Answered step by step

Verified Expert Solution

Question

1 Approved Answer

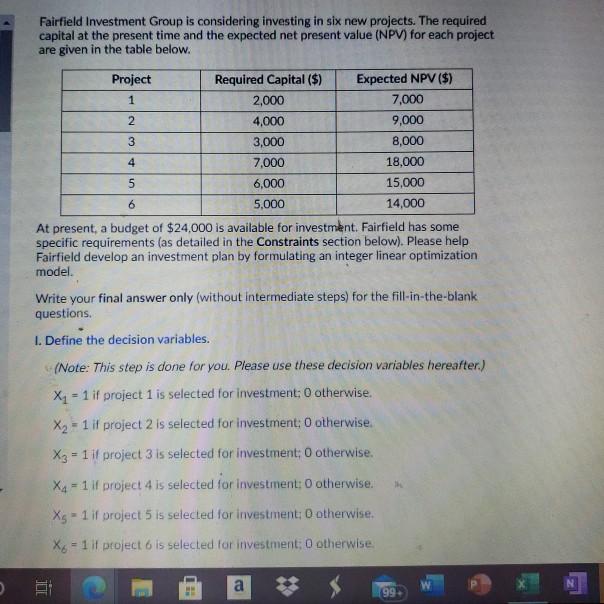

Fairfield Investment Group is considering investing in six new projects. The required capital at the present time and the expected net present value (NPV) for

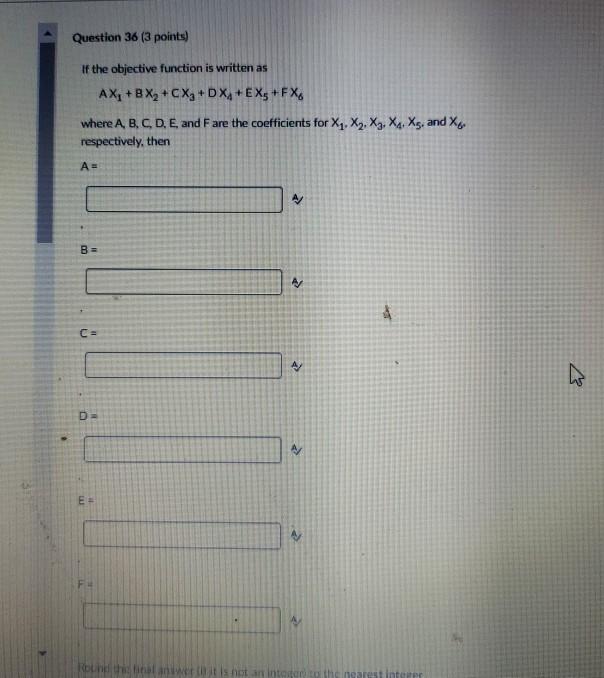

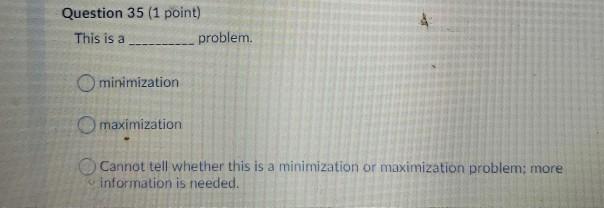

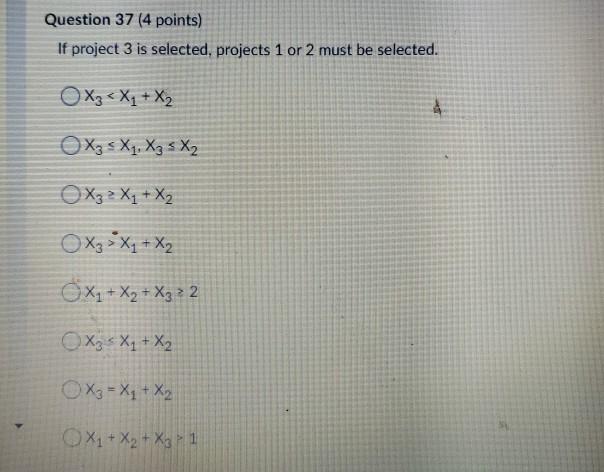

Fairfield Investment Group is considering investing in six new projects. The required capital at the present time and the expected net present value (NPV) for each project are given in the table below. 3 4 5 Project Required Capital ($) Expected NPV ($) 1 2,000 7,000 2 4,000 9,000 3,000 8,000 7,000 18,000 6,000 15,000 6 5,000 14,000 At present, a budget of $24,000 is available for investment. Fairfield has some specific requirements (as detailed in the Constraints section below). Please help Fairfield develop an investment plan by formulating an integer linear optimization model. Write your final answer only (without intermediate steps) for the fill-in-the-blank questions. 1. Define the decision variables. (Note: This step is done for you. Please use these decision variables hereafter.) X1 - 1 if project 1 is selected for investment: 0 otherwise. X2 - 1 il project 2 is selected for investment: O otherwise. X3 - 1 if project 3 is selected for investment: 0 otherwise. X4 - 1 if project 4 is selected for investment: 0 otherwise. Xg - 1 if project 5 is selected for investment: 0 otherwise. Xo = 1 il project 6 is selected for investment: 0 otherwise. TE a 199 Question 36 (3 points) If the objective function is written as AX, BX, CXg+DX4+EX5 +FX where A, B, C, D, E, and F are the coefficients for X, X, X, X, Xs, and X respectively, then A= B = 4 C= A/ w D E- ROL Question 35 (1 point) This is a problem. minimization O maximization Cannot tell whether this is a minimization or maximization problem: more information is needed. Question 37 (4 points) If project 3 is selected, projects 1 or 2 must be selected. X3 X1 + X2 X2 + xy + X3 2 2 X3 X1 + X2 OX3 = X1 + X2 X1 + X2 + X 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started