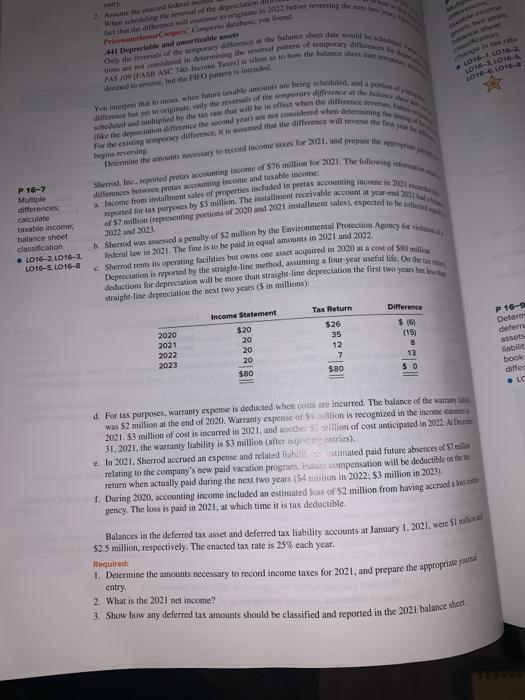

FAOIRS AS Tall the balance muhal hy there that will be in the the different reven For the sury inced that the difference will the come from installment sales of properties included in predating income in a ropaned purposes by million. The installment receivable account year-end like the depth an arredhe debut Deine the cand income tales for 21. and prepare the of 57 million representing part of 2000 and 2021 installment sales, expected to be cool Sherred wined a penalty of $2 million by the Environmental Protection Agency for A two year Priceweapon Code in: Hi thpreendamine change L016-1.1016-2 D16016- LOT-1016 med one, but the FIFO paded differences between pretax accounting income and taxable income Shed Increpane preta aning income of 576 million for 2021. The following Depreciation is reported by the straight line method, assuming a four-year useful life. On the 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal hervering P 16-7 Multiple differences calculate taxable income balance sheet 2002 and 2021 classification L016-2016-3 federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022, L016-5.1016-8 deduction for depreciation will be more than straight line depreciation the first two years be hones straight line depreciation the next two years is in millions): Income Statement Tax Return Difference $26 $20 2020 $ (6) 35 20 (15) 2021 12 20 2022 8 7 20 2023 13 $80 $80 d For tax purposes, warranty expense is deducted when costs are incurred. The balance of the wat was $2 million at the end of 2020. Warranty expense of billion is recognized in the income tamen 2021. $3 million of cost is incurred in 2021, and another million of cost anticipated in 2022. De 31, 2021, the warranty liability is $3 million (after tries). e. In 2021. Sherrod accrued an expense and related liabilitimated paid future absences Smule relating to the company's new paid vacation programs. For compensation will be deductible on the return when actually paid during the next two years (S4 milion in 2022: S3 million in 2023) 1. During 2020, accounting income included an estimated laws of $2 million from having accrued and gency. The loss is paid in 2021, at which time it is tax deductible Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2021, were si milli $2.5 million, respectively. The enacted tax rate is 25% each year. Required: P 16-9 Determ defem assets labit book differ ole entry 2. What is the 2021 net income? 3. Show how any deferred tax amounts should be classified and reported in the 2021 balance shell FAOIRS AS Tall the balance muhal hy there that will be in the the different reven For the sury inced that the difference will the come from installment sales of properties included in predating income in a ropaned purposes by million. The installment receivable account year-end like the depth an arredhe debut Deine the cand income tales for 21. and prepare the of 57 million representing part of 2000 and 2021 installment sales, expected to be cool Sherred wined a penalty of $2 million by the Environmental Protection Agency for A two year Priceweapon Code in: Hi thpreendamine change L016-1.1016-2 D16016- LOT-1016 med one, but the FIFO paded differences between pretax accounting income and taxable income Shed Increpane preta aning income of 576 million for 2021. The following Depreciation is reported by the straight line method, assuming a four-year useful life. On the 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal hervering P 16-7 Multiple differences calculate taxable income balance sheet 2002 and 2021 classification L016-2016-3 federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022, L016-5.1016-8 deduction for depreciation will be more than straight line depreciation the first two years be hones straight line depreciation the next two years is in millions): Income Statement Tax Return Difference $26 $20 2020 $ (6) 35 20 (15) 2021 12 20 2022 8 7 20 2023 13 $80 $80 d For tax purposes, warranty expense is deducted when costs are incurred. The balance of the wat was $2 million at the end of 2020. Warranty expense of billion is recognized in the income tamen 2021. $3 million of cost is incurred in 2021, and another million of cost anticipated in 2022. De 31, 2021, the warranty liability is $3 million (after tries). e. In 2021. Sherrod accrued an expense and related liabilitimated paid future absences Smule relating to the company's new paid vacation programs. For compensation will be deductible on the return when actually paid during the next two years (S4 milion in 2022: S3 million in 2023) 1. During 2020, accounting income included an estimated laws of $2 million from having accrued and gency. The loss is paid in 2021, at which time it is tax deductible Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2021, were si milli $2.5 million, respectively. The enacted tax rate is 25% each year. Required: P 16-9 Determ defem assets labit book differ ole entry 2. What is the 2021 net income? 3. Show how any deferred tax amounts should be classified and reported in the 2021 balance shell