Answered step by step

Verified Expert Solution

Question

1 Approved Answer

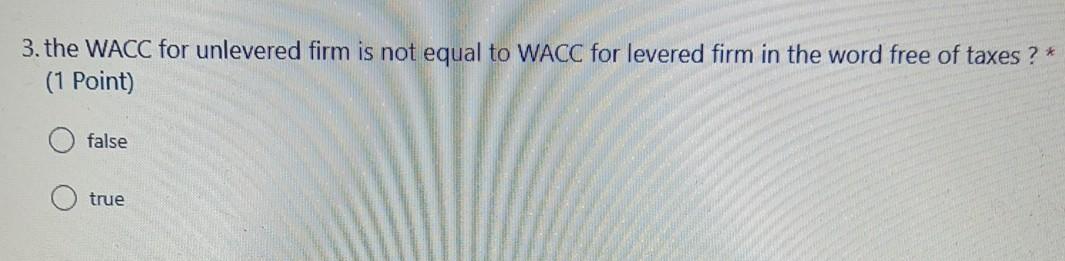

fast please 3. the WACC for unlevered firm is not equal to WACC for levered firm in the word free of taxes ? * (1

fast please

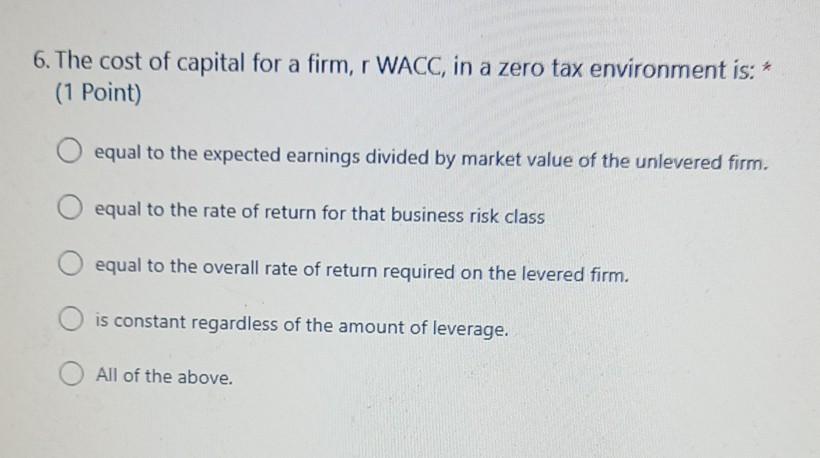

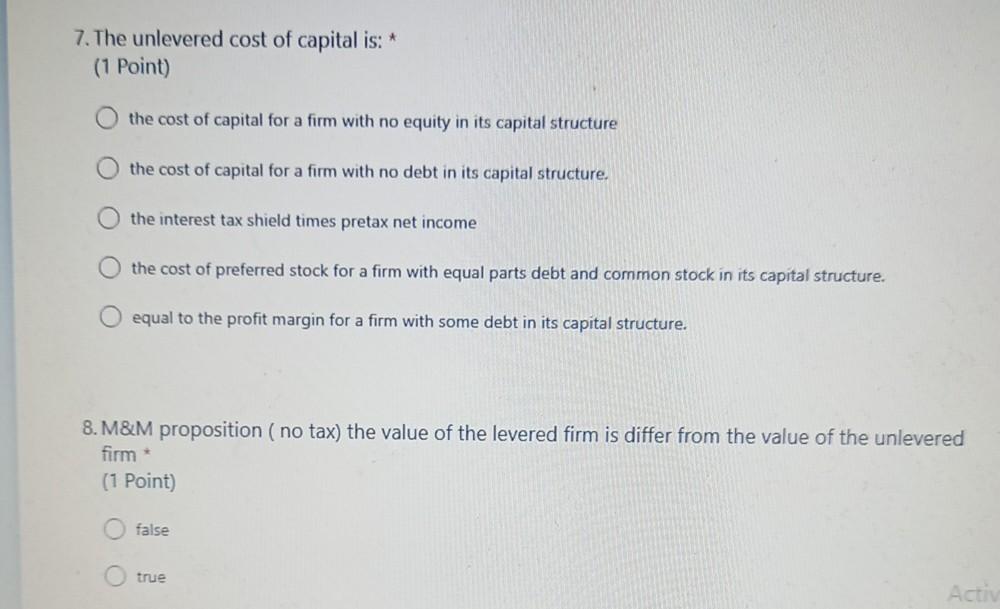

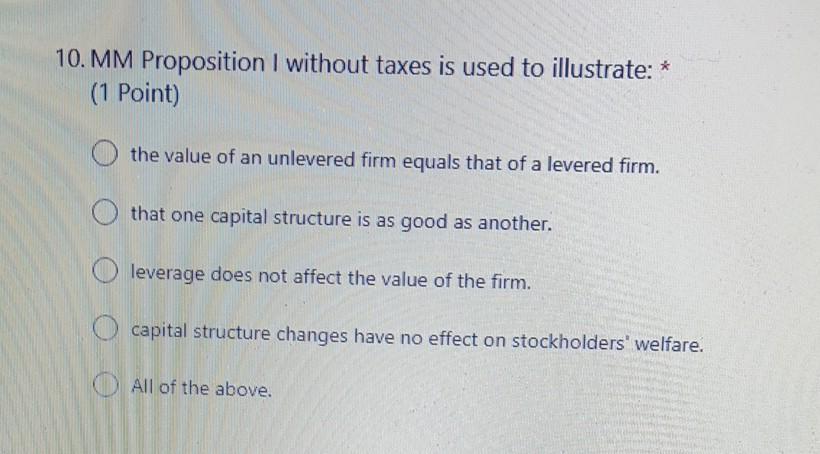

3. the WACC for unlevered firm is not equal to WACC for levered firm in the word free of taxes ? * (1 Point) false true 6. The cost of capital for a firm, r WACC, in a zero tax environment is: * (1 Point) equal to the expected earnings divided by market value of the unlevered firm. equal to the rate of return for that business risk class equal to the overall rate of return required on the levered firm. is constant regardless of the amount of leverage. All of the above. 7. The unlevered cost of capital is: * (1 Point) the cost of capital for a firm with no equity in its capital structure O the cost of capital for a firm with no debt in its capital structure, o the interest tax shield times pretax net income the cost of preferred stock for a firm with equal parts debt and common stock in its capital structure. O O equal to the profit margin for a firm with some debt in its capital structure. 8. M&M proposition (no tax) the value of the levered firm is differ from the value of the unlevered firm (1 Point) false true Activ 10.MM Proposition I without taxes is used to illustrate: (1 Point) the value of an unlevered firm equals that of a levered firm. that one capital structure is as good as another. leverage does not affect the value of the firm. O capital structure changes have no effect on stockholders' welfare. All of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started