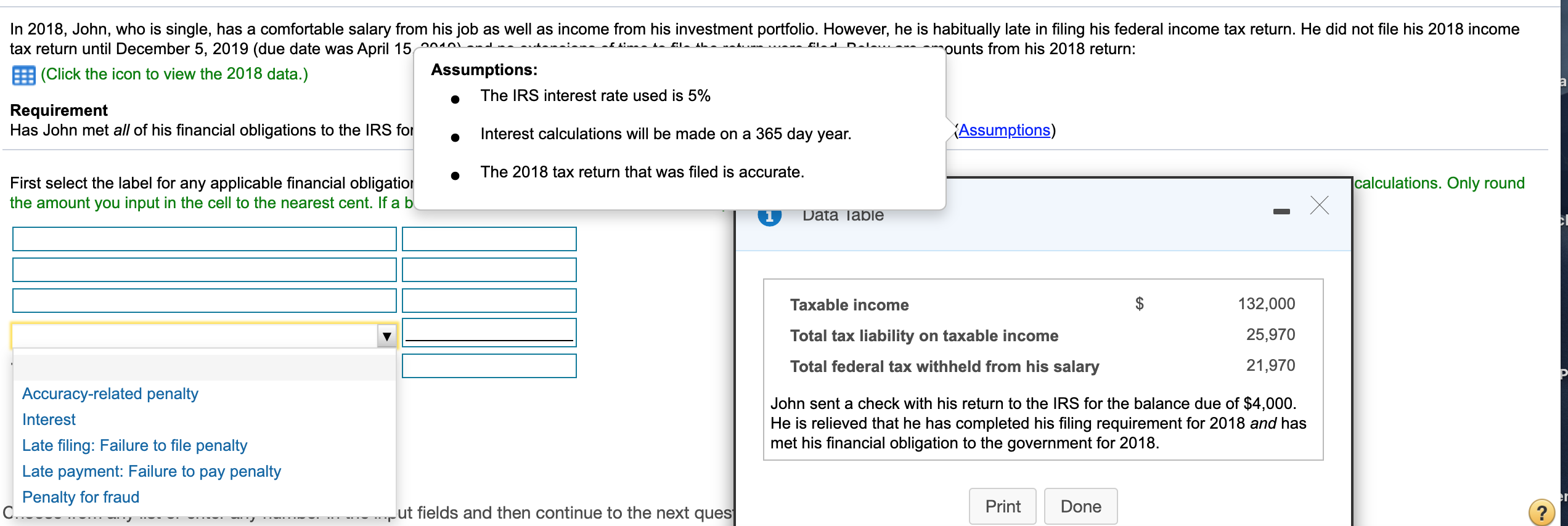

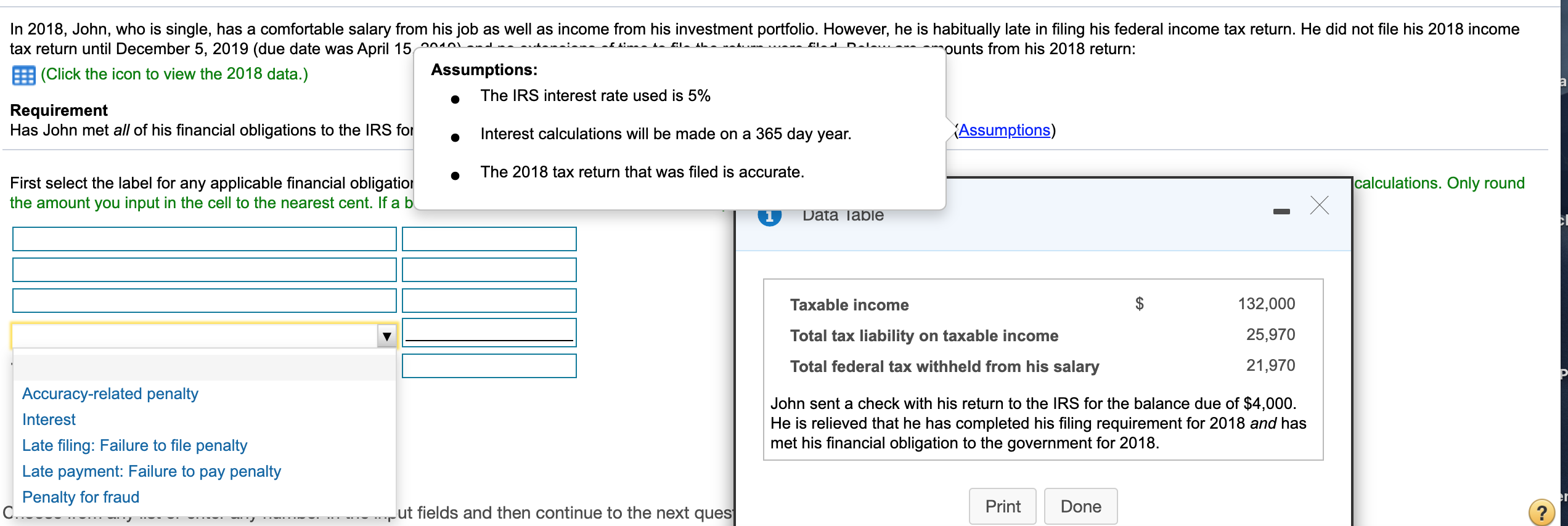

f 1.... CL. IL..1..- clad Delo... In 2018, John, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his 2018 income tax return until December 5, 2019 (due date was April 15 Poland ounts from his 2018 return: (Click the icon to view the 2018 data.) Assumptions: The IRS interest rate used is 5% Requirement Has John met all of his financial obligations to the IRS for Interest calculations will be made on a 365 day year. (Assumptions) 2 . The 2018 tax return that was filed is accurate. calculations. Only round First select the label for any applicable financial obligation the amount you input in the cell to the nearest cent. If a b X Data Table Taxable income 132,000 25,970 Total tax liability on taxable income Total federal tax withheld from his salary 21,970 D Accuracy-related penalty Interest Late filing: Failure to file penalty Late payment: Failure to pay penalty Penalty for fraud John sent a check with his return to the IRS for the balance due of $4,000. He is relieved that he has completed his filing requirement for 2018 and has met his financial obligation to the government for 2018. ut fields and then continue to the next ques Print t Done ? --- f 1.... CL. IL..1..- clad Delo... In 2018, John, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his 2018 income tax return until December 5, 2019 (due date was April 15 Poland ounts from his 2018 return: (Click the icon to view the 2018 data.) Assumptions: The IRS interest rate used is 5% Requirement Has John met all of his financial obligations to the IRS for Interest calculations will be made on a 365 day year. (Assumptions) 2 . The 2018 tax return that was filed is accurate. calculations. Only round First select the label for any applicable financial obligation the amount you input in the cell to the nearest cent. If a b X Data Table Taxable income 132,000 25,970 Total tax liability on taxable income Total federal tax withheld from his salary 21,970 D Accuracy-related penalty Interest Late filing: Failure to file penalty Late payment: Failure to pay penalty Penalty for fraud John sent a check with his return to the IRS for the balance due of $4,000. He is relieved that he has completed his filing requirement for 2018 and has met his financial obligation to the government for 2018. ut fields and then continue to the next ques Print t Done