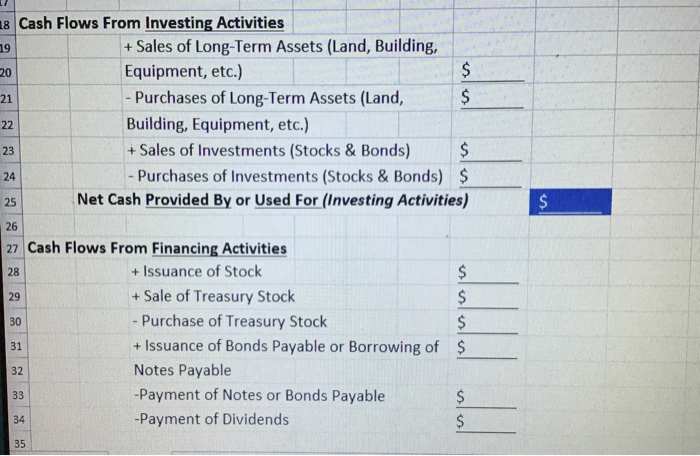

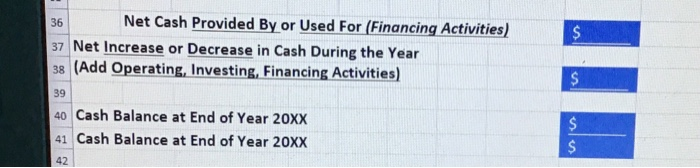

Fill in the blanks based on the information given in the income statement and balance sheet

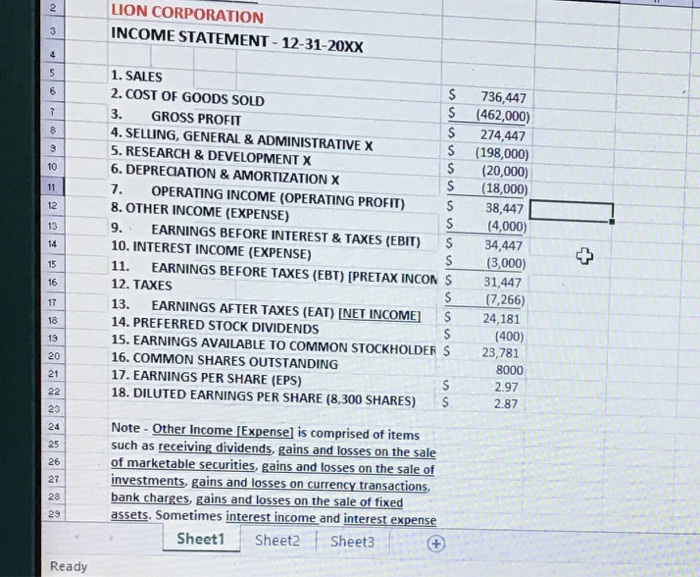

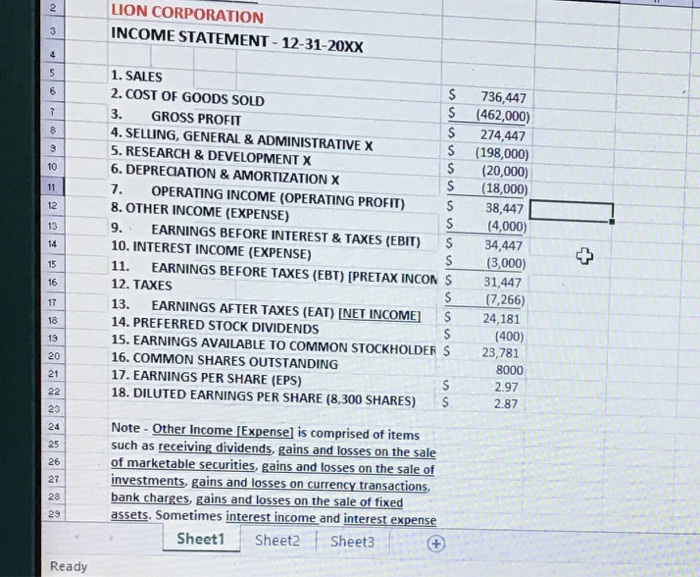

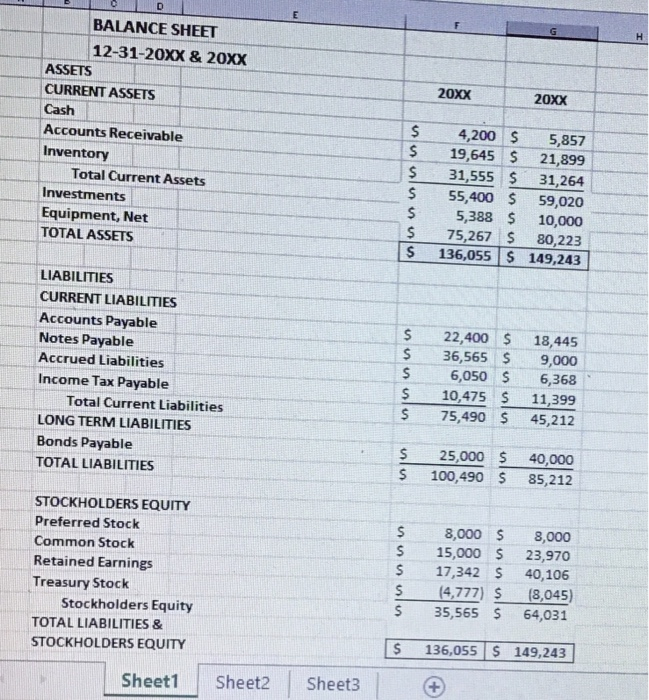

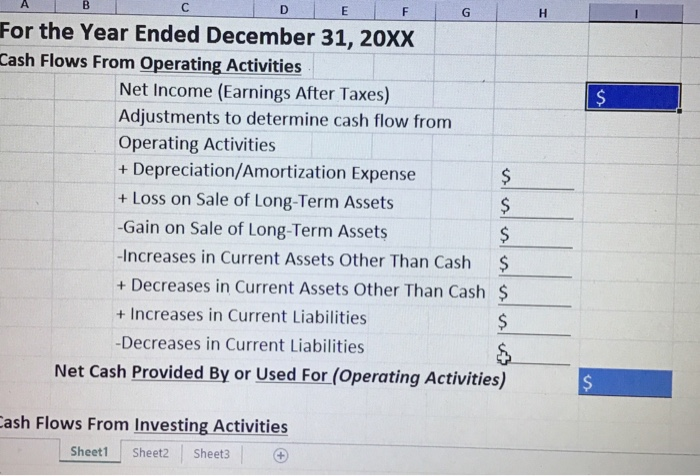

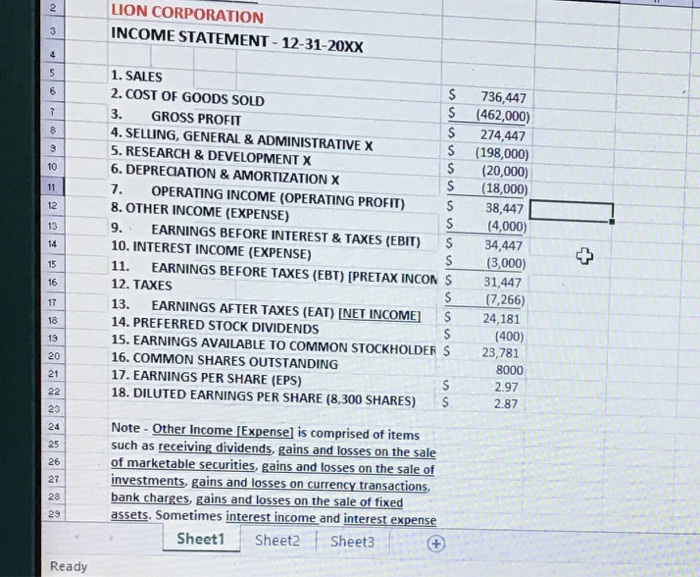

LION CORPORATION INCOME STATEMENT-12-31-20xX 1. SALES 2. COST OF GOODS SOLD 3. GROSS PROFIT 4. SELLING,GENERAL&ADMINISTRATIVE 5. RESEARCH & DEVELOPMENT X 6. DEPREIATION &AMORTIZATION X S 736,447 (462,000) S 274,447 S (198,000) S (20,000) S (18,000) 7. OPERATING INCOME (OPERATING PROFIT) S 38,447 S(4,000) 9 EARNINGS BEFORE INTEREST & TAXES (EBIT) $ 34,447 (3,000) 31,447 (7,266) 24,181 $(400) 23,781 8000 S 2.97 S2.87 10 8. OTHER INCOME (EXPENSE) 12 13 14 10. INTEREST INCOME (EXPENSE) 11. EARNINGS BEFORE TAXES (EBT) [PRETAX INCON S 12. TAXES 13. EARNINGS AFTER TAXES (EAT) INETINCOME S 14. PREFERRED STOCK DIVIDENDS 15. EARNINGS AVAILABLE TO COMMON STOCKHOLDER S 16. COMMON SHARES OUTSTANDING 17. EARNINGS PER SHARE (EPS) 18. DILUTED EARNINGS PER SHARE (8,300 SHARES) 16 18 13 20 21 23 24 25 26 27 28 23 Note Other Income [Expensel is comprised of items such as receiving dividends, gains and losses on the sale of marketable securities, gains and losses on the sale of investments, gains and losses on currency transactions assets, Sometimes interest income and interest expense | Sheet1 : Sheet2 | Sheet3 | Ready BALANCE SHEET 12-31-20XX & 200x ASSETS CURRENT ASSETS Cash Accounts Receivable Inventory 20XX 20xX S 4,200 5,857 S 19,645 21,899 $ 31,555 31,264 S 55,400 $ 59,020 S5,388 10,000 $ 75,267 80,223 S 136,055 $ 149,243 Total Current Assets Investments Equipment, Net TOTAL ASSETS LIABILITIES CURRENT LIABILITIES Accounts Payable Notes Payable Accrued Liabilities Income Tax Payable $ 22,400 18,445 S36,565 S9,000 6,050 S 6,368 $10,475 11,399 $ 75,490 S 45,212 Total Current Liabilities LONG TERM LIABILITIES Bonds Payable TOTAL LIABILITIES $ 25,000 40,000 $100,490 85,212 STOCKHOLDERS EQUITY Preferred Stock Common Stock Retained Earnings Treasury Stock S 8,000 S 8,000 S 15,000 S 23,970 S 17,342 40,106 S (4,777) $(8,045) S 35,565 $ 64,031 Stockholders Equity TOTAL LIABILITIES & STOCKHOLDERS EQUITY 136,055 S 149,243 Sheet1 | Sheet2 | Sheet3 | For the Year Ended December 31, 20xx Cash Flows From Operating Activities Net Income (Earnings After Taxes) Adjustments to determine cash flow from Operating Activities + Depreciation/Amortization Expense + Loss on Sale of Long-Term Assets -Gain on Sale of Long-Term Assets -Increases in Current Assets Other Than Cash + Decreases in Current Assets Other Than Cash $ + Increases in Current Liabilities -Decreases in Current Liabilities Net Cash Provided By or Used For (Operating Activities) ash Flows From Investing Activities Sheet Sheet2 Sheet3 8 Cash Flows From Investing Activities 19 20 21 + Sales of Long-Term Assets (Land, Building, Equipment, etc.) Purchases of Long-Term Assets (Land, S Building, Equipment, etc.) +Sales of Investments (Stocks &Bonds) Purchases of Investments (Stocks & Bonds) $ 24 25 Net Cash Provided By or Used For (Investing Activities) 26 Cash Flows From Financing Activities + Issuance of Stock +Sale of Treasury Stoclk 29 Purchase of Treasury Stock + Issuance of Bonds Payable or Borrowing of Notes Payable -Payment of Notes or Bonds Payable -Payment of Dividends 31 $ 32 34 35 Net Cash Provided By or Used For (Financing Activities 36 37 Net Increase or Decrease in Cash During the Year 38 (Add Operating, Investing, Financing Activities) 39 0 Cash Balance at End of Year 20XX 41 Cash Balance at End of Year 20xx 42