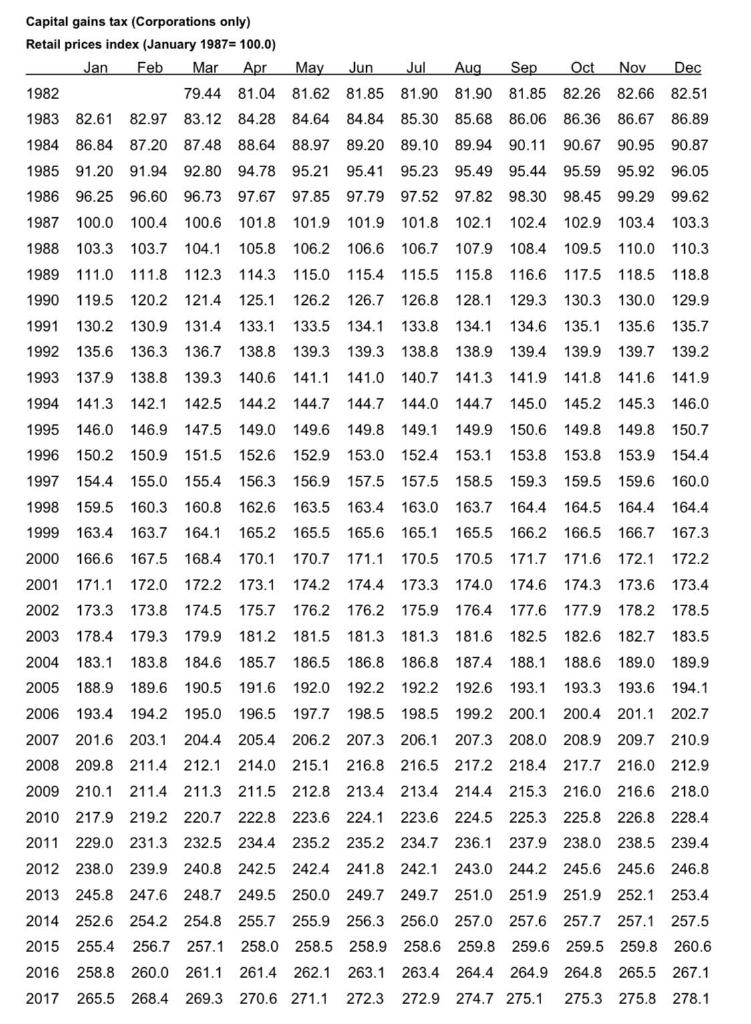

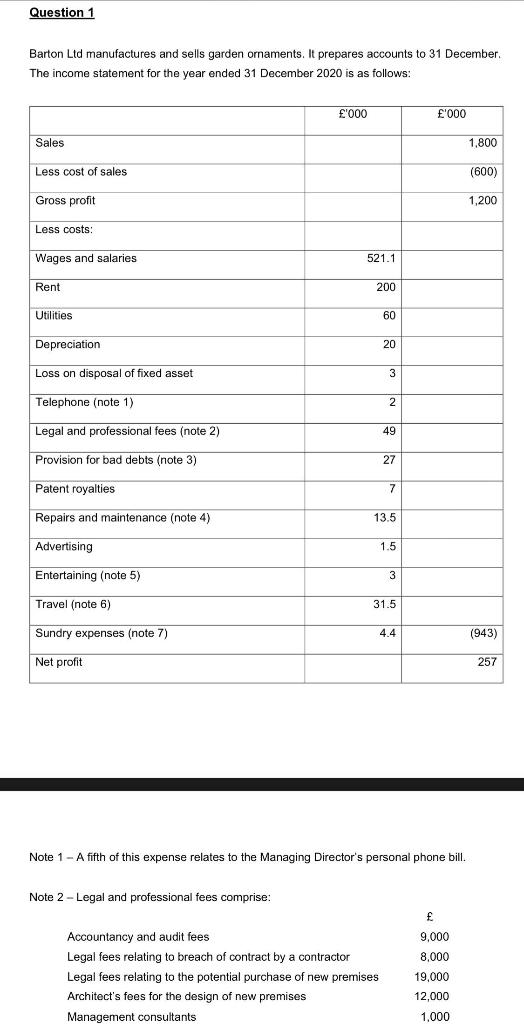

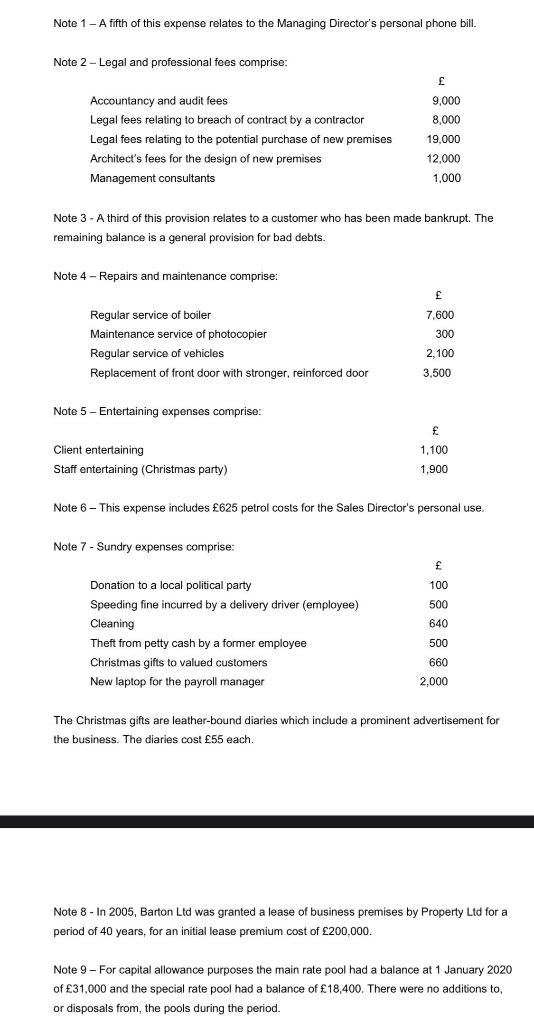

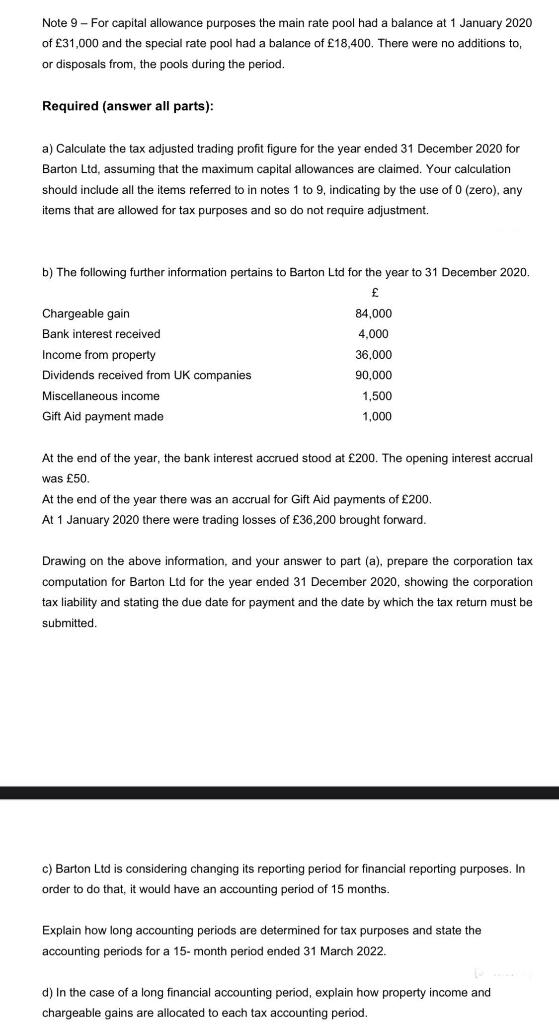

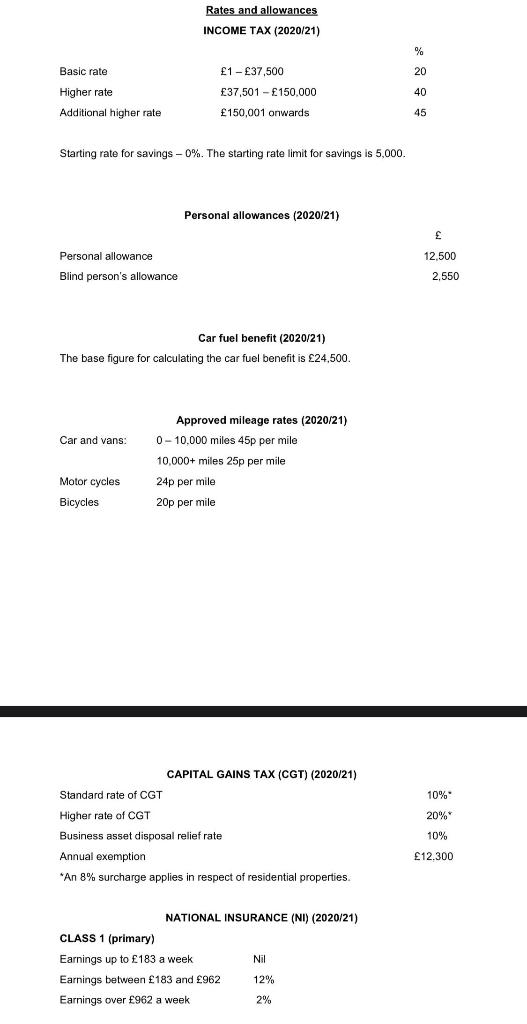

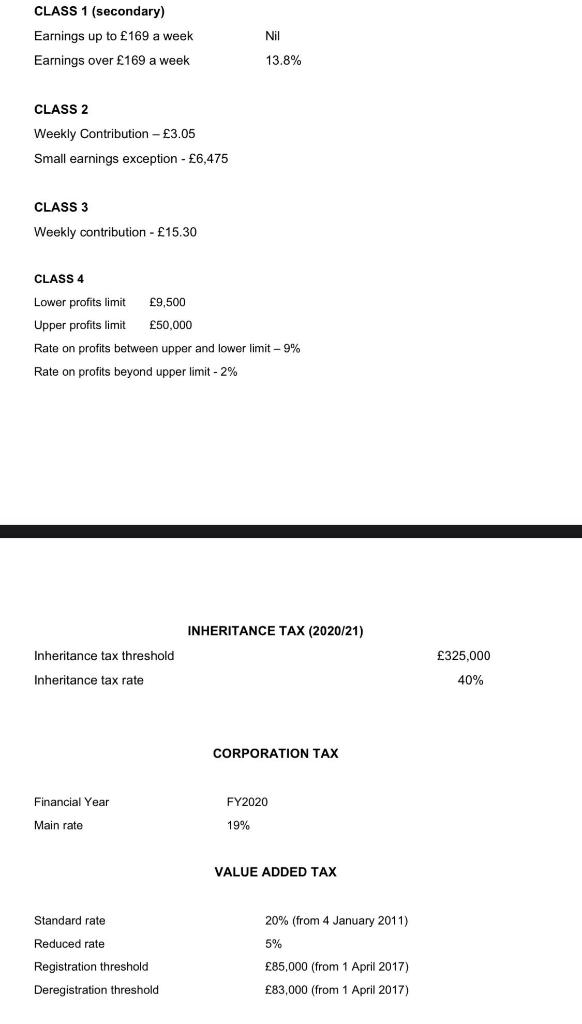

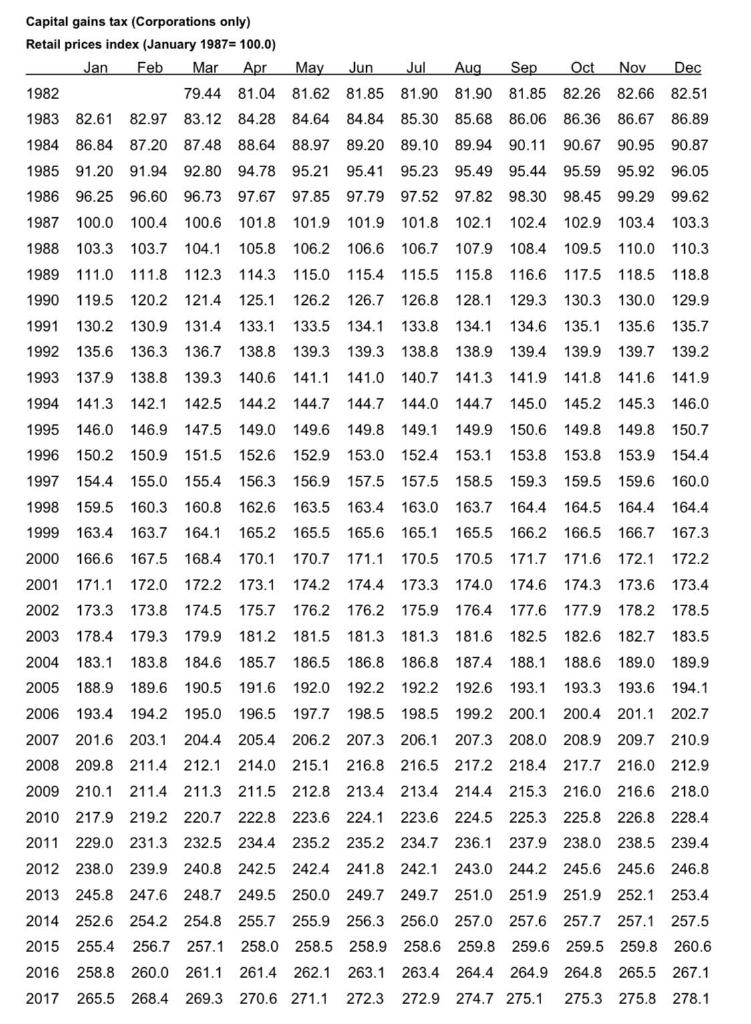

Question 1 Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December The income statement for the year ended 31 December 2020 is as follows: f'000 '000 Sales 1,800 Less cost of sales (600) Gross profit 1,200 Less costs: Wages and salaries 521.1 Rent 200 Utilities 60 Depreciation 20 Loss on disposal of fixed asset 3 Telephone (note 1) 2 Legal and professional fees (note 2) 49 Provision for bad debts (note 3) 27 Patent royalties 7 Repairs and maintenance (note 4) 13.5 Advertising 1.5 Entertaining (note 5) 3 Travel (note 6) 31.5 Sundry expenses (note 7) 4.4 (943) Net profit 257 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: 9,000 Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 8,000 19,000 12,000 1,000 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: 9,000 8,000 Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 19.000 12.000 1,000 Note 3 - A third of this provision relates to a customer who has been made bankrupt. The remaining balance is a general provision for bad debts. Note 4 - Repairs and maintenance comprise: 4 - 7.600 300 Regular service of boiler Maintenance service of photocopier Regular service of vehicles Replacement of front door with stronger, reinforced door 2,100 3,500 Note 5 - Entertaining expenses comprise: f Client entertaining Staff entertaining (Christmas party) 1,100 1,900 Note 6 - This expense includes 625 petrol costs for the Sales Director's personal use. Note 7 - Sundry expenses comprise: f 100 Donation to a local political party Speeding fine incurred by a delivery driver (employee) Cleaning Theft from petty cash by a former employee Christmas gifts to valued customers New laptop for the payroll manager 500 640 500 660 2.000 The Christmas gifts are leather-bound diaries which include a prominent advertisement for the business. The diaries cost 55 each. Note 8 - In 2005, Barton Ltd was granted a lease of business premises by Property Ltd for a period of 40 years, for an initial lease premium cost of 200,000. Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to, or disposals from the pools during the period. Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to, or disposals from the pools during the period. Required (answer all parts): a) Calculate the tax adjusted trading profit figure for the year ended 31 December 2020 for Barton Ltd, assuming that the maximum capital allowances are claimed. Your calculation should include all the items referred to in notes 1 to indicating by the use of 0 (zero), any items that are allowed for tax purposes and so do not require adjustment. b) The following further information pertains to Barton Ltd for the year to 31 December 2020. f Chargeable gain 84.000 Bank interest received 4,000 Income from property 36,000 Dividends received from UK companies 90,000 Miscellaneous income 1,500 Gift Aid payment made 1,000 At the end of the year, the bank interest accrued stood at 200. The opening interest accrual was 50. At the end of the year there was an accrual for Gift Aid payments of 200. At 1 January 2020 there were trading losses of 36,200 brought forward. Drawing on the above information, and your answer to part (a), prepare the corporation tax computation for Barton Ltd for the year ended 31 December 2020, showing the corporation tax liability and stating the due date for payment and the date by which the tax return must be submitted c) Barton Ltd is considering changing its reporting period for financial reporting purposes. In order to do that, it would have an accounting period of 15 months. Explain how long accounting periods are determined for tax purposes and state the accounting periods for a 15-month period ended 31 March 2022. d) In the case of a long financial accounting period, explain how property income and chargeable gains are allocated to each tax accounting period. Rates and allowances INCOME TAX (2020/21) % Basic rate 20 1 - 37,500 37,501 - 150,000 150,001 onwards Higher rate Additional higher rate 40 45 Starting rate for savings - 0%. The starting rate limit for savings is 5,000. Personal allowances (2020/21) () 12,500 Personal allowance Blind person's allowance 2,550 Car fuel benefit (2020/21) The base figure for calculating the car fuel benefit is 24,500 Car and vans: Approved mileage rates (2020/21) 0 - 10.000 miles 45p per mile 10,000+ miles 25p per mile 24p per mile 20p per mile Motor cycles Bicycles CAPITAL GAINS TAX (CGT) (2020/21) Standard rate of CGT Higher rate of CGT Business asset disposal relief rate Annual exemption * *An 8% surcharge applies in respect of residential properties 10% 20% 10% 12.300 NATIONAL INSURANCE (NI) (2020/21) CLASS 1 (primary) Earnings up to 183 a week Nil Earnings between 183 and 962 12% Earnings over 962 a week 2% CLASS 1 (secondary) Earnings up to 169 a week Earnings over 169 a week Nil 13.8% CLASS 2 Weekly Contribution - 3.05 Small earnings exception - 6,475 CLASS 3 Weekly contribution - 15.30 CLASS 4 Lower profits limit 9,500 Upper profits limit 50,000 Rate on profits between upper and lower limit -9% Rate on profits beyond upper limit - 2% INHERITANCE TAX (2020/21) Inheritance tax threshold 325,000 Inheritance tax rate 40% CORPORATION TAX Financial Year FY2020 Main rate 19% VALUE ADDED TAX Standard rate 20% (from 4 January 2011) 5% Reduced rate Registration threshold Deregistration threshold 85,000 (from 1 April 2017) 83,000 (from 1 April 2017) 1988 Capital gains tax (Corporations only) Retail prices index (January 1987= 100.0) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1982 79.44 81.04 81.62 81.85 81.90 81.90 81.85 82.26 82.66 82.51 1983 82.61 82.97 83.12 84.28 84.64 84.84 85.30 85.68 86.06 86.36 86.67 86.89 1984 86.84 87.20 87.48 88.64 88.97 89.20 89.10 89.94 90.11 90.67 90.95 90.87 1985 91.20 91.94 92.80 94.78 95.21 95.41 95.23 95.49 95.44 95.59 95.92 96.05 1986 96.25 96.60 96.73 97.67 97.85 97.79 97.52 97.82 98.30 98.45 99.29 99.62 1987 100.0 100.4 100.6 101.8 101.9 101.9 101.8 102.1 102.4 102.9 103.4 103.3 103.3 103.7 104.1 105.8 106.2 106.6 106.7 107.9 108.4 109.5 110.0 110.3 1989 111.0 111.8 112.3 114.3 115.0 115.4 115.5 115.8 116.6 117.5 118.5 118.8 1990 119.5 120.2 121.4 125.1 126.2 126.7 126.8 128.1 129.3 130.3 130.0 129.9 1991 130.2 130.9 131.4 133.1 133.5 134.1 133.8 134.1 134.6 135.1 135.6 135.7 1992 135.6 136.3 136.7 138.8 139.3 139.3 138.8 138.9 139.4 139.9 139.7 139.2 1993 137.9 138.8 139.3 140.6 141.1 141.0 140.7 141.3 141.9 141.8 141.6 141.9 1994 141.3 142.1 142.5 144.2 144.7 144.7 144.0 144.7 145.0 145.2 145.3 146.0 1995 146.0 146.9 147.5 149.0 149.6 149.8 149.1 149.9 150.6 149.8 149.8 150.7 1996 150.2 150.9 151.5 152.6 152.9 153.0 152.4 153.1 153.8 153.8 153.9 154.4 1997 154.4 155.0 155.4 156.3 156.9 157.5 157.5 158.5 159.3 159.5 159.6 160.0 1998 159.5 160.3 160.8 162.6 163.5 163.4 163.0 163.7 164.4 164.5 164.4 164.4 163.4 163.7 164.1 165.2 165.5 165.6 165.1 165.5 166.2 166.5 166.7 167.3 2000 166.6 167.5 168.4 170.1 170.7 171.1 170.5 170.5 171.7 171.6 172.1 172.2 2001 171.1 172.0 172.2 173.1 174.2 174.4 173.3 174.0 174.6 174.3 173.6 173.4 2002 173.3 173.8 174.5 175.7 176.2 176.2 175.9 176.4 177.6 177.9 178.2 178.5 2003 178.4 179.3 179.9 181.2 181.5 181.3 181.6 182.5 182.6 182.7 183.5 2004 183.1 183.8 184.6 185.7 186.5 186.8 186.8 187.4 188.1 188.6 189.0 189.9 2005 188.9 189.6 190.5 191.6 192.0 1922 192.2 192.6 193.1 193.3 193.6 194.1 2006 193.4 194.2 195.0 196.5 197.7 198.5 198.5 199.2 200.1 200.4 201.1 202.7 2007 201.6 203.1 204.4 205.4 206.2 207.3 206.1 207.3 208.0 208.9 209.7 210.9 2008 209.8 211.4 212.1 214.0 215.1 216.8 216.5 217.2 218.4 217.7 216.0 212.9 2009 210.1 211.4 211.3 211.5 212.8 213.4 213.4 214.4 215.3 216.0 216.6 218.0 2010 217.9 219.2 220.7 222.8 223.6 224.1 223.6 224.5 225.3 225.8 226.8 228.4 2011 229.0 231.3 232.5 234.4 235.2 235.2 234.7 236.1 237.9 238.0 238.5 239.4 2012 238.0 239.9 240.8 242.5 242.4 241.8 242.1 243.0 244.2 245.6 245.6 246.8 2013 245.8 247.6 248.7 249.5 250.0 249.7 249.7 251.0 251.9 251.9 252.1 253.4 2014 252.6 254.2 254.8 255.7 255.9 256.3 256.0 257.0 257.6 257.7 257.1 257.5 2015 255.4 256.7 257.1 258.0 258.5 258.9 258.6 259.8 259.6 259.5 259.8 260.6 2016 258.8 260.0 261.1 261.4 262.1 263.1 263.4 264.4 264.9 264.8 265.5 267.1 2017 265.5 268.4 269.3 270.6 271.1 272.3 272.9 274.7 275.1 275.3 275.8 278.1 1999 181.3 Question 1 Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December The income statement for the year ended 31 December 2020 is as follows: f'000 '000 Sales 1,800 Less cost of sales (600) Gross profit 1,200 Less costs: Wages and salaries 521.1 Rent 200 Utilities 60 Depreciation 20 Loss on disposal of fixed asset 3 Telephone (note 1) 2 Legal and professional fees (note 2) 49 Provision for bad debts (note 3) 27 Patent royalties 7 Repairs and maintenance (note 4) 13.5 Advertising 1.5 Entertaining (note 5) 3 Travel (note 6) 31.5 Sundry expenses (note 7) 4.4 (943) Net profit 257 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: 9,000 Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 8,000 19,000 12,000 1,000 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: 9,000 8,000 Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 19.000 12.000 1,000 Note 3 - A third of this provision relates to a customer who has been made bankrupt. The remaining balance is a general provision for bad debts. Note 4 - Repairs and maintenance comprise: 4 - 7.600 300 Regular service of boiler Maintenance service of photocopier Regular service of vehicles Replacement of front door with stronger, reinforced door 2,100 3,500 Note 5 - Entertaining expenses comprise: f Client entertaining Staff entertaining (Christmas party) 1,100 1,900 Note 6 - This expense includes 625 petrol costs for the Sales Director's personal use. Note 7 - Sundry expenses comprise: f 100 Donation to a local political party Speeding fine incurred by a delivery driver (employee) Cleaning Theft from petty cash by a former employee Christmas gifts to valued customers New laptop for the payroll manager 500 640 500 660 2.000 The Christmas gifts are leather-bound diaries which include a prominent advertisement for the business. The diaries cost 55 each. Note 8 - In 2005, Barton Ltd was granted a lease of business premises by Property Ltd for a period of 40 years, for an initial lease premium cost of 200,000. Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to, or disposals from the pools during the period. Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to, or disposals from the pools during the period. Required (answer all parts): a) Calculate the tax adjusted trading profit figure for the year ended 31 December 2020 for Barton Ltd, assuming that the maximum capital allowances are claimed. Your calculation should include all the items referred to in notes 1 to indicating by the use of 0 (zero), any items that are allowed for tax purposes and so do not require adjustment. b) The following further information pertains to Barton Ltd for the year to 31 December 2020. f Chargeable gain 84.000 Bank interest received 4,000 Income from property 36,000 Dividends received from UK companies 90,000 Miscellaneous income 1,500 Gift Aid payment made 1,000 At the end of the year, the bank interest accrued stood at 200. The opening interest accrual was 50. At the end of the year there was an accrual for Gift Aid payments of 200. At 1 January 2020 there were trading losses of 36,200 brought forward. Drawing on the above information, and your answer to part (a), prepare the corporation tax computation for Barton Ltd for the year ended 31 December 2020, showing the corporation tax liability and stating the due date for payment and the date by which the tax return must be submitted c) Barton Ltd is considering changing its reporting period for financial reporting purposes. In order to do that, it would have an accounting period of 15 months. Explain how long accounting periods are determined for tax purposes and state the accounting periods for a 15-month period ended 31 March 2022. d) In the case of a long financial accounting period, explain how property income and chargeable gains are allocated to each tax accounting period. Rates and allowances INCOME TAX (2020/21) % Basic rate 20 1 - 37,500 37,501 - 150,000 150,001 onwards Higher rate Additional higher rate 40 45 Starting rate for savings - 0%. The starting rate limit for savings is 5,000. Personal allowances (2020/21) () 12,500 Personal allowance Blind person's allowance 2,550 Car fuel benefit (2020/21) The base figure for calculating the car fuel benefit is 24,500 Car and vans: Approved mileage rates (2020/21) 0 - 10.000 miles 45p per mile 10,000+ miles 25p per mile 24p per mile 20p per mile Motor cycles Bicycles CAPITAL GAINS TAX (CGT) (2020/21) Standard rate of CGT Higher rate of CGT Business asset disposal relief rate Annual exemption * *An 8% surcharge applies in respect of residential properties 10% 20% 10% 12.300 NATIONAL INSURANCE (NI) (2020/21) CLASS 1 (primary) Earnings up to 183 a week Nil Earnings between 183 and 962 12% Earnings over 962 a week 2% CLASS 1 (secondary) Earnings up to 169 a week Earnings over 169 a week Nil 13.8% CLASS 2 Weekly Contribution - 3.05 Small earnings exception - 6,475 CLASS 3 Weekly contribution - 15.30 CLASS 4 Lower profits limit 9,500 Upper profits limit 50,000 Rate on profits between upper and lower limit -9% Rate on profits beyond upper limit - 2% INHERITANCE TAX (2020/21) Inheritance tax threshold 325,000 Inheritance tax rate 40% CORPORATION TAX Financial Year FY2020 Main rate 19% VALUE ADDED TAX Standard rate 20% (from 4 January 2011) 5% Reduced rate Registration threshold Deregistration threshold 85,000 (from 1 April 2017) 83,000 (from 1 April 2017) 1988 Capital gains tax (Corporations only) Retail prices index (January 1987= 100.0) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1982 79.44 81.04 81.62 81.85 81.90 81.90 81.85 82.26 82.66 82.51 1983 82.61 82.97 83.12 84.28 84.64 84.84 85.30 85.68 86.06 86.36 86.67 86.89 1984 86.84 87.20 87.48 88.64 88.97 89.20 89.10 89.94 90.11 90.67 90.95 90.87 1985 91.20 91.94 92.80 94.78 95.21 95.41 95.23 95.49 95.44 95.59 95.92 96.05 1986 96.25 96.60 96.73 97.67 97.85 97.79 97.52 97.82 98.30 98.45 99.29 99.62 1987 100.0 100.4 100.6 101.8 101.9 101.9 101.8 102.1 102.4 102.9 103.4 103.3 103.3 103.7 104.1 105.8 106.2 106.6 106.7 107.9 108.4 109.5 110.0 110.3 1989 111.0 111.8 112.3 114.3 115.0 115.4 115.5 115.8 116.6 117.5 118.5 118.8 1990 119.5 120.2 121.4 125.1 126.2 126.7 126.8 128.1 129.3 130.3 130.0 129.9 1991 130.2 130.9 131.4 133.1 133.5 134.1 133.8 134.1 134.6 135.1 135.6 135.7 1992 135.6 136.3 136.7 138.8 139.3 139.3 138.8 138.9 139.4 139.9 139.7 139.2 1993 137.9 138.8 139.3 140.6 141.1 141.0 140.7 141.3 141.9 141.8 141.6 141.9 1994 141.3 142.1 142.5 144.2 144.7 144.7 144.0 144.7 145.0 145.2 145.3 146.0 1995 146.0 146.9 147.5 149.0 149.6 149.8 149.1 149.9 150.6 149.8 149.8 150.7 1996 150.2 150.9 151.5 152.6 152.9 153.0 152.4 153.1 153.8 153.8 153.9 154.4 1997 154.4 155.0 155.4 156.3 156.9 157.5 157.5 158.5 159.3 159.5 159.6 160.0 1998 159.5 160.3 160.8 162.6 163.5 163.4 163.0 163.7 164.4 164.5 164.4 164.4 163.4 163.7 164.1 165.2 165.5 165.6 165.1 165.5 166.2 166.5 166.7 167.3 2000 166.6 167.5 168.4 170.1 170.7 171.1 170.5 170.5 171.7 171.6 172.1 172.2 2001 171.1 172.0 172.2 173.1 174.2 174.4 173.3 174.0 174.6 174.3 173.6 173.4 2002 173.3 173.8 174.5 175.7 176.2 176.2 175.9 176.4 177.6 177.9 178.2 178.5 2003 178.4 179.3 179.9 181.2 181.5 181.3 181.6 182.5 182.6 182.7 183.5 2004 183.1 183.8 184.6 185.7 186.5 186.8 186.8 187.4 188.1 188.6 189.0 189.9 2005 188.9 189.6 190.5 191.6 192.0 1922 192.2 192.6 193.1 193.3 193.6 194.1 2006 193.4 194.2 195.0 196.5 197.7 198.5 198.5 199.2 200.1 200.4 201.1 202.7 2007 201.6 203.1 204.4 205.4 206.2 207.3 206.1 207.3 208.0 208.9 209.7 210.9 2008 209.8 211.4 212.1 214.0 215.1 216.8 216.5 217.2 218.4 217.7 216.0 212.9 2009 210.1 211.4 211.3 211.5 212.8 213.4 213.4 214.4 215.3 216.0 216.6 218.0 2010 217.9 219.2 220.7 222.8 223.6 224.1 223.6 224.5 225.3 225.8 226.8 228.4 2011 229.0 231.3 232.5 234.4 235.2 235.2 234.7 236.1 237.9 238.0 238.5 239.4 2012 238.0 239.9 240.8 242.5 242.4 241.8 242.1 243.0 244.2 245.6 245.6 246.8 2013 245.8 247.6 248.7 249.5 250.0 249.7 249.7 251.0 251.9 251.9 252.1 253.4 2014 252.6 254.2 254.8 255.7 255.9 256.3 256.0 257.0 257.6 257.7 257.1 257.5 2015 255.4 256.7 257.1 258.0 258.5 258.9 258.6 259.8 259.6 259.5 259.8 260.6 2016 258.8 260.0 261.1 261.4 262.1 263.1 263.4 264.4 264.9 264.8 265.5 267.1 2017 265.5 268.4 269.3 270.6 271.1 272.3 272.9 274.7 275.1 275.3 275.8 278.1 1999 181.3