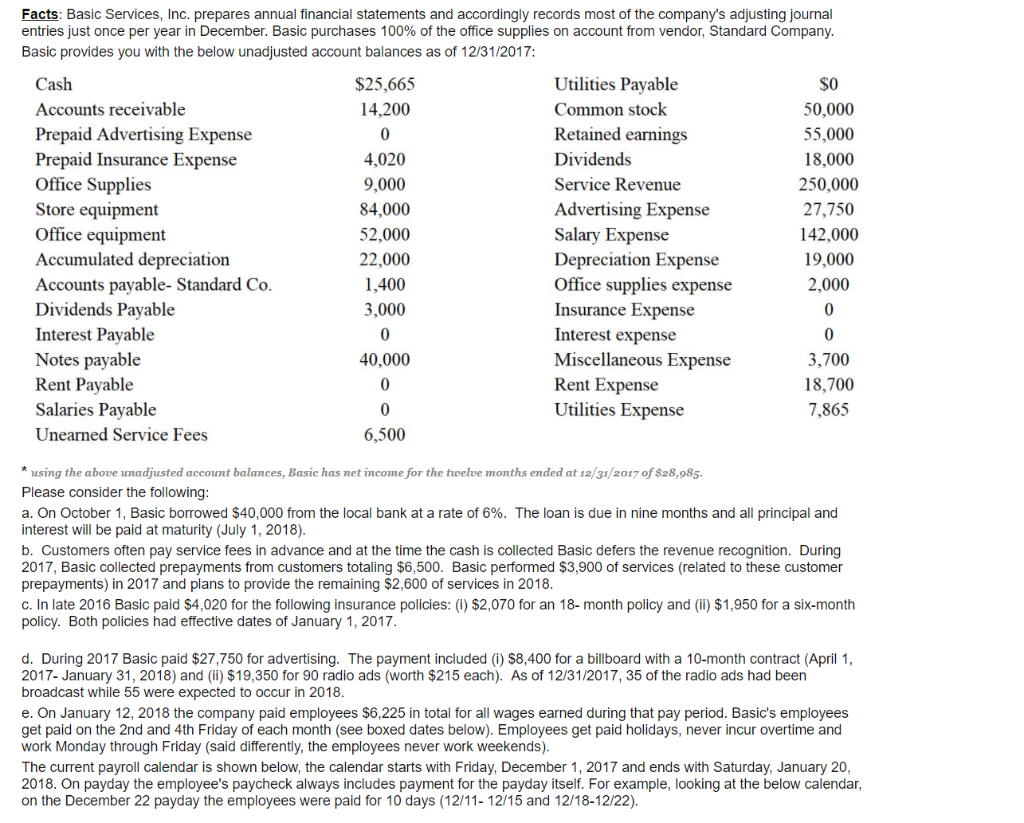

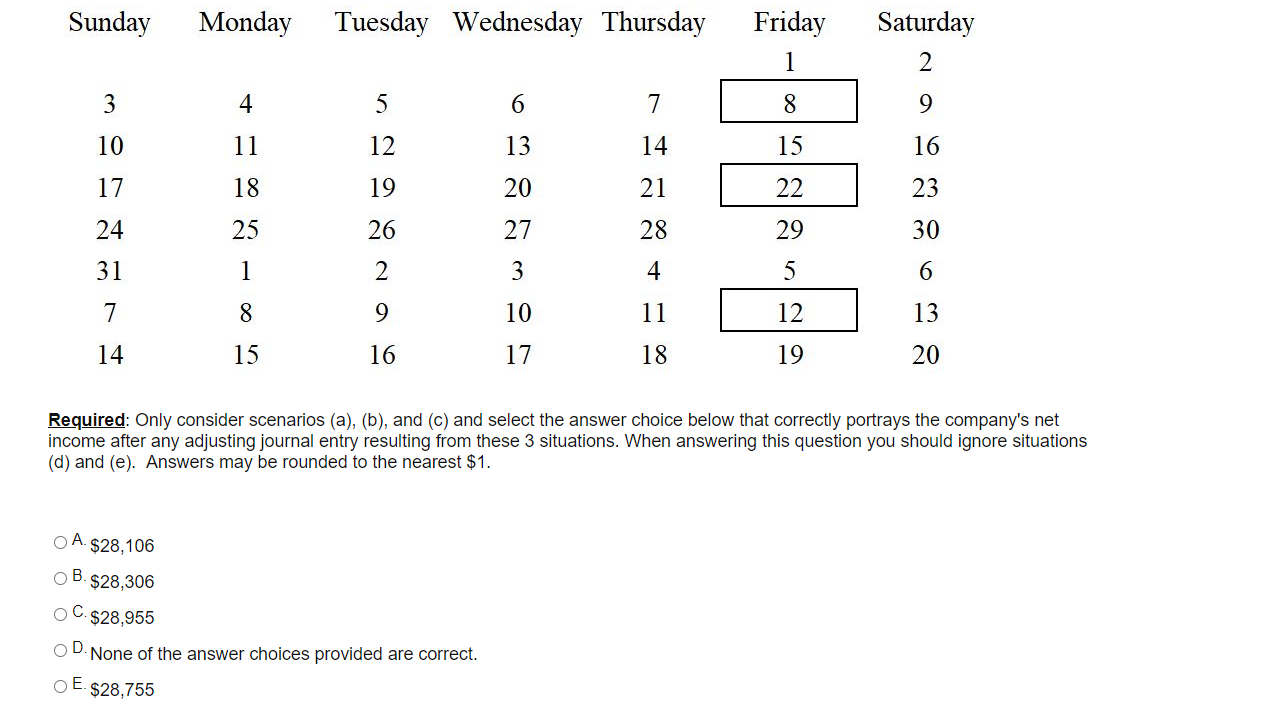

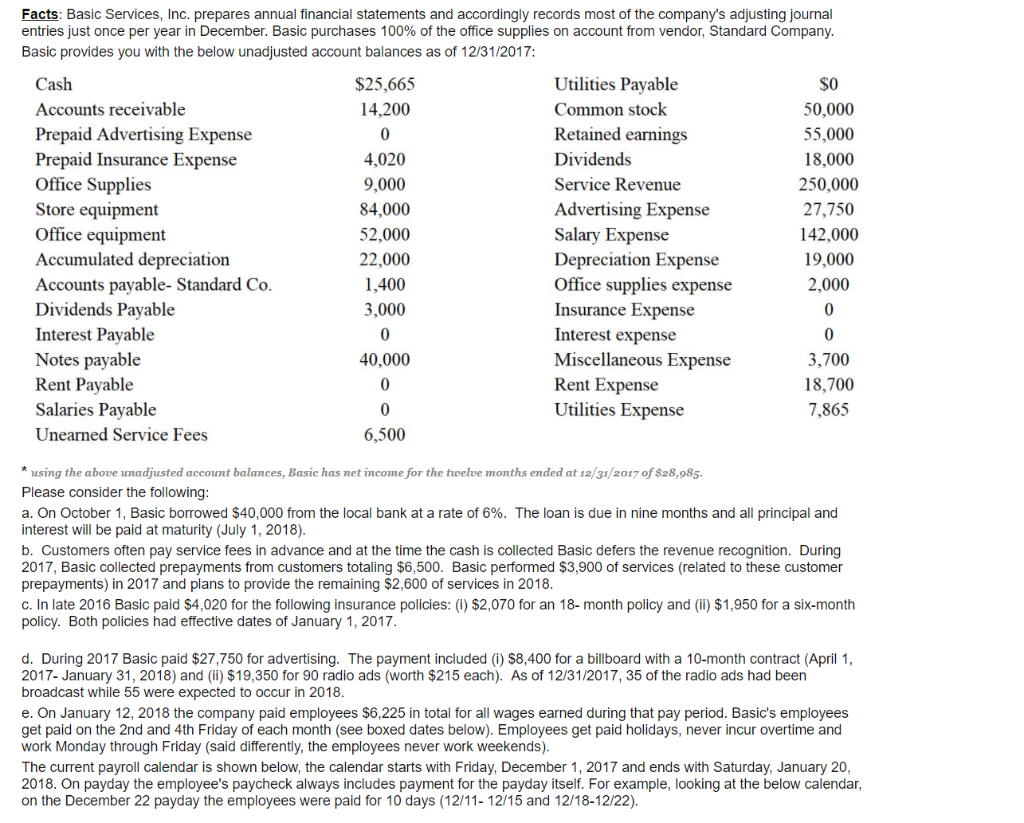

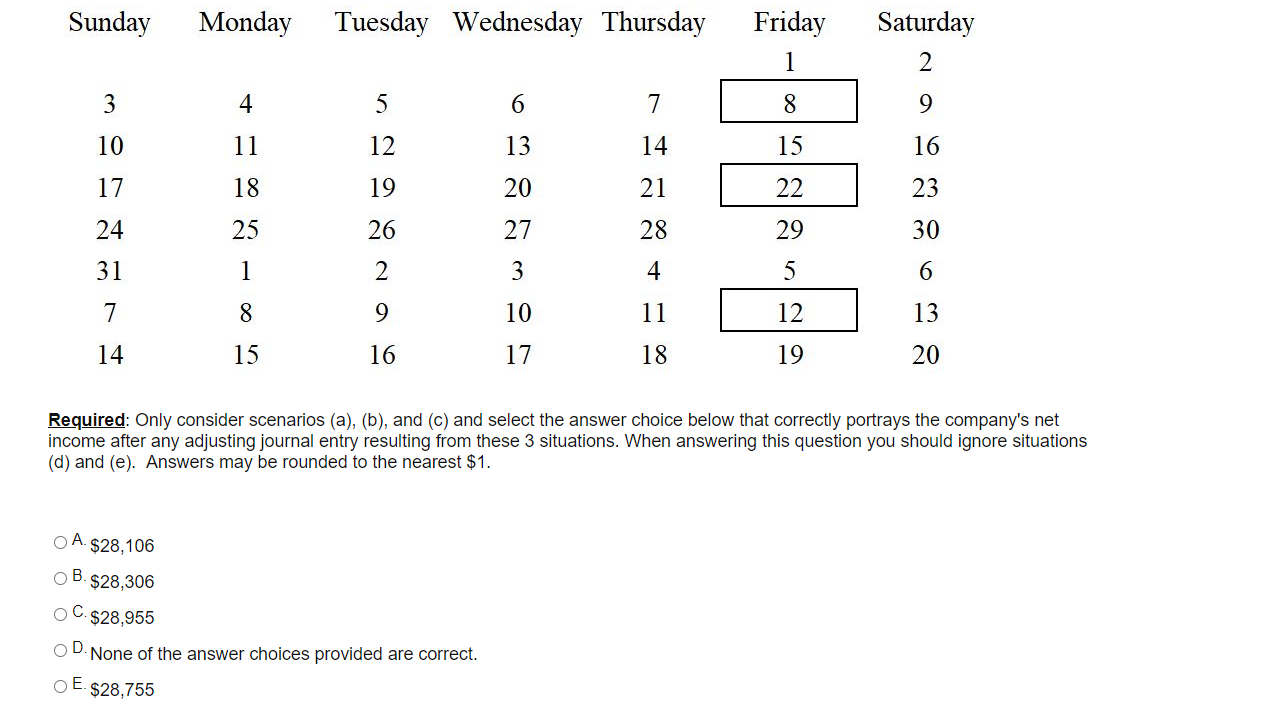

Facts: Basic Services, Inc. prepares annual financial statements and accordingly records most of the company's adjusting journal entries just once per year in December. Basic purchases 100% of the office supplies on account from vendor, Standard Company. Basic provides you with the below unadjusted account balances as of 12/31/2017: Cash $25,665 Utilities Payable $0 Accounts receivable 14,200 Common stock 50,000 Prepaid Advertising Expense 0 Retained earnings 55,000 Prepaid Insurance Expense 4,020 Dividends 18,000 Office Supplies 9,000 Service Revenue 250,000 Store equipment 84,000 Advertising Expense 27,750 Office equipment 52,000 Salary Expense 142,000 Accumulated depreciation 22,000 Depreciation Expense 19,000 Accounts payable- Standard Co. 1,400 Office supplies expense 2,000 Dividends Payable 3,000 Insurance Expense 0 Interest Payable 0 Interest expense 0 Notes payable 40,000 Miscellaneous Expense Rent Payable 0 Rent Expense 18,700 Salaries Payable 0 Utilities Expense 7,865 Unearned Service Fees 6,500 3,700 * using the above unadjusted account balances, Basic has net income for the twelve months ended at 12/31/2017 of $28,985. Please consider the following: a. On October 1, Basic borrowed $40,000 from the local bank at a rate of 6%. The loan is due in nine months and all principal and interest will be paid at maturity (July 1, 2018). b. Customers often pay service fees in advance and at the time the cash is collected Basic defers the revenue recognition. During 2017, Basic collected prepayments from customers totaling $6,500. Basic performed $3,900 of services (related to these customer prepayments) in 2017 and plans to provide the remaining $2,600 of services in 2018. c. In late 2016 Basic paid $4,020 for the following insurance policies: (1) $2,070 for an 18-month policy and (ii) $1,950 for a six-month policy. Both policies had effective dates of January 1, 2017. d. During 2017 Basic paid $27,750 for advertising. The payment included (0) $8,400 for a billboard with a 10-month contract (April 1, 2017- January 31, 2018) and (ii) $19,350 for 90 radio ads (worth $215 each). As of 12/31/2017, 35 of the radio ads had been broadcast while 55 were expected to occur in 2018. e. On January 12, 2018 the company paid employees $6,225 in total for all wages earned during that pay period. Basic's employees get paid on the 2nd and 4th Friday of each month (see boxed dates below). Employees get paid holidays, never incur overtime and work Monday through Friday (said differently, the employees never work weekends). The current payroll calendar is shown below, the calendar starts with Friday, December 1, 2017 and ends with Saturday, January 20, 2018. On payday the employee's paycheck always includes payment for the payday itself. For example, looking at the below calendar, on the December 22 payday the employees were paid for 10 days (12/11- 12/15 and 12/18-12/22). Sunday Monday Tuesday Wednesday Thursday Friday 1 Saturday 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Required: Only consider scenarios (a), (b), and (c) and select the answer choice below that correctly portrays the company's net income after any adjusting journal entry resulting from these 3 situations. When answering this question you should ignore situations (d) and (e). Answers may be rounded to the nea $1. A. $28,106 OB. $28,306 O C.$28,955 OD. None of the answer choices provided are correct. E. $28,755